Institutional Crypto Investing: The Ultimate Guide for 2025

Introduction

Crypto markets in 2025 offer institutional investors unmatched opportunities for diversification, high returns, and innovation.

Blockchain’s disruptive power, paired with AI analytics and clear regulations, transforms finance.

This guide equips hedge funds, pension funds, endowments, and family offices with proven strategies to navigate crypto confidently.

Discover secure custody, regulated ETFs, DeFi yields, and ESG-aligned investments to achieve resilient, high-yield portfolios.

Crypto’s low correlation with traditional assets boosts returns while mitigating risks. With over $100 billion in crypto ETFs and growing tokenized assets, institutions can’t ignore this frontier.

1. Why Institutions Embrace Crypto

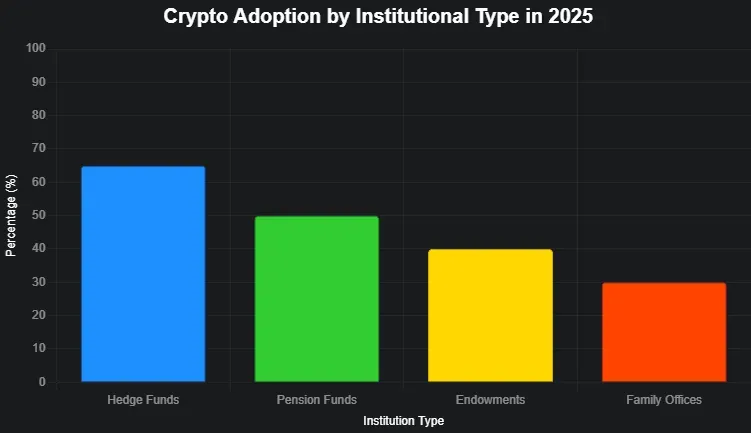

Crypto’s allure lies in diversification, high yields, and blockchain’s potential. Bitcoin and Ethereum, with low correlation to stocks and bonds, enhance risk-adjusted returns. In 2025, 65% of hedge funds, 50% of pension funds, 40% of endowments, and 30% of family offices allocate 1–5% to crypto.

"The blockchain symbolizes a shift in power from the centers to the edges of the networks."

— William Mougayar

Overcoming Barriers

- Regulatory Complexity: Partner with legal experts to navigate global policies like EU’s MiCA.

- Secure Custody: Use providers like Coinbase Custody for audited security.

- Volatility: AI-driven hedging minimizes price swings.

- Expertise: Internal training builds stakeholder confidence.

More on Institutional Adoption Coming Soon:

- Drivers of Institutional Crypto Adoption

Demand for diversification, inflation hedging, and tech innovation. - Benefits of Crypto for Institutions

High returns, liquidity, transparency, and 24/7 markets. - Barriers to Institutional Crypto Adoption

Regulatory risks, custody issues, and lack of expertise. - Crypto Allocation Strategies for Funds

Small allocations, diversified baskets, and yield strategies. - Why Hedge Funds Invest in Crypto

Asymmetric returns and low market correlation. - Family Office Crypto Investment

Diversification and long-term wealth preservation.

2. Secure Crypto Custody

Secure custody protects assets from cyber threats and ensures compliance. Institutional-grade solutions like cold wallets and multi-signature systems safeguard Bitcoin, Ethereum, and tokenized assets.

"At Coinbase, our first priority is to ensure that we operate the most secure and compliant digital currency exchange in the world."

— Brian Armstrong, CEO, Coinbase

Top Custody Providers

- Coinbase Custody: $320M insurance, SOC compliance.

- Fidelity Digital Assets: Cold storage, regulatory alignment.

- Anchorage Digital: Federal charter, DeFi integration.

Advanced Custody Tech

- Multi-Party Computation (MPC): Eliminates single points of failure.

- AI Security: Detects threats in real time.

- Cold Wallets: Protects long-term holdings.

More on Crypto Custody Coming Soon:

- Institutional Crypto Custody Solutions

Tools for safely storing large crypto holdings. - Secure Crypto Custody Infrastructure

Robust systems to prevent loss or theft. - MPC Crypto Custody Providers

Firms using multi-party computation for secure access. - Cold Wallet Custody for Institutions

Offline storage to maximize asset protection. - Regulatory Requirements for Crypto Custody

Compliance standards for secure, legal custody.

