In the wake of an emerging digital future, crypto and AI infrastructure requires immense amounts of energy for compute. What if the future of crypto and AI ran on dirt-cheap, 100% renewable energy? In 2025, Paraguay isn’t just powering cities—it’s fueling a $1.1B digital revolution.

Paraguay– a country leveraging its immense hydroelectric resources, primarily from the Itaipú Dam, to fuel a significant digital gold rush.

With electricity costs among the lowest globally, Paraguay has attracted over 60 crypto-mining sites, representing over $1.1 billion in investments since 2021 [1, 2].

Why this matters?

For crypto miners and AI innovators, Paraguay offers a rare blend of low-cost, green energy and a crypto-friendly regulatory framework, positioning it as a global hub for high-performance computing (HPC).

Yet, challenges like aging grid infrastructure and regulatory uncertainties loom. This article dives deep into how Paraguay's hydropower is reshaping crypto and AI industries, offering actionable insights for investors and tech enthusiasts.

Summary

- Crypto & AI Boom: Paraguay’s cheap hydropower fuels $1.1B in investments, with 60+ mining sites.

- Energy Surplus: 46 TWh generated, 32 TWh surplus at ~$0.05/kWh; miners pay ~$0.075/kWh.

- Crypto Regulations: 2019 law supports mining, but illegal farms and tariff hikes pose risks.

- AI Growth: Morphware AI uses green energy for cost-effective model training.

- Grid Issues: Aging infrastructure causes outages; $500M upgrade planned.

- Strategic Moves: Secure PPAs, build near Itaipú, diversify into AI/HPC.

- Future Potential: Grid upgrades and carbon credits to boost tech hub by 2026.

- Retail Access: Sazmining offers investors cheap power at $0.061/kWh.

Explore Our Institutional Crypto Investment Hub!

