Learn How Blockchain & Stablecoins are Refining Global Finance in 2025

A Global Financial System Ready for Reinvention

In today's digitally interconnected world, when compared to how easy it is to communicate across long distances, the way we move money across borders still feels stuck in the past.

International payments can take days, cost more than they should, and rely on a tangled web of intermediaries. For the 800 million people who depend on remittances — the money sent home by migrant workers — these inefficiencies aren’t just frustrating. They’re costly and, in some regions, deeply exclusionary.

Now, a powerful alliance between blockchain technology and stablecoins is rewriting the playbook for global finance. What was once a slow, expensive, and opaque system is being transformed into one that is faster, cheaper, and more transparent.

Defining the Basics

Before diving deeper, let’s break down the three pillars of this transformation:

- Payments refer to the transfer of money between parties — whether across the street or across the globe. Traditionally, this is done via banks, credit networks, or money transfer services.

- Remittances are cross-border payments sent by individuals, often migrant workers, to their families in other countries. These are crucial sources of income for developing nations.

- Stablecoins are a type of cryptocurrency designed to maintain a stable value, typically by being pegged to a fiat currency like the U.S. dollar. Unlike volatile assets like Bitcoin, stablecoins are ideal for everyday transactions and international transfers.

Why Cross-Border Fees Stay High in 2025

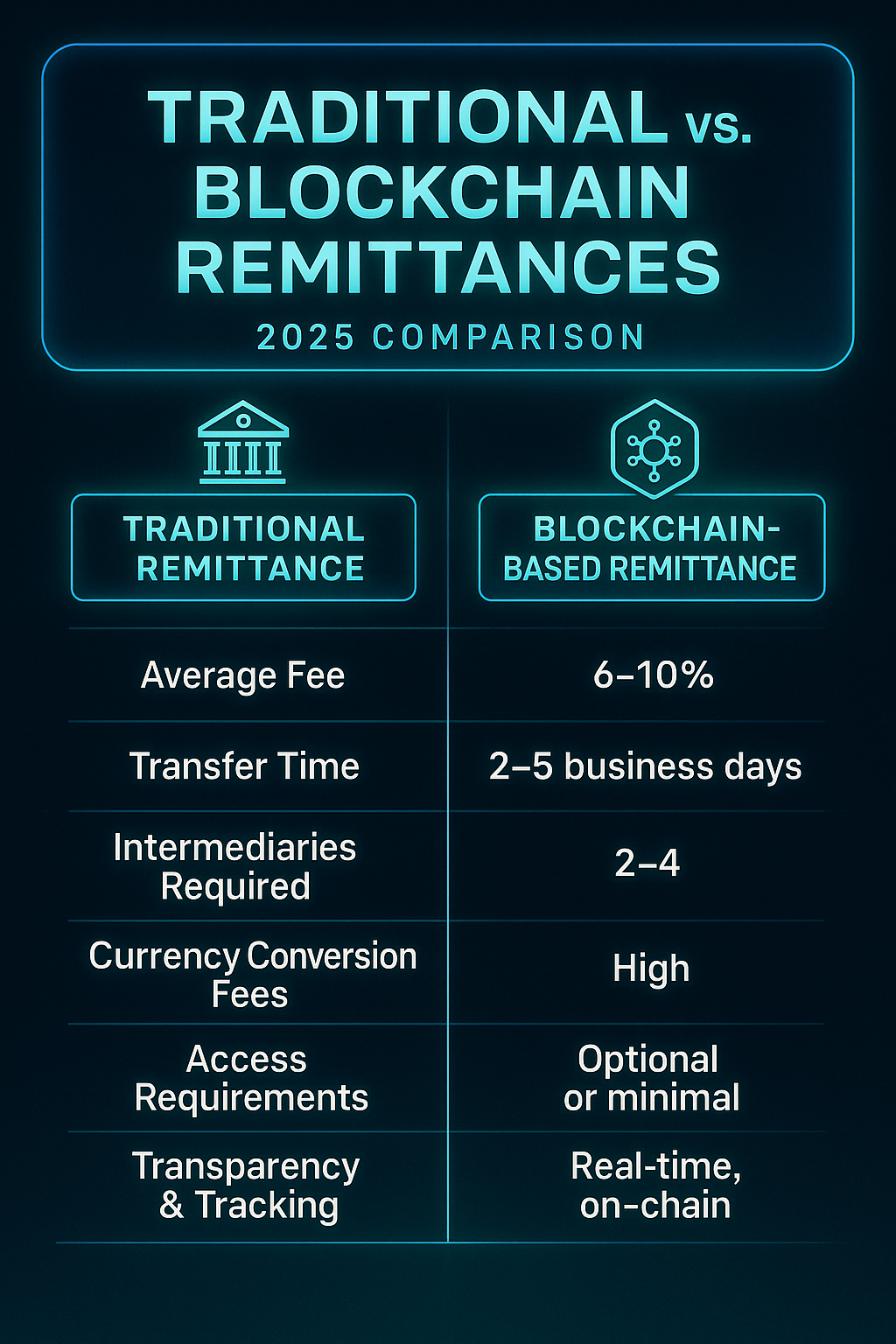

The legacy remittance system continues to burden senders and receivers with high costs. At a 6.26% global average, every $1B in remittances leaks ~$62.6M to fees—stablecoin rails can cut this by >70% in compliant corridors. [1]

The legacy financial system relies heavily on outdated infrastructure like SWIFT, a messaging network for banks created in the 1970s. While trusted, SWIFT-based wire transfers can take 2–5 business days to settle and often incur multiple layers of fees — especially when involving currency conversions or intermediary banks.

Remittance corridors, such as those between the U.S. and Mexico or Gulf States and South Asia, often face the highest fees. In Sub-Saharan Africa, for example, sending $200 can cost an average of 8.35% in fees.

The Blockchain and Stablecoin Advantage

Blockchain technology eliminates the need for intermediaries. Transactions are processed peer-to-peer, often in seconds and at a fraction of the cost.

Stablecoins like USDC, DAI, and Tether (USDT) offer a digital form of cash that holds its value and is easily transferable via mobile wallets or crypto platforms — even in countries with limited banking infrastructure.

This evolution in finance is not just about speed — it’s about accessibility, transparency, and financial inclusion.

For millions of unbanked individuals worldwide, blockchain-powered payments and remittances open up entirely new possibilities for participation in the global economy.

TL;DR: Why Blockchain Matters for Payments & Remittances

- Traditional remittances are slow and expensive, especially in developing regions.

- Payments and remittances are lifelines for hundreds of millions globally.

- Blockchain enables faster, lower-cost transactions without intermediaries.

- Stablecoins provide price stability, making crypto usable for real-world money movement.

- Greater transparency, speed, and accessibility are empowering users in underbanked regions.

Learn About Jobs Growth in AI and HPC | CryptoBitMag 2025

A System Built for the Past, Struggling in the Present

Shifting From the Fiat Paradigm to the Crypto Paradigm 2025 Outlook

Despite the speed of innovation in nearly every sector of global commerce, the infrastructure behind cross-border payments and remittances still operates on technology built in the pre-internet era.

For billions of people, particularly those in developing countries or working as part of the global diaspora, sending or receiving money is a painful, expensive, and slow process.

Whether it's an immigrant in the U.S. wiring funds back home to family in Guatemala, or a small business in Nigeria paying a supplier in China, the underlying systems are often inefficient, opaque, and disproportionately costly to those who can least afford it.

How Cross-Border Payments Currently Work

Most international payments today move through a legacy network built on centralized intermediaries, such as correspondent banks and remittance service providers.

Here’s a simplified look at how a typical transaction flows:

- A sender initiates a transfer with a remittance company (e.g., Western Union) or their local bank.

- The request is routed through SWIFT (Society for Worldwide Interbank Financial Telecommunication), a messaging protocol used by over 11,000 financial institutions globally.

- Several correspondent banks may act as intermediaries, each taking a cut and adding time to the process.

- The recipient’s bank or local agent receives the transfer, often in local currency after additional currency conversion fees.

- The recipient finally collects the funds — sometimes in cash — after providing identification and navigating local bureaucracy.

Major Players in the Legacy System

- SWIFT: Not a payment system itself, but a global messaging network for financial institutions. Its reliance on intermediary banks creates lag and multiple fee layers.