3. Crypto Investment Vehicles

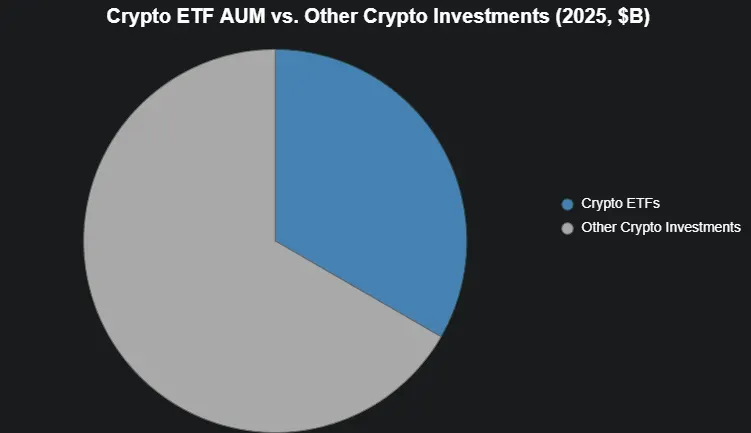

Crypto ETFs and tokenized assets simplify market exposure. In 2025, ETFs manage $100B+, offering liquidity and regulatory oversight. Tokenized real estate and bonds unlock fractional ownership.

Role of Crypto ETFs

ETFs for Bitcoin and Ethereum streamline investments, reducing complexity. Regulated in the U.S. and EU, they ensure tax efficiency and portfolio integration.

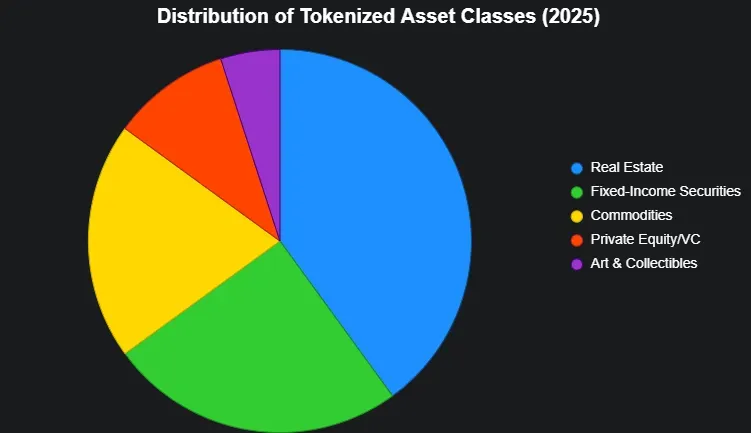

Tokenized Assets

Tokenized real estate, bonds, and art provide liquidity and low entry barriers. Platforms like Securitize ensure compliance.

"I look at it as digital gold... and I do believe there's a real need for everyone to look at it as one alternative."

— Larry Fink, CEO of BlackRock

Portfolio Strategies

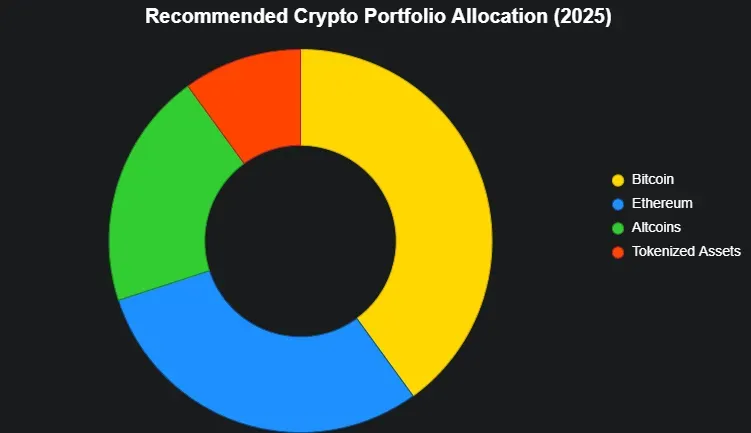

- Allocation: 2–5% to Bitcoin (40%), Ethereum (30%), altcoins (20%), tokenized assets (10%).

- Rebalancing: Adjust quarterly for risk management.

- AI Optimization: Use CoinMetrics for real-time insights.

More on Investment Vehicles Coming Soon:

- Crypto ETFs for Institutions

Regulated funds offering easy crypto exposure. - Tokenized Asset Funds

Traditional assets turned into blockchain-based tokens. - Institutional Access to Crypto Index Funds

Broad market exposure through diversified crypto baskets. - Structured Crypto Investment Products (e.g., Derivatives, Yield Products)

Custom instruments like derivatives and yield strategies. - Tokenized Fixed-Income Assets

Blockchain bonds and debt instruments for steady returns. - Crypto Venture Capital Funds

Early-stage crypto project investments for high upside.