Key Points

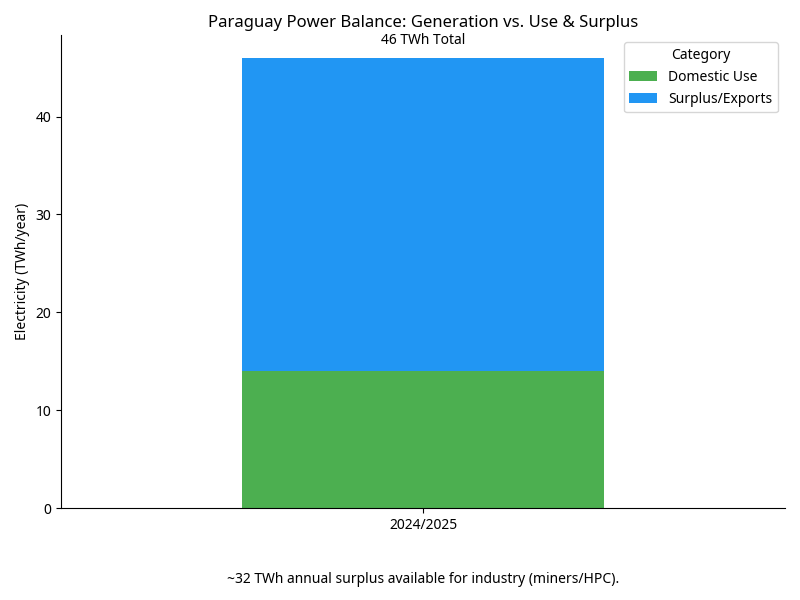

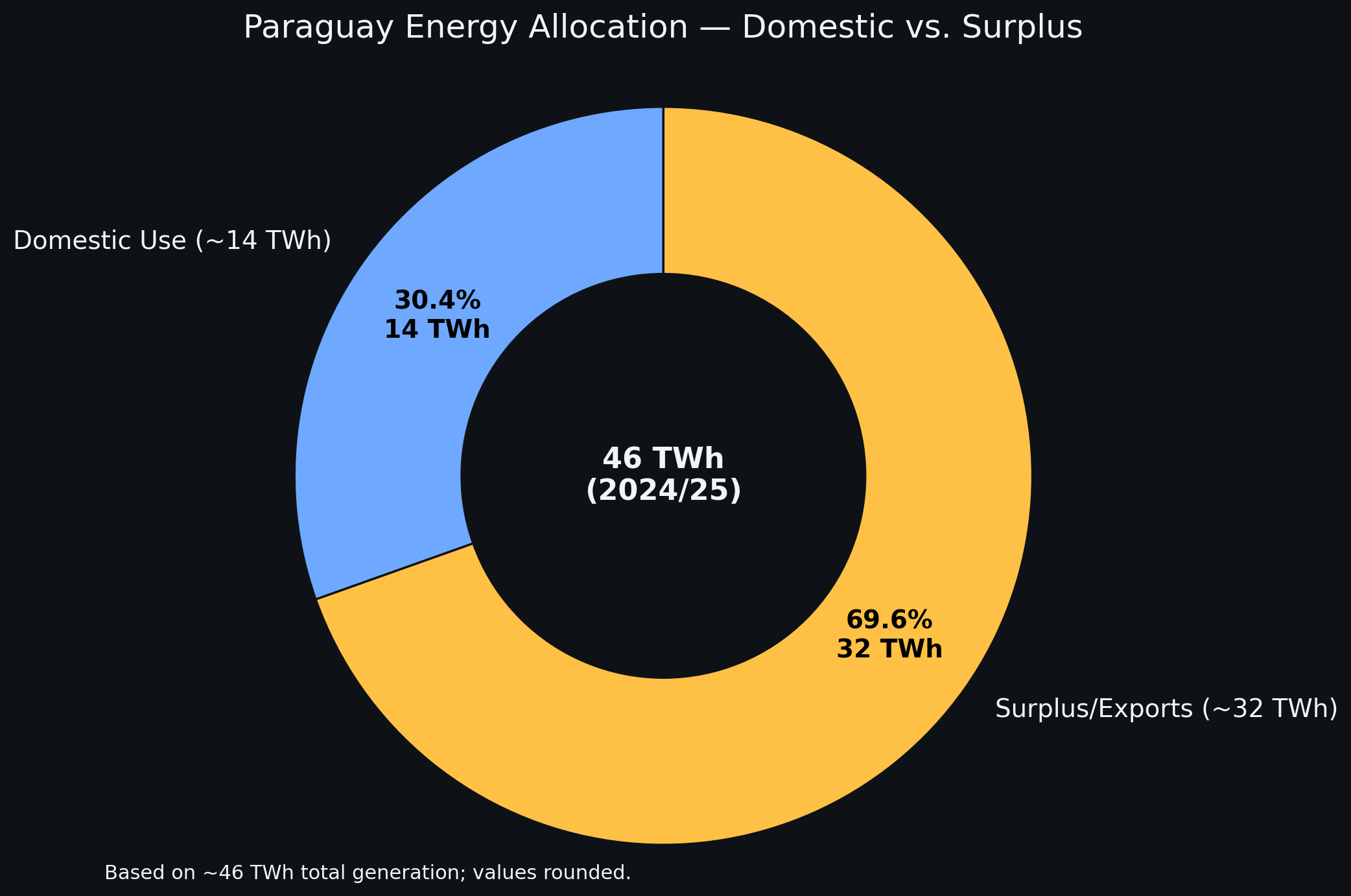

*Paraguay generates approximately 46 terawatt-hours (TWh) of electricity annually, predominantly from the Itaipú Dam, one of the world's largest hydroelectric facilities.

*With domestic consumption hovering around 14 TWh, a substantial surplus of 32 TWh remains, which is either exported or sold to industrial users at highly competitive rates [1].

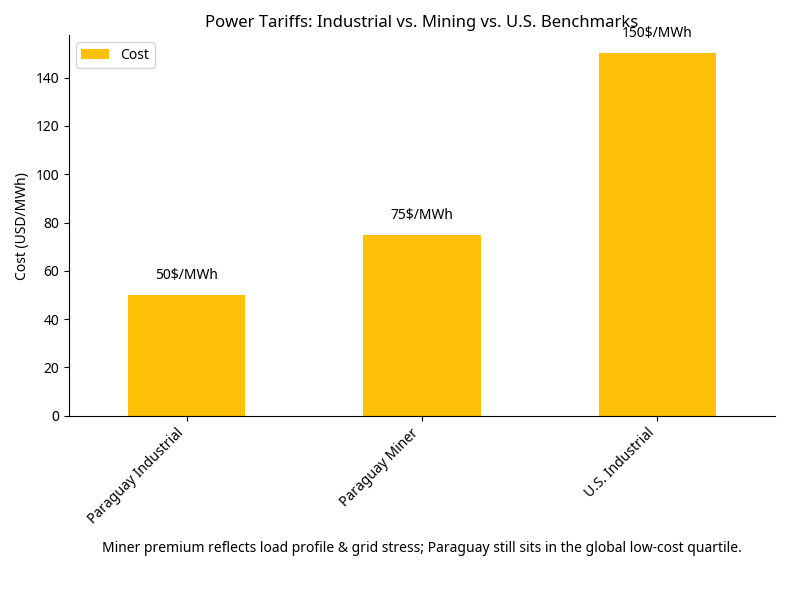