- Western Union: Operates in over 200 countries, known for agent-based cash delivery — useful in unbanked regions, but notorious for high fees.

- MoneyGram: Similar to Western Union, often used for cash-based remittances, especially in Africa, South Asia, and Latin America.

- Traditional Banks: Still dominate high-value B2B payments, but are often inaccessible to unbanked users and slow on retail remittances.

The Real Costs of Sending Money

The global average cost of sending $200 was 6.25%, with some regions — like Sub-Saharan Africa — facing costs over 8–10%. That means $12–20 in fees just to send a small amount of money.

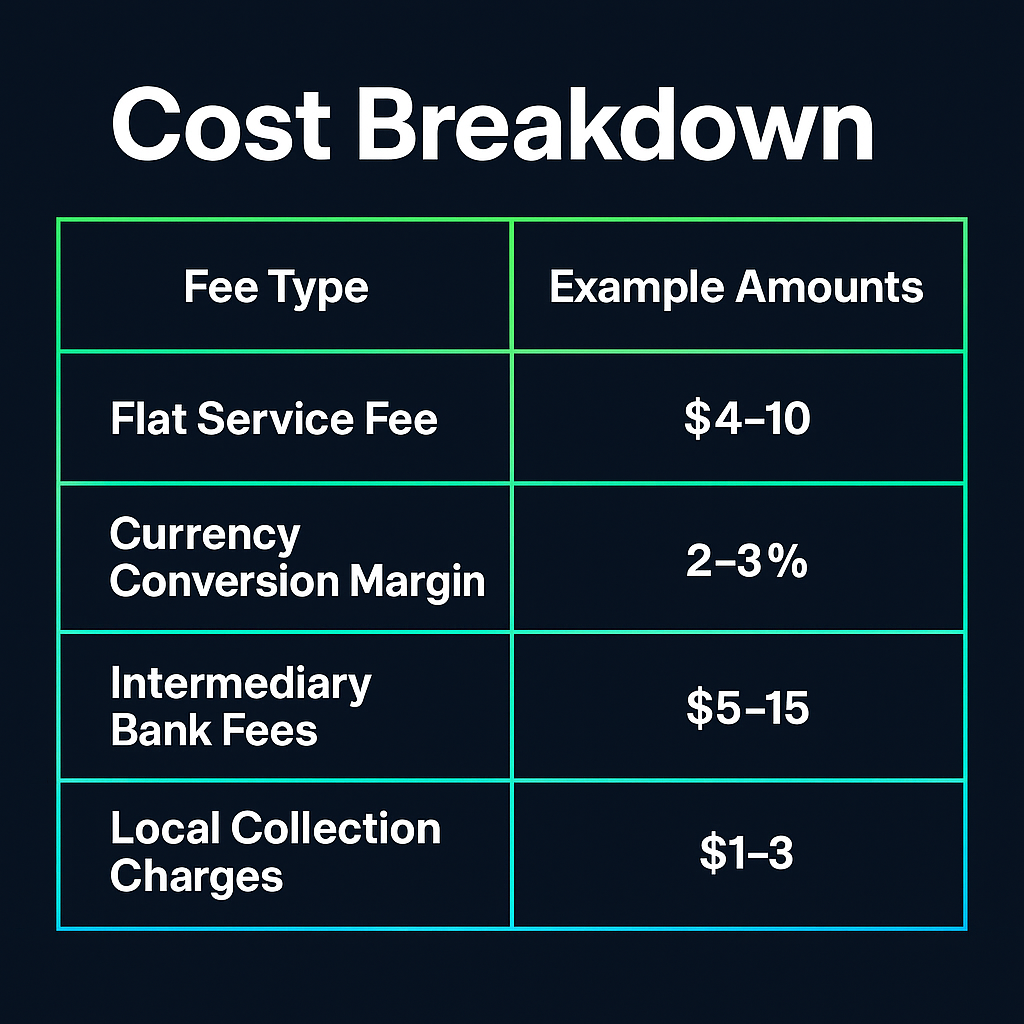

Here's how the cost breakdown might look:

Now, consider this: the average remittance sent globally is $200–300 per transaction. That means a single family could lose $15–25 per transfer, every time.

Hidden Time Delays and Risks

Beyond fees, the traditional payment system is plagued by delays and opacity:

- Delays: Cross-border transfers take anywhere from 2 to 5 business days, depending on currency, country pair, and banking hours.

- Weekend Bottlenecks: Transactions initiated late in the week are often delayed until Monday or Tuesday.

- Opaque Tracking: Senders and recipients often have no way of tracking the funds once sent — a frustrating lack of transparency.

- Risk of Rejection: Transfers can be blocked, reversed, or delayed due to compliance checks or mismatched details, often without clear explanation.

Access Barriers in Rural and Unbanked Regions

More than 1.4 billion people globally remain unbanked (World Bank, 2023), with no access to formal banking infrastructure. For these individuals, legacy remittance services offer few good options:

- Cash dependency means long trips to agent locations, often in unsafe or unreliable conditions.

- Lack of identification documents blocks access to formal remittance services.

- Limited business hours and technical literacy further restrict access, especially for elderly recipients.

In countries like Bangladesh, Nigeria, and El Salvador, local remittance recipients sometimes wait hours in line, or travel miles, just to retrieve funds that are already a fraction of the original amount sent.

Read About Paraguay's Cheap Hydropower for AI & BTC Mining | CryptoBitMag 2025

A Real-World Example

Take the case of María, a domestic worker in Los Angeles sending $250 twice a month to her family in rural Guatemala. She uses a popular U.S. remittance service. Here's what she deals with:

- Service fee: $9.99

- FX margin: $4.50

- Total received by family: ~$235

- Wait time: 2–3 days for pickup

- Required: National ID + bank visit

Over the year, María loses over $240 in fees — the equivalent of a month’s groceries for her family.

Now imagine if she could send USDC via a mobile wallet on the Stellar network — the fee would be pennies, and the money would arrive in seconds, with clear tracking and no intermediaries.

Side-by-Side Comparison: Traditional vs. Blockchain Remittances

The Takeaway: Broken by Design

The legacy system wasn’t built to serve a digitally connected, mobile-first, and globalized population.

It was designed for large institutions and high-value transactions — not for everyday people trying to support their families across borders.

This creates a massive opportunity for blockchain-powered solutions, especially those leveraging stablecoins, to offer a better alternative: faster, cheaper, borderless, and more inclusive.

What Are Stablecoins?

A Bridge Between Traditional Money and Crypto Innovation

In the fast-moving world of digital assets, stablecoins have quietly become one of the most important tools in the blockchain ecosystem.

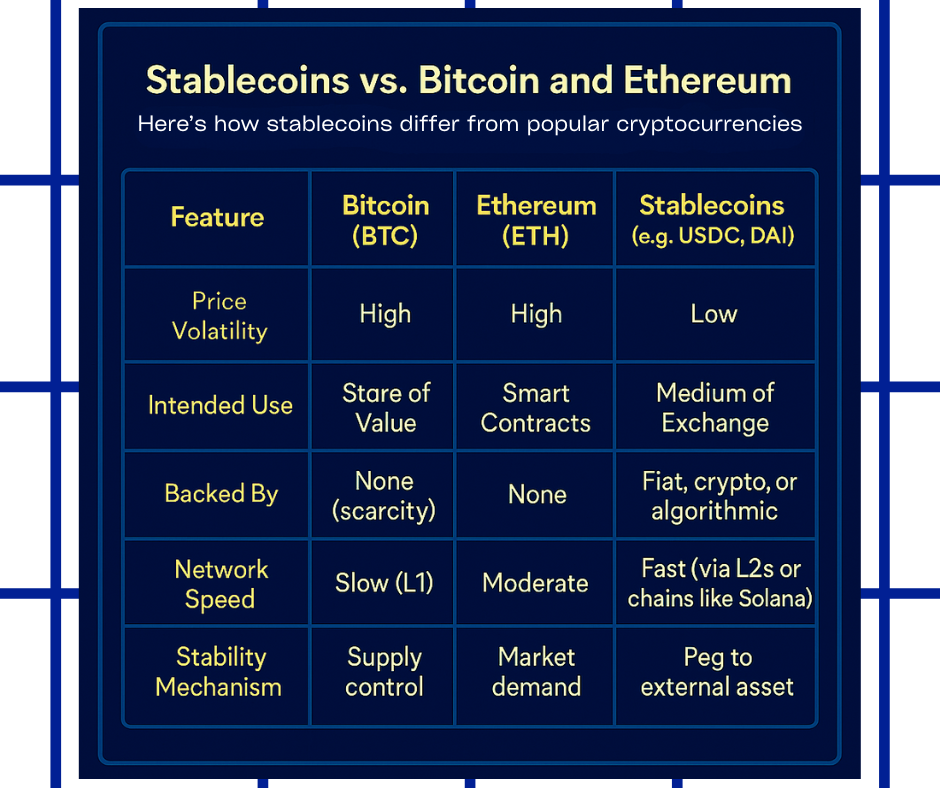

Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins are designed to maintain a consistent value, usually pegged to a fiat currency like the U.S. dollar or euro.