4. Institutional DeFi Strategies

DeFi delivers high yields through staking, lending, and liquidity provision. Platforms like Aave Arc offer audited, compliant solutions for institutions.

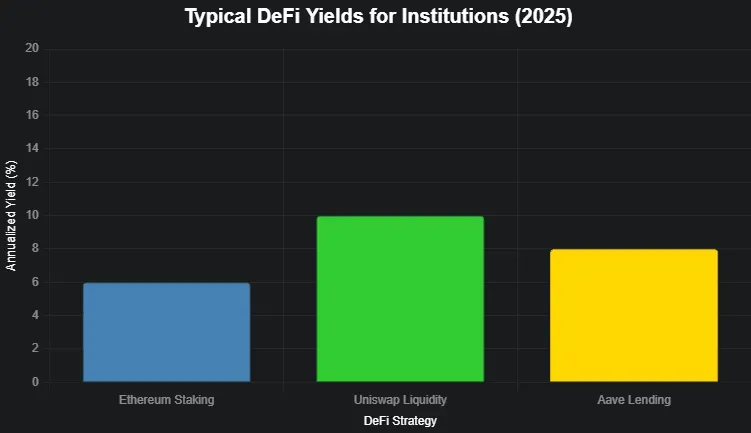

DeFi Yields

- Staking Ethereum: 4–8% returns.

- Liquidity Provision: 5–15% yields on Uniswap.

- Stablecoin Lending: Competitive rates on Aave.

Risk Mitigation

- Audits: Choose platforms vetted by Certik.

- Diversification: Spread investments across Aave, Compound.

- AI Tools: Monitor impermanent loss.

"I'm very excited about the potential that DeFi offers in principle. The idea that anyone anywhere in the world can have access and choose their financial exposure is a very powerful thing.”

— Vitalik Buterin, co-founder of Ethereum

More on Institutional DeFi Coming Soon:

- Institutional DeFi Yield Strategies

Earning returns through decentralized finance tools. - DeFi Liquidity Management for Funds

Optimizing capital across DeFi protocols. - Stablecoin Yield for Institutions

Low-volatility returns using stable digital assets. - Crypto Lending Platforms for Institutions

Earn or borrow via trusted lending protocols. - Staking Protocols for Institutional Investors

Lock tokens to earn rewards while securing networks. - DeFi Risk Management for Institutions

Tools to mitigate smart contract and market risks.

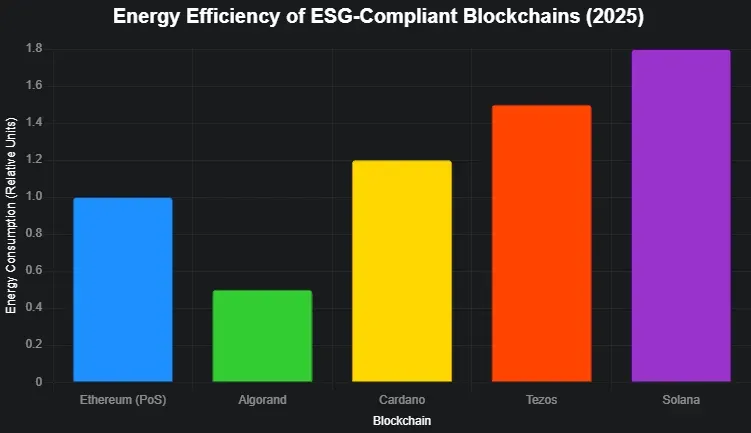

5. ESG-Aligned Crypto Investing

ESG priorities shape 2025’s crypto landscape. Energy-efficient blockchains like Ethereum (post-Merge) and Algorand align with sustainability goals.

Sustainable Blockchains

- Ethereum: 99% less energy post-Merge.

- Algorand: Carbon-negative, scalable.

- Cardano: Low-footprint, community-driven.

ESG Strategies

- Invest in tokenized green projects.

- Conduct AI-driven ESG audits.

- Support financial inclusion initiatives.

More on ESG Investing Coming Soon:

- ESG Crypto Investing for Funds

Aligning crypto portfolios with environmental, social, and governance goals. - Green Blockchain Projects for Institutions

Eco-friendly networks focused on low energy use. - Carbon-Neutral Crypto Portfolios

Offsetting emissions to achieve net-zero impact. - Tokenized Carbon Credits for Investors

Blockchain-based credits to fund sustainability. - Social and Governance Aspects of Crypto

Evaluating transparency, equity, and decentralization.

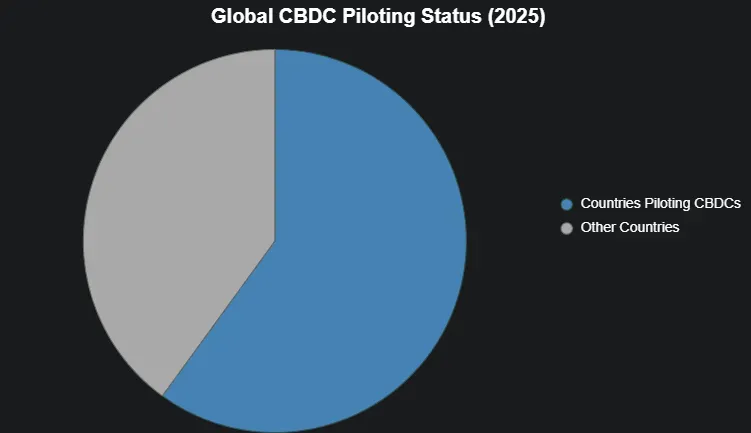

6. Central Bank Digital Currencies (CBDCs)

CBDCs like China’s digital yuan offer stability and efficiency. Over 120 countries pilot CBDCs in 2025, enhancing portfolio diversification.

"It has become increasingly clear that the future of money will be fueled by crypto."

— Goldman Sachs Research

CBDC Benefits

- Stability: Low-volatility assets.

- Efficiency: Instant cross-border settlements.

- Transparency: Auditable blockchain records.

More on CBDCs Coming Soon:

- CBDC vs Crypto for Institutional Use

Comparing government-issued vs decentralized digital assets. - Institutional Impact of Global CBDCs

How central bank currencies reshape finance operations. - Programmable Money for Finance Firms

Customizable digital currency for automated transactions. - CBDC Integration for Banks

Connecting traditional systems with digital currencies. - Policy and Regulation of CBDCs

Rules shaping CBDC design and deployment. - CBDC Adoption Challenges for Institutions

Barriers to implementing central bank digital currencies.

7. Navigating Crypto Regulations

Global regulations like EU’s MiCA and Singapore’s Payment Services Act provide clarity. Compliance ensures trust and market access.

"The crypto industry's record of failures, frauds and bankruptcies is not because we do not have rules or because the rules are unclear. It's because many players in the crypto industry don't play by the rules."

— Gary Gensler, Former Chair of US SEC

AML/KYC Compliance

- Partner with Chainalysis for transaction monitoring.

- Use AI tools for real-time compliance.

Compliant Strategies

- Invest in regulated ETFs.

- Conduct quarterly audits.

- Engage legal experts.

More on Regulations Coming Soon:

- Global Crypto Regulatory Compliance

Meeting international laws for digital assets. - MiCA Compliance for Crypto Funds

Aligning with EU’s crypto regulatory framework. - AML and KYC for Institutional Crypto

Preventing fraud through identity and risk checks. - Crypto Tax Strategy for Hedge Funds

Optimizing taxes on crypto gains and trades. - Crypto Regulatory Trends for Institutions

Tracking evolving laws shaping institutional adoption.

8. AI-Driven Risk Management

AI analytics optimize risk and returns. Tools like CoinMetrics and Glassnode monitor volatility, liquidity, and on-chain activity.

"Bitcoin is a technological tour de force. It's a way for individuals to be their own bank."

— Bill Gates, Founder of Microsoft

Risk Frameworks

- Value-at-Risk (VaR): Quantify potential losses.

- Stress Testing: Simulate market crashes.

- AI Monitoring: Predict whale movements.

More on Risk Management Coming Soon:

- AI Tools for Crypto Investment Risk

Assessing volatility and threats with machine learning. - Institutional Crypto Analytics Platforms

Data-driven insights for large-scale crypto investing. - Crypto Risk Stress Testing with AI

Simulating market shocks to test portfolio resilience. - Whale Activity Tracking Tools

Monitoring large transactions to predict market moves. - Predictive Analytics for Crypto Funds

Forecasting trends and prices using AI models. - AI for Crypto Portfolio Optimization

Balancing risk and return with intelligent automation.

9. Tokenization Opportunities

Tokenization unlocks liquidity in real estate, bonds, and art. Platforms like Polymath enable compliant, fractional ownership.

"Blockchain technologies will change transactions in a broad way."