That simple design choice has powerful implications: fast, borderless, programmable money that still holds its value.

From remittances and DeFi to cross-border payroll and e-commerce, stablecoins are the connective tissue between traditional finance and Web3.

Stablecoin Basics: What Makes Them “Stable”?

At their core, stablecoins are blockchain-based tokens that aim to track the value of real-world assets — most commonly fiat currencies. For example:

- 1 USDC = $1 USD

- 1 EURC = €1 EUR

- 1 DAI ≈ $1 USD (via crypto collateral)

This “stability” is achieved through mechanisms like collateralization, smart contract control, or algorithmic balancing. Stablecoins can be transferred just like any cryptocurrency — through wallets, exchanges, and smart contracts — but without the extreme price swings associated with traditional crypto assets.

Stablecoins vs. Bitcoin and Ethereum

Here’s how stablecoins differ from popular cryptocurrencies:

Types of Stablecoins

Not all stablecoins work the same way. Here are the three major types, with real-world examples and trade-offs:

1. Fiat-Collateralized Stablecoins

Definition: These are backed 1:1 by fiat reserves (USD, EUR, etc.) held in banks or regulated custodians.

Examples:

- USDC (by Circle)

- USDT (Tether)

- TrueUSD (TUSD)

Pros:

- Easy to understand

- Trusted peg to fiat currencies

- Used by most major crypto exchanges

Cons:

- Centralized issuer

- Regulatory risks

- Requires audit transparency

Fiat-backed coins dominate the stablecoin market — especially USDT and USDC, which together account for over 80% of global stablecoin volume as of 2025.

2. Crypto-Collateralized Stablecoins

Definition: These are backed by other cryptocurrencies (like ETH or BTC) and maintained via over-collateralization and smart contracts.

Examples:

- DAI (by MakerDAO)

- LUSD (by Liquity)

Pros:

- Decentralized and transparent

- Doesn’t rely on fiat banks

- Maintains peg through incentive design

Cons:

- More complex to understand

- Can become undercollateralized during volatility

- Requires active governance

DAI has become the flagship decentralized stablecoin, widely used in DeFi protocols such as Aave, Compound, and Uniswap.

3. Algorithmic Stablecoins

Definition: These maintain their peg using algorithms that control supply and demand, often without collateral.

Examples:

- FRAX (partially algorithmic)

- UST (Terra) (collapsed in 2022)

Pros:

- Highly capital-efficient

- Programmable and scalable

- Often decentralized

Cons:

- Prone to collapse in high-stress markets

- Peg stability is vulnerable to market sentiment

- Risk of “death spiral,” as seen with UST

Case Study: The collapse of TerraUSD (UST) in 2022 wiped out billions in user funds and prompted a global regulatory response.

It’s now considered a cautionary tale in algorithmic design gone wrong.

Stablecoins in the Broader Crypto Economy

Stablecoins serve as the liquidity backbone of decentralized finance (DeFi), centralized exchanges (CEXs), and emerging Web3 applications.

Key roles include:

- Trading pair anchor: Most crypto trades use USDT or USDC pairs

- DeFi collateral: Used to borrow, lend, and earn yield on platforms like Aave and Curve

- Cross-border payments: Stablecoins offer near-instant settlement for remittances and payroll

- Hedging tool: Traders and investors use stablecoins to avoid crypto volatility

- On/off ramp medium: Bridges between fiat and blockchain ecosystems

In short, stablecoins make crypto usable for real-world transactions.

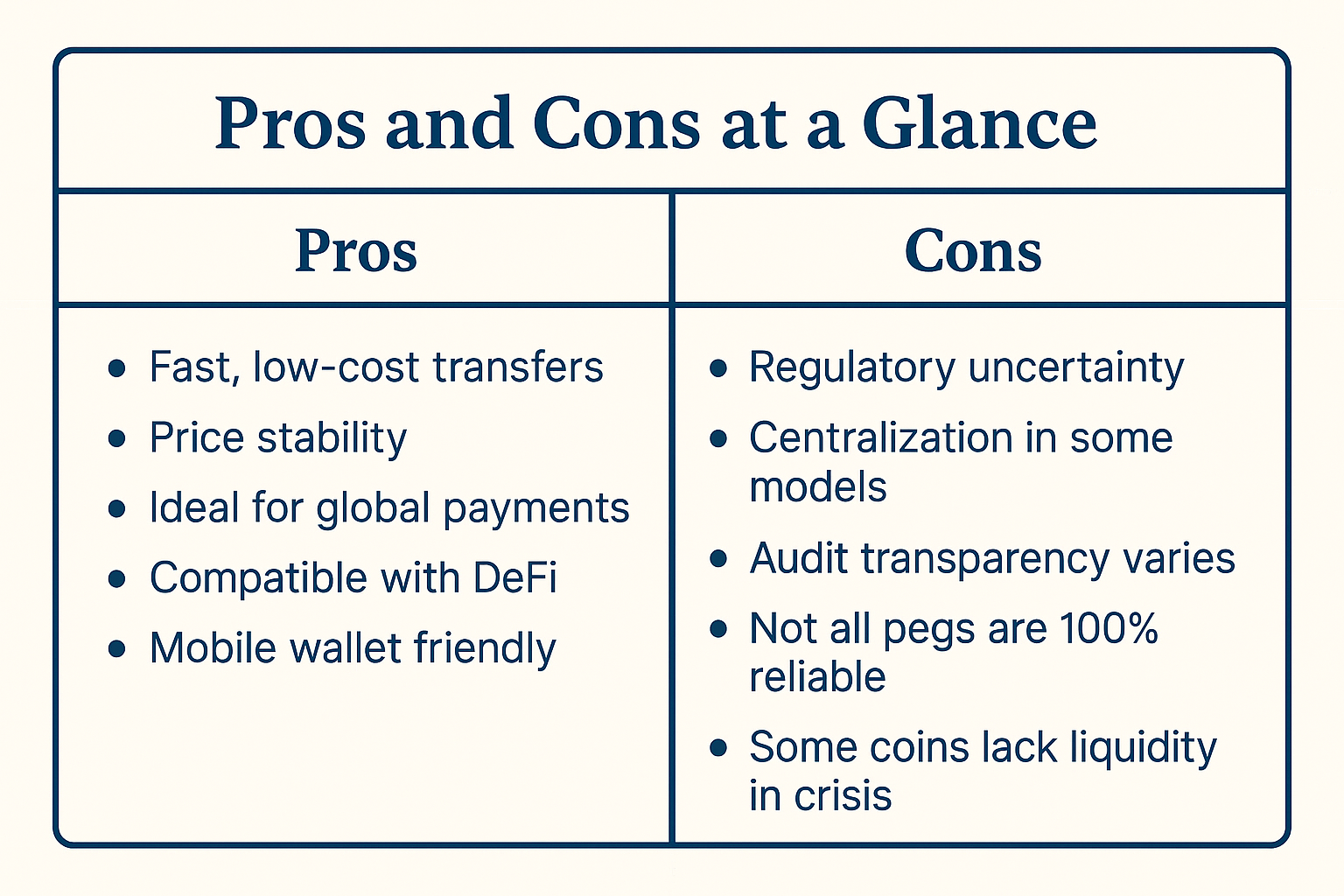

Pros and Cons at a Glance

Global Regulatory Landscape

Governments around the world are catching up with the explosion of stablecoin use. Here’s a snapshot of where things stand in 2025:

United States

- SEC and CFTC tightening scrutiny of issuers

- Push for stablecoin legislation around audit, reserves, and transparency

- Circle (USDC) seen as the most compliant model

European Union

- MiCA (Markets in Crypto-Assets) regulation officially rolled out in 2025

- Requires stablecoin issuers to meet reserve, licensing, and disclosure standards

Asia-Pacific

- Japan and South Korea have approved licensed stablecoin issuance

- Singapore remains friendly to regulated digital dollars

- China bans private stablecoins in favor of state-issued digital yuan

Latin America & Africa

- High adoption due to inflation and capital controls

- USDT widely used in Argentina, Venezuela, and Nigeria via P2P platforms

- Regulatory guidance still developing, but adoption continues to grow

Read About Tokenized Carbin Credits for Investors | CryptoBitMag 2025 Insights

Key Takeaways

- Stablecoins combine the efficiency of crypto with the stability of fiat, making them ideal for payments, savings, and DeFi.

- Models vary from centralized fiat-backed (USDC) to decentralized crypto-backed (DAI) to algorithmic experiments (FRAX, UST).

- Global regulators are moving quickly to define rules and frameworks to protect users while encouraging innovation.

TL;DR: What You Need to Know About Stablecoins

- Stablecoins are digital currencies pegged to real-world assets, typically fiat currencies like USD or EUR.

- They differ from volatile crypto like Bitcoin because they aim to hold steady value.

- Fiat-backed coins dominate the market, but crypto-backed and algorithmic models exist.

- Use cases include trading, remittances, savings, and access to DeFi.

- Regulation is catching up, especially in the U.S. and EU, with MiCA and other initiatives underway.

How Blockchain Is Streamlining Payments and Remittances

Stablecoin / Bitcoin Innovation vs Compliance | Financial Revolution 2025

A Financial Revolution in Real Time

The modern world demands speed, transparency, and low fees in how money moves — yet traditional payment systems remain clunky and exclusionary.

The average international remittance still takes several business days to settle and can cost between 6% to 10% of the total amount.

For millions of people living paycheck to paycheck — especially in emerging markets — that’s not just inefficient, it’s unsustainable.

This is where blockchain technology steps in, fundamentally reengineering the financial rails we rely on to send, receive, and store value.

Whether it's transferring wages across borders or paying for services in decentralized marketplaces, blockchain offers a scalable solution that blends speed, low cost, and accessibility — all without the friction of traditional intermediaries.

How Blockchain Processes Transactions Differently

Blockchain transactions are processed on decentralized networks, where independent nodes verify and record transactions on a public ledger.

Unlike traditional bank transfers that move through a chain of intermediaries, blockchain networks settle peer-to-peer transactions directly.

There are two layers of these blockchain systems currently driving payment innovation:

Layer 1 Networks

These are the base chains where transactions are natively recorded and validated.

- Ethereum: Supports smart contracts and stablecoins like USDC and DAI.

- Solana: Known for high throughput and low fees, ideal for microtransactions.

- Stellar: Optimized specifically for remittances and cross-border payments.

- Bitcoin: The original Layer 1, enhanced via Layer 2 tools like Lightning.

Layer 2 Networks

Layer 2s are built on top of Layer 1s to offer faster, cheaper transactions while anchoring security to the base chain.

- Lightning Network (Bitcoin): Enables instant BTC transfers with virtually zero fees.

- Arbitrum, Optimism (Ethereum): Scale Ethereum-based apps and payments.

- Polygon (Ethereum-compatible): Offers near-instant transactions with low gas costs.

In these systems, the need for trust is replaced by verifiability. Every transaction is traceable, immutable, and—thanks to cryptographic protocols—secure without centralized control.

30,000+ attendees at the Bitcoin Conference in Las Vegas 2025 | CryptoBitMag

Case Study: Bitcoin Remittances in El Salvador

In 2021, El Salvador made headlines by becoming the first country to adopt Bitcoin as legal tender.

While controversial, the move was part of a broader effort to streamline remittances — which account for over 23% of the nation’s GDP, according to World Bank data.

The country launched the Chivo Wallet, a mobile app allowing citizens to send and receive Bitcoin through the Lightning Network, a Layer 2 scaling solution. Here’s what it changed:

- Transaction fees: Reduced from ~$15 via Western Union to near-zero.

- Settlement time: From 3–5 days to instant.

- Accessibility: Users could send or receive money with just a smartphone and internet connection — no bank required.

Though adoption has been mixed, the experiment highlighted the potential of blockchain for mass-scale remittance modernization.

Case Study: Stellar and Cross-Border Payments in Southeast Asia

Stellar (XLM) has emerged as a strong contender for cross-border remittance solutions, particularly in countries like the Philippines, Vietnam, and Indonesia — regions with high inbound remittance volumes and limited banking access.

Stellar’s design emphasizes fast and cheap transactions. It uses anchors — regulated financial institutions — to connect local fiat to digital assets. One notable implementation is through Coins.ph, a crypto wallet that allows Filipinos to receive remittances via Stellar with minimal fees and same-day availability.

The result?

- Remittance costs dropped from 7–8% to less than 1%.

- Settlement became nearly real-time, even in rural regions.

- Users gained access to financial services like bill pay, loans, and savings via mobile.

These case studies make one thing clear: blockchain is no longer a theory — it’s already powering everyday financial life in many regions.

The Role of Mobile Wallets and dApps in Blockchain Payments

One of blockchain’s most transformative aspects is its mobile-first nature. Decentralized applications (dApps) and crypto wallets allow users to transact, store funds, and interact with financial services directly from their phones — without needing a bank account.

Popular tools include:

Strike (Built on Bitcoin Lightning)

Strike allows users in the U.S., El Salvador, Argentina, and more to send USD-denominated payments using Bitcoin’s Lightning Network under the hood — instantly and without fees.

- A U.S. user can send $100 to a family member in El Salvador

- The funds are converted to BTC on the backend

- Delivered in local currency or as BTC in seconds

Wallet of Satoshi

A minimalist Bitcoin Lightning wallet that allows frictionless remittance, used widely in El Salvador and Latin America. No account setup required — just scan and send.

Circle (USDC issuer)

Circle offers developer-friendly APIs and apps for embedding USDC-based payments into wallets, fintech platforms, or e-commerce. Businesses and individuals can use Circle to send near-zero-fee stablecoin payments globally.

These apps showcase how blockchain infrastructure is consumer-ready, delivering a user experience that rivals traditional fintech — but with drastically improved costs and transparency.

Stablecoins: The Backbone of Modern Crypto Payments

Stablecoins play a central role in blockchain-powered remittances. Pegged to fiat currencies and backed by reserves, they offer price stability while retaining all the benefits of crypto infrastructure.

Why stablecoins matter for payments and remittances:

- No volatility: Unlike BTC or ETH, they don’t fluctuate wildly in value

- Lower costs: Transaction fees are often under a penny

- Global usability: Can be sent and received across borders with minimal friction

- Easy to understand: Pegging to USD or EUR makes value intuitive

According to Chainalysis, stablecoins like USDT, USDC, and DAI accounted for over 70% of crypto-based cross-border transactions in emerging markets by early 2025.

Interoperability: Connecting the Crypto Ecosystem

A major advantage of blockchain over traditional systems is interoperability — the ability to move assets seamlessly between different networks and applications.

Imagine sending funds from Ethereum to Solana to pay a merchant using USDC — all in under 30 seconds, without needing three different apps or bank approvals. That’s what tools like:

- LayerZero

- Wormhole

- Axelar Network

enable by acting as cross-chain bridges.

This means users are no longer locked into one financial “walled garden” like with banks. Instead, they’re part of a fluid, composable global financial layer.

Fiat On-Ramps, Off-Ramps, and Remaining Accessibility Challenges

For blockchain-based payments to reach full mainstream adoption, conversion between fiat and crypto must be frictionless. This is where “on-ramps” and “off-ramps” come in — platforms that let users convert USD, EUR, NGN, or MXN into stablecoins and vice versa.

Leading on/off ramp providers in 2025 include:

- Ramp Network

- MoonPay

- Binance P2P

- Coinbase Wallet + ACH transfer

However, challenges remain:

- Banking bans or delays in jurisdictions like India, Nigeria, and Pakistan

- Identification requirements that exclude unbanked or undocumented populations

- Limited coverage for cash-to-crypto services in rural areas

Innovators are working to solve this with cash voucher models, QR code payments, and agent-based networks — much like what made M-Pesa successful in Africa.

Comparing Blockchain-Based and Traditional Remittance Workflows

Traditional Workflow:

- Sender visits a money transfer agent

- Pays in cash + fee

- Money routed through SWIFT and multiple banks

- Local partner handles delivery

- Recipient travels to collect

Blockchain Workflow:

- Sender uses mobile wallet

- Sends USDC/BTC via blockchain network

- Transaction arrives instantly

- Recipient spends, converts, or stores funds

The difference isn’t just technical — it’s transformational. Blockchain compresses cost, complexity, and time into a single tap.

Key Insights: Borderless Money, Realized

Blockchain isn’t just an abstract idea or niche investment tool anymore. In payments and remittances, it’s solving very real problems for people around the world. Migrant workers can keep more of their hard-earned money.

Merchants can receive payments instantly. Unbanked populations can join the digital economy without relying on fragile or exploitative systems.

This is the beginning of a new era in finance — faster, cheaper, decentralized, and open to everyone with a smartphone and a connection.

The Role of Stablecoins in Emerging Markets

Stablecoins as Lifelines in Volatile Economies

In many developing economies, stablecoins have moved beyond speculative assets to become everyday financial tools.

Amid inflation, unstable banking systems, and currency devaluation, people are turning to stablecoins like USDT, USDC, and DAI to protect their earnings, access global markets, and transact outside traditional systems.

Unlike in the West, where crypto adoption is often tied to investment or innovation, in emerging markets, stablecoins serve a very different function: survival.

A Hedge Against Hyperinflation

In countries such as Argentina, Venezuela, and Nigeria, inflation has decimated national currencies.

According to the IMF World Economic Outlook (2025), inflation in Argentina reached 211%, with the peso losing over 85% of its purchasing power in three years. Venezuelans face an even more dire situation, with triple-digit inflation persisting for years.

In these economies:

- USDT and USDC are used as day-to-day savings tools

- Freelancers and small businesses demand payment in dollar-pegged stablecoins

- Peer-to-peer (P2P) markets facilitate informal exchanges outside banking systems

In Nigeria, where the naira continues to lose value, citizens increasingly use stablecoins for online commerce, overseas payments, and even local transactions. According to Chainalysis 2025 Regional Crypto Report, over 40% of crypto volume in Nigeria is stablecoin-related, driven by rising demand for financial stability.

Decentralized Savings in Action: DeFi Meets the Global South

For citizens with access to the internet but not reliable banks, Decentralized Finance (DeFi) offers an alternative. Stablecoins play a central role in this emerging ecosystem.

In Brazil, Indonesia, and Kenya, mobile-savvy users are utilizing apps like MetaMask, Aave, and Curve to earn yield on stablecoin deposits. These users:

- Convert fiat or crypto to USDC or DAI

- Deposit into DeFi lending pools

- Earn interest rates above 5% annually — often beating local inflation

While risks remain — including smart contract exploits or volatile yields — the opportunity to escape devaluation and access global liquidity is driving rapid adoption.

Stablecoins in Informal Economies

Emerging markets are often driven by informal sectors — unregistered businesses, P2P trade, gig work, and small vendors. These make up 50–70% of total employment in many regions (ILO 2024).

In these communities, stablecoins are gaining traction because they offer:

- Instant transactions via mobile wallets

- Privacy without needing bank approval

- Borderless access to buyers, suppliers, and services

- Reduced friction for small, daily payments

Services like Binance P2P, Paxful, and LocalBitcoins allow users in Ghana, Pakistan, and the Philippines to convert between stablecoins and local currency with minimal fees and no centralized oversight.

In some urban markets, QR-code payments in USDT are becoming just as common as cash.

Case Study: Digital Dollars in Southeast Asia

In Southeast Asia, especially the Philippines, Vietnam, and Indonesia, stablecoins are increasingly being used as digital dollars. In countries where access to USD bank accounts is limited, USDC offers a frictionless, censorship-resistant alternative.

Real-world applications include:

- Freelancers receiving USDC payments from U.S. clients

- Overseas workers sending home remittances via mobile wallets

- E-commerce sellers accepting USDC directly on Shopify or WhatsApp

Apps like Coins.ph in the Philippines and Trust Wallet across the region are making these transfers easier than ever — no intermediary, no banking delays, and no weekend bottlenecks.

In response, governments and startups are exploring regional stablecoins like XIDR (Indonesian Rupiah) and PHPC (Philippine Peso), which blend local trust with global reach.

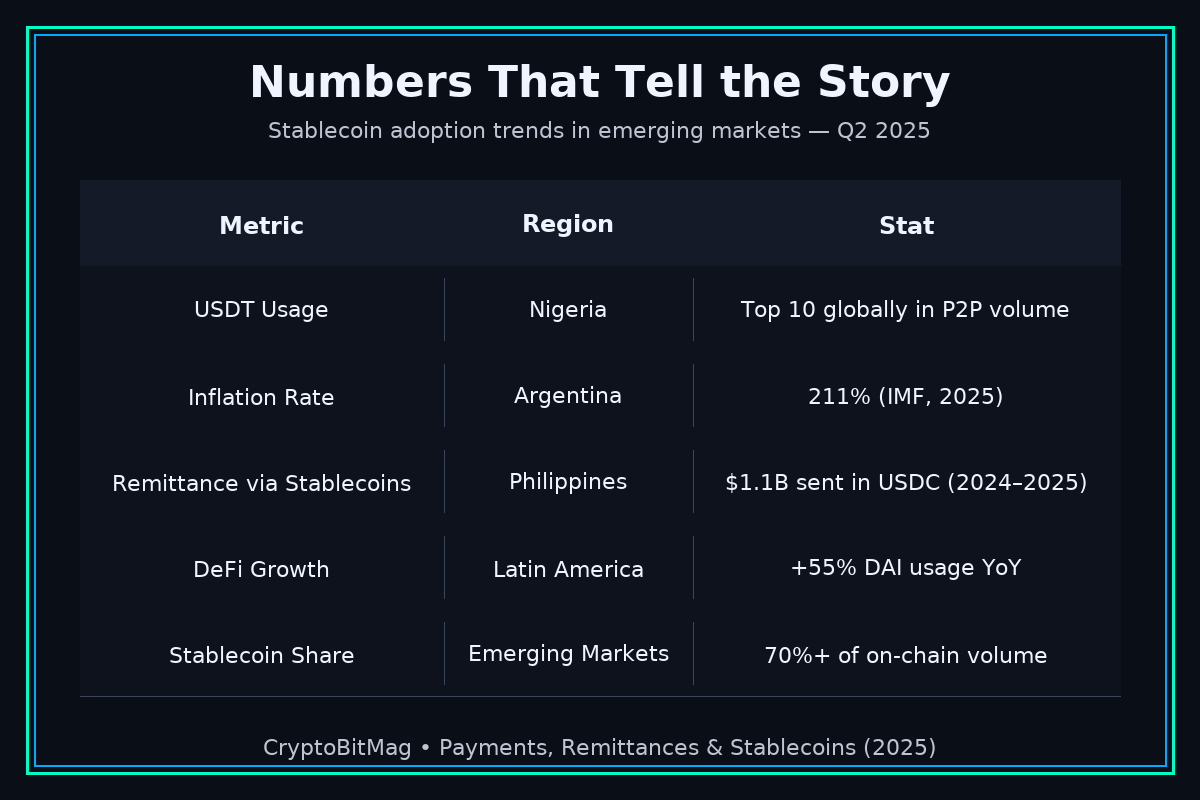

Numbers That Tell the Story

Here’s a snapshot of stablecoin adoption trends in emerging markets as of Q2 2025:

The Policy Response: Friend or Foe?

As stablecoins become more entrenched, regulators are taking notice. Central banks see both risk and opportunity in this new paradigm:

- Argentina and Nigeria have attempted to limit crypto access through banking restrictions

- India remains ambivalent, though stablecoin usage is surging in P2P channels

- Brazil and the Philippines are developing pro-stablecoin frameworks, seeking a middle ground

- China remains firm on banning private stablecoins in favor of its e-CNY (Digital Yuan)

Many nations are also racing to develop CBDCs (Central Bank Digital Currencies) to compete with or complement stablecoins — a topic we explore in [this related guide to CBDCs and stablecoin integration →].

Why Stablecoins Are Now Essential Infrastructure

In emerging markets, stablecoins aren’t just financial instruments. They are tools of economic empowerment, offering:

- A hedge against inflation

- An alternative to broken banking systems

- A bridge to global markets

- A gateway to decentralized finance

As more users adopt mobile-first crypto wallets and stablecoin liquidity grows, these digital dollars are becoming part of the everyday financial fabric of the Global South.

From preserving value in hyperinflated economies to powering cross-border payments, stablecoins are already reshaping financial inclusion. And the story is just beginning.

CryptoBitMag 2025 Beginner's Guide to Blockchain Gaming

Risks and Regulatory Uncertainty

Stability in Name, But Not Always in Practice

While stablecoins promise reliability and low volatility, their rapid rise has exposed cracks in both technical design and regulatory infrastructure. From high-profile collapses to tightening government scrutiny, 2025 is shaping up to be a pivotal year for defining what “stability” really means in the digital economy.

As global adoption accelerates—especially in remittances, DeFi, and emerging markets—stablecoins face increasing legal, security, and compliance risks. Understanding these challenges is essential for builders, investors, and users alike.

Lessons from Terra/LUNA: The Collapse That Shook the Market

In 2022, the collapse of TerraUSD (UST), an algorithmic stablecoin once valued at $18 billion, shocked the crypto world. Unlike fiat- or crypto-backed stablecoins, UST maintained its peg via a mint-and-burn algorithm with LUNA, its sister token.

The system worked—until it didn’t.

A cascade of sell-offs and arbitrage attacks caused UST to depeg and collapse to near-zero, taking LUNA with it. Millions of retail investors were wiped out, and the event triggered a multi-year wave of global regulatory intervention.

📉 Key lesson: Stability mechanisms must be backed by robust, transparent reserves or mechanisms that can withstand extreme market stress.

The U.S. Approach: Regulatory Headwinds and Clarity Battles

In the United States, 2025 has been marked by conflicting signals from agencies like the SEC, CFTC, and Federal Reserve over how stablecoins should be regulated.

Key Developments:

- The SEC has increased scrutiny of centralized stablecoin issuers like Tether (USDT) and Circle (USDC), raising questions about whether they constitute securities.

- The House Financial Services Committee reintroduced a stablecoin bill proposing 1:1 reserve requirements, mandatory audits, and licensed custodians.

- The FedNow real-time payment system now allows limited stablecoin on-ramp experimentation, indicating a tentative bridge between TradFi and Web3.

Circle, issuer of USDC, has leaned into compliance, regularly publishing audited reserve reports and working closely with U.S. regulators.

Meanwhile, Tether continues to face criticism over its opaque disclosures, despite commanding the largest market share.

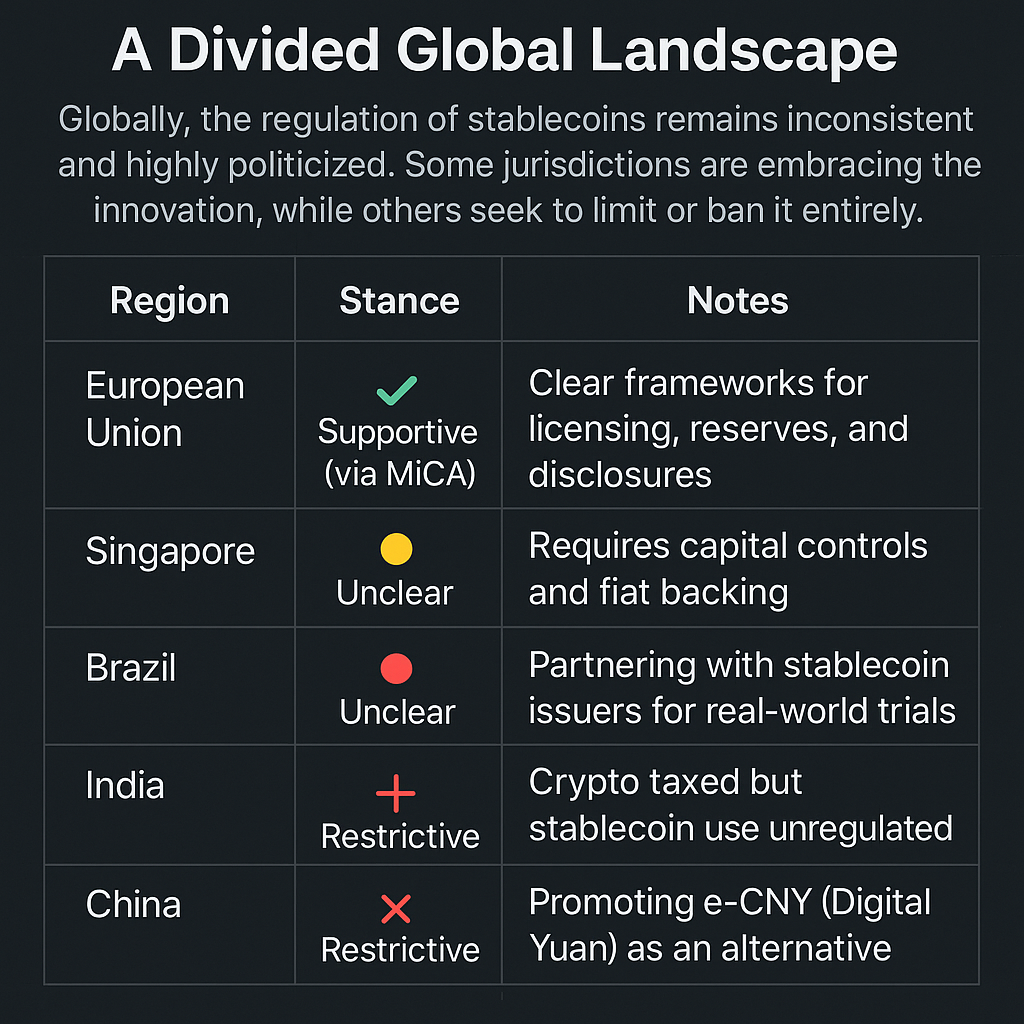

A Divided Global Landscape

Globally, the regulation of stablecoins remains inconsistent and highly politicized. Some jurisdictions are embracing the innovation, while others seek to limit or ban it entirely.

KYC and AML Compliance in a Decentralized World

One of the thorniest issues facing stablecoins is how to balance decentralization with regulatory compliance—especially in regard to Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Centralized issuers (e.g., Circle) can enforce KYC through fiat on/off-ramps.

But DeFi protocols or P2P marketplaces using stablecoins operate without these controls, raising red flags among regulators concerned about:

- Money laundering

- Terrorist financing

- Tax evasion

New tools are emerging to address this, including zero-knowledge identity layers, wallet scoring systems, and compliance plugins. Still, the debate remains: how much oversight is compatible with true decentralization?

Security Risks: Smart Contracts and Custody

While stablecoins aim to reduce volatility, they’re still subject to technical and human risks:

- Smart contract bugs: Exploits in protocols like Curve, Aave, or staking vaults can drain user funds

- Custodial hacks: Centralized wallets or bridges can be compromised (see: Wormhole and Poly Network incidents)

- Imposter tokens: Scammers deploy fake stablecoins on lesser-known chains to trick users

Even audited, secure smart contracts can be vulnerable. Users must practice self-custody, use reputable platforms, and be cautious with unknown protocols.

2025: A Year of Legal Clarity and Evolution

The regulatory landscape is maturing, slowly. Some key trends to watch in 2025:

- MiCA in the EU has set the global benchmark for stablecoin compliance

- CBDC pilot programs in over 40 countries are exploring stablecoin interoperability

- Global Financial Stability Board (FSB) is pushing for international stablecoin coordination by late 2025

- ISO 20022 messaging standards are being updated to support stablecoin integration with banking systems

In many ways, 2025 marks the transition from experimental token economies to legally integrated financial instruments.

What's in Sight? Navigating Uncertainty with Eyes Open

Stablecoins remain among the most promising innovations in modern finance — enabling fast, cheap, borderless value transfer. But their continued growth depends on trust, transparency, and regulatory alignment.

As users, developers, and governments continue to negotiate what “safe” and “stable” truly mean in a decentralized context, one thing is clear: stablecoins are no longer fringe. They are core infrastructure, and how we regulate them will shape the future of money.

Innovations and the Future of Borderless Money

From Utility to Ubiquity: The Next Evolution of Digital Currency

The shift toward borderless, programmable finance is no longer theoretical — it’s well underway.

Driven by advances in smart contracts, decentralized infrastructure, and regulatory adaptation, stablecoins and blockchain-based payment systems are entering a new phase: mainstream usability at scale.

As the foundational rails for crypto-based remittances and global transactions become more sophisticated, new layers of functionality — like conditional logic, streaming payments, and cross-chain interoperability — are redefining what money can do.

The next five years will likely determine whether stablecoins remain niche or become core infrastructure in the global economy. Spoiler alert: all signs point to the latter.

Programmable Money: Payments With Built-In Logic

Unlike fiat, which merely represents value, programmable money adds intelligence to transactions.

Using smart contracts, users can create automated conditions under which funds are released, returned, split, or re-routed — no human intermediary needed.

Example use cases:

- Escrow payments that release funds only after delivery confirmation

- Payroll streaming that pays employees by the second

- Conditional subsidies from NGOs based on geolocation and activity

Platforms like Gnosis Safe, Parcel, and Superfluid are enabling businesses and DAOs to automate complex multi-party financial flows, reducing overhead and increasing transparency.

Micropayments and Streaming Money: From Theory to Practice

Traditional financial systems are not designed to support microtransactions — fees and infrastructure overhead make sending $0.01 impractical. But on blockchain networks with low gas costs, micro- and nano-payments become viable.

Tools like Sablier and Superfluid are pioneering real-time money streaming, allowing users to:

- Pay for services by the second (e.g., content subscriptions, Wi-Fi access)

- Distribute creator royalties instantly as content is consumed

- Enable transparent, time-based grant disbursement

In the context of remittances, this innovation allows families to receive money continuously, rather than in large, delayed chunks. This could help balance budgets, reduce risk, and provide real-time financial security.

Cross-Chain Payments: Breaking the Silo Problem

One of the major pain points in early blockchain infrastructure was fragmentation: users had to stick to specific chains (Ethereum, Solana, Avalanche) to access funds and applications. But now, cross-chain protocols are removing these barriers.

Projects like Axelar, LayerZero, and Wormhole are enabling interoperable payments, allowing users to send and receive stablecoins across different blockchains seamlessly.

Example: A user in Argentina could receive a remittance in USDC on Solana, swap it to Polygon via LayerZero, and spend it on a DeFi app — all within minutes.

Cross-chain bridges are also becoming more secure, with multi-signature and zero-knowledge proof mechanisms protecting against the vulnerabilities that plagued earlier implementations.

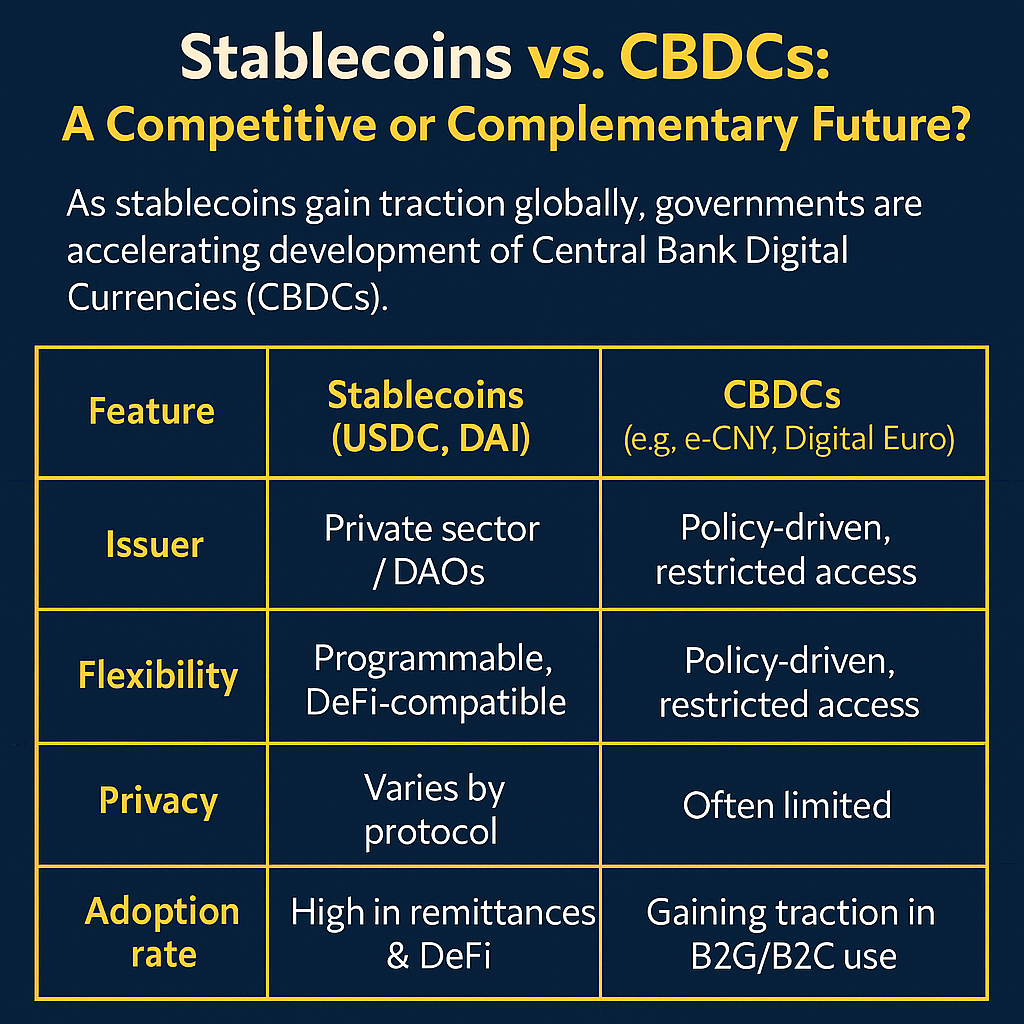

Stablecoins vs. CBDCs: A Competitive or Complementary Future?

As stablecoins gain traction globally, governments are accelerating development of Central Bank Digital Currencies (CBDCs). As of mid-2025, over 130 countries are exploring CBDCs, with China, India, and the EU actively piloting or soft-launching digital versions of their national currencies.

While some view CBDCs as stablecoin competitors, many analysts predict parallel coexistence. Stablecoins will dominate in open-source innovation and cross-border utility, while CBDCs will power government-to-citizen payments, regulatory enforcement, and domestic infrastructure.

What the Future Holds: Predictions for 2026 and Beyond

As we approach 2026, the convergence of technology, policy, and public demand is setting the stage for mass adoption of blockchain-based money. Here are five trends to watch:

1. Mainstream Remittance Corridors Go Crypto

By 2026, we expect major corridors like U.S.–Mexico, Gulf–India, and Europe–Africa to see >30% of remittance volume processed via blockchain.

2. Regulated Stablecoins as Default Payment Rails

USDC, DAI, and regional variants like XSGD (Singapore Dollar) will be embedded in financial apps, POS systems, and neobanks — especially in developing markets.

3. Micropayments for AI & IoT

Machine-to-machine transactions will become commonplace, with smart appliances and autonomous vehicles using streamed payments for bandwidth, data, or power.

4. Cross-Chain Settlements Become Invisible

Thanks to bridges like Axelar and LayerZero, users won’t need to understand what chain they’re on. Payments will be chain-agnostic and UX-friendly.

5. CBDCs and Stablecoins Interoperability Standards

Organizations like the Bank for International Settlements (BIS) are working toward frameworks that allow CBDCs and private stablecoins to interact via standardized APIs and messaging layers.

The Borderless Economy Is Coming Into Focus

Money is no longer static. It is dynamic, programmable, global — and increasingly independent of traditional banking rails. From the tiniest fraction of a cent to million-dollar B2B settlements, the next chapter of finance is being written on-chain.

Stablecoins and programmable finance are no longer experiments — they’re infrastructure. Whether remitting funds to family, launching a DAO, or paying for streamed services, the future of money is fluid, decentralized, and borderless.

Frequently Asked Questions (FAQ)

![Cyberpunk investigator using a glowing magnifying glass to examine a holographic globe covered in Bitcoin, Ethereum, USD, USDT, and USDC symbols, with transaction lines and floating data screens. [ FAQ's include: What is the difference between stablecoins and Bitcoin? Can I use stablecoins to send money to family abroad? Are blockchain payments legal in my country? How are stablecoins backed? What are the best apps for crypto remittances?]](https://www.cryptobitmag.com/content/images/2025/08/Stablecoin-FAQ-s.png)

1.What is the difference between stablecoins and Bitcoin?

While both are digital currencies built on blockchain technology, stablecoins and Bitcoin serve very different purposes.

- Bitcoin (BTC) is a decentralized asset with a fixed supply of 21 million coins, often viewed as a store of value or “digital gold.” Its price fluctuates based on market demand and speculation.

- Stablecoins, such as USDC, DAI, or USDT, are designed to maintain a stable value, typically pegged to fiat currencies like the U.S. dollar. This makes them far more suitable for daily transactions, remittances, and use in decentralized finance (DeFi).

2.Can I use stablecoins to send money to family abroad?

Yes — and in many cases, it’s faster and more affordable than using banks or traditional remittance services like Western Union.

Stablecoin remittances allow you to send digital dollars (like USDC or USDT) across borders in seconds with fees under 1%, using blockchain networks such as Ethereum, Solana, or the Bitcoin Lightning Network (via tokenized assets).

Recipients only need a crypto wallet app and internet access. Apps like Strike, Coins.ph, or Trust Wallet make this process accessible to users in the Philippines, El Salvador, Nigeria, India, and beyond.

3.Are blockchain payments legal in my country?

Legality varies by jurisdiction. In many countries, stablecoin usage is permitted — especially for remittances, personal use, or DeFi — but subject to tax and compliance regulations.

| Region | Status (as of 2025) |

|---|---|

| United States | Permitted, regulated under state/federal frameworks |

| European Union | Permitted under MiCA (Markets in Crypto-Assets) |

| Brazil | Legal, with central bank engagement |

| India | Unregulated but not banned |

| China | Banned (private stablecoins); promotes e-CNY |

| Nigeria | Restricted banking access, high P2P adoption |

Always consult a local financial advisor or regulatory authority if you're unsure.

4.How are stablecoins backed?

It depends on the type of stablecoin:

- Fiat-backed stablecoins (e.g., USDC, USDT) are backed 1:1 by cash, U.S. Treasury bills, or other high-quality reserves held by a centralized issuer. Reputable issuers publish monthly audits.

- Crypto-collateralized stablecoins (e.g., DAI, LUSD) are backed by other cryptocurrencies and overcollateralized using smart contracts.

- Algorithmic stablecoins (e.g., FRAX, [formerly UST]) use supply-adjusting algorithms to maintain a peg. These are riskier and often less transparent.

Always verify whether a stablecoin is audited, regulated, and transparent about its reserves.

5.What are the best apps for crypto remittances?

Here are several popular apps enabling fast and low-cost stablecoin remittances in 2025:

- Strike – Uses the Bitcoin Lightning Network to send U.S. dollar equivalents instantly across borders.

- Coins.ph – Popular in Southeast Asia for receiving USDC and local stablecoins.

- Binance P2P – Enables direct swaps between stablecoins and local fiat currencies in over 100 countries.

- Wallet of Satoshi – Simple app for Bitcoin and Lightning-based stablecoin transfers.

- Circle – Offers APIs and apps for global business and individual payments using USDC.

When choosing an app, consider fees, supported currencies, withdrawal methods, and compliance features like KYC or regional support.

Conclusion: The Future of Global Finance Is Decentralized

A Borderless, Inclusive, Transparent Financial Future

From Buenos Aires to Manila, Lagos to Jakarta, a silent revolution is underway — and it’s not being led by banks or governments, but by everyday people using blockchain-powered tools to send, save, and spend value. This article has traced the rise of stablecoins, programmable money, and cross-chain payment systems, showing how they are redefining what money is — and what it can do — in a digitally connected world.

What began as a niche experiment in decentralized currency has evolved into a global infrastructure shift. Stablecoins now facilitate billions in daily transactions, not only for crypto traders and fintech developers, but also for migrant workers, small business owners, remote freelancers, and unbanked citizens across the globe.

The Case for Decentralized Money Movement

In an age of hyper-connectivity, it’s baffling that sending money across borders still feels like mailing a check in the 1990s. Legacy systems—laden with intermediaries, delays, and high fees—remain a persistent bottleneck in global finance. But blockchain-powered money movement is rapidly reshaping this landscape, offering a faster, cheaper, and radically more inclusive alternative.

This isn’t just a technical upgrade. It’s a financial revolution—especially for the billions excluded or underserved by traditional banking.

TL;DR – Why Blockchain-Based Payments Are a Game-Changer:

- Faster settlements: Transactions complete in seconds or minutes, not business days.

- Massive cost savings: Remittance fees drop from 6–10% to below 1%.

- Transparent records: On-chain transactions are publicly auditable and tamper-resistant.

- Financial access: Anyone with a smartphone and internet can participate—no banking required.

- Global interoperability: Cross-chain bridges and Layer 2s unlock frictionless, borderless transfers.

Faster, Smarter, Cheaper: The Blockchain Advantage

Let’s break it down:

- Speed: Traditional remittances can take 2–5 business days. With blockchains like Solana, Polygon, or Lightning Network on Bitcoin, transfers can be confirmed in seconds to under a minute. In regions where speed equates to survival—say, in crisis zones or rapidly inflating economies—this is no small perk.

- Cost-efficiency: According to the World Bank, the global average cost of sending $200 is about 6.3%. For millions relying on remittances, that's a devastating tax. On chains like Stellar or using stablecoins like USDC, those fees can plummet below 1%—unlocking billions in retained value.

- Transparency & auditability: Every on-chain transaction is logged, timestamped, and verifiable by anyone. This builds trust in payment systems, combats corruption, and streamlines auditing—especially critical for NGOs, aid agencies, or social impact programs operating in volatile jurisdictions.

But the Road Ahead Requires Vigilance

While the outlook is optimistic, it’s not without risks. The fall of TerraUSD reminded us that not all stablecoins are stable. They can still be subject to threats such as project rugging, or a developer leaving the project. When this occurs, it can be devastating and difficult to fix unless it is backed by the community. Vigilance must be made to ensure that this works correctly.

Regulatory uncertainty still lingers, especially in jurisdictions struggling to balance innovation and oversight. Technical vulnerabilities — from smart contract exploits to bridge hacks — remain concerns that developers and regulators alike must address.

Yet, progress continues. From MiCA in the EU to CBDC pilot programs, institutions are beginning to adapt. Startups are building more resilient infrastructure.

Communities are educating themselves and taking control of their financial futures.

The financial revolution isn’t just on the horizon. It’s already in motion.

Bibliography / Sources

- IMF World Economic Outlook (April 2025)

Argentina’s inflation data and macroeconomic overview. - Atlantic Council CBDC Tracker

Central Bank Digital Currency developments by country. - ILO Informal Economy Overview (2024)

Size and scope of informal sectors in emerging markets. - World Bank. Global Findex Database (2021; site updated 2025). https://www.worldbank.org/en/publication/globalfindex

- World Bank. Remittance Prices Worldwide (Q4 2024–Q1 2025 updates). https://remittanceprices.worldbank.org/

- ESMA / EBA / Central Bank of Ireland; Legal Nodes. MiCA stablecoin (ART/EMT) rules effective June 30, 2024; phased regime 2024–25.

- Library of Congress; Reuters. Hong Kong Stablecoins Ordinance (effective August 1, 2025); industry reaction.

- BIS. Annual Economic Report 2025 – Next-gen monetary & financial system (stablecoins fall short as mainstay).

Written by Richard Saunders

Published August 2025 | Scheduled update January 2026

Images & Tables by Mac Carter, Editor-in-Chief [email protected]

Discussion