— Brad Garlinghouse, CEO of Ripple(XRP)

Key Asset Classes

- Real Estate: Invest from $10,000.

- Bonds: Faster settlements, lower costs.

- Art: Diversify with collectibles.

More on Tokenization Coming Soon:

- Tokenized Real Estate Investment

Buying property shares as blockchain-based tokens. - Tokenized Securities and Fractional Ownership

Enabling shared ownership of stocks and assets. - Asset Tokenization Platforms for Funds

Tools to digitize and manage real-world assets. - Private Equity Tokenization with Blockchain

Unlocking liquidity in traditionally illiquid investments. - Tokenization Regulatory Challenges

Legal hurdles in issuing and trading tokenized assets.

10. Layer 2 Solutions

Layer 2 platforms like Arbitrum reduce costs by 90% and boost transaction speeds, ideal for trading and DeFi.

"I think bitcoin is on the verge of getting broad acceptance by conventional finance people."

— Elon Musk, Co-Fdr. Tesla, Fdr. of SpaceX

Top Platforms

- Arbitrum: High-throughput, Ethereum-compatible.

- Polygon: Interoperable, cost-effective.

- zkSync: Privacy-enhanced transactions.

More on Layer 2 Coming Soon:

- Layer 2 Networks for Institutional Adoption

Fast, low-cost blockchain scaling for institutions. - Arbitrum for Scalable Crypto Finance

Ethereum Layer 2 boosting transaction speed and savings. - ZK-Rollup Solutions for Finance

Secure, privacy-focused off-chain transaction bundling. - Polygon DeFi for Institutional Users

A multi-chain ecosystem offering efficient DeFi access at scale. - Layer 2 Security Considerations for Institutions

Evaluating risks and safeguards in off-chain transaction processing.

Conclusion

Crypto in 2025 empowers institutions with diversification, high yields, and innovation. Secure custody, regulated ETFs, DeFi, and tokenized assets drive success. Leverage AI analytics and ESG strategies to stay ahead. This guide equips you to thrive in blockchain’s transformative frontier.

"Bitcoin will be here for a while."

— Changpeng "CZ" Zhao

"The future of money is digital currency."

— Bill Gates

"Blockchain technology isn't just a more efficient way to settle securities. It will fundamentally change market structures, and maybe even the architecture of the Internet itself."

— Abigail Johnson

FAQ

Why are institutions investing in crypto in 2025?

Crypto offers diversification, high yields, and blockchain innovation. Bitcoin and Ethereum hedge inflation and volatility, with AI analytics ensuring precise market predictions.

How can institutions overcome crypto adoption barriers?

Navigate regulations with legal experts, secure assets with custodians like Coinbase, and use AI hedging to manage volatility. Training builds expertise.

Why is secure custody critical?

Custody protects against cyber threats and ensures compliance. Providers like Fidelity use cold wallets and AI to safeguard assets.

What are the benefits of crypto ETFs?

ETFs simplify exposure with liquidity and oversight. They manage $100B+ in 2025, integrating seamlessly with portfolios.

How can institutions mitigate DeFi risks?

Choose audited platforms, diversify investments, and use AI to monitor smart contract risks and impermanent loss.

How do ESG considerations shape crypto?

Sustainable blockchains like Ethereum and Algorand align with ESG goals, supported by tokenized green projects and AI audits.

What are CBDC benefits for portfolios?

CBDCs offer stability, fast settlements, and transparency, complementing volatile crypto assets in diversified portfolios.

How do institutions ensure regulatory compliance?

Partner with AML/KYC providers, invest in regulated ETFs, and use AI tools to track global regulations like MiCA.

How does tokenization enhance investments?

Tokenization unlocks liquidity in real estate and bonds, enabling fractional ownership via platforms like Securitize.

Why are Layer 2 solutions important?

Layer 2 platforms like Arbitrum reduce costs and speed up transactions, optimizing trading and DeFi strategies.

"If you don't believe it or don't get it, I don't have the time to try to convince you, sorry."

— Satoshi Nakamoto

Glossary of Key Terms

- Blockchain: A decentralized ledger ensuring secure, transparent transactions.

- Cryptocurrency: Digital assets like Bitcoin, secured by cryptography.

- DeFi: Blockchain-based finance without intermediaries, offering high yields.

- Crypto ETF: Regulated funds tracking crypto for easy exposure.

- Tokenization: Digitizing assets for fractional ownership and liquidity.

- CBDC: Central bank-backed digital currencies for stability.

- Layer 2: Scalable solutions reducing blockchain costs and delays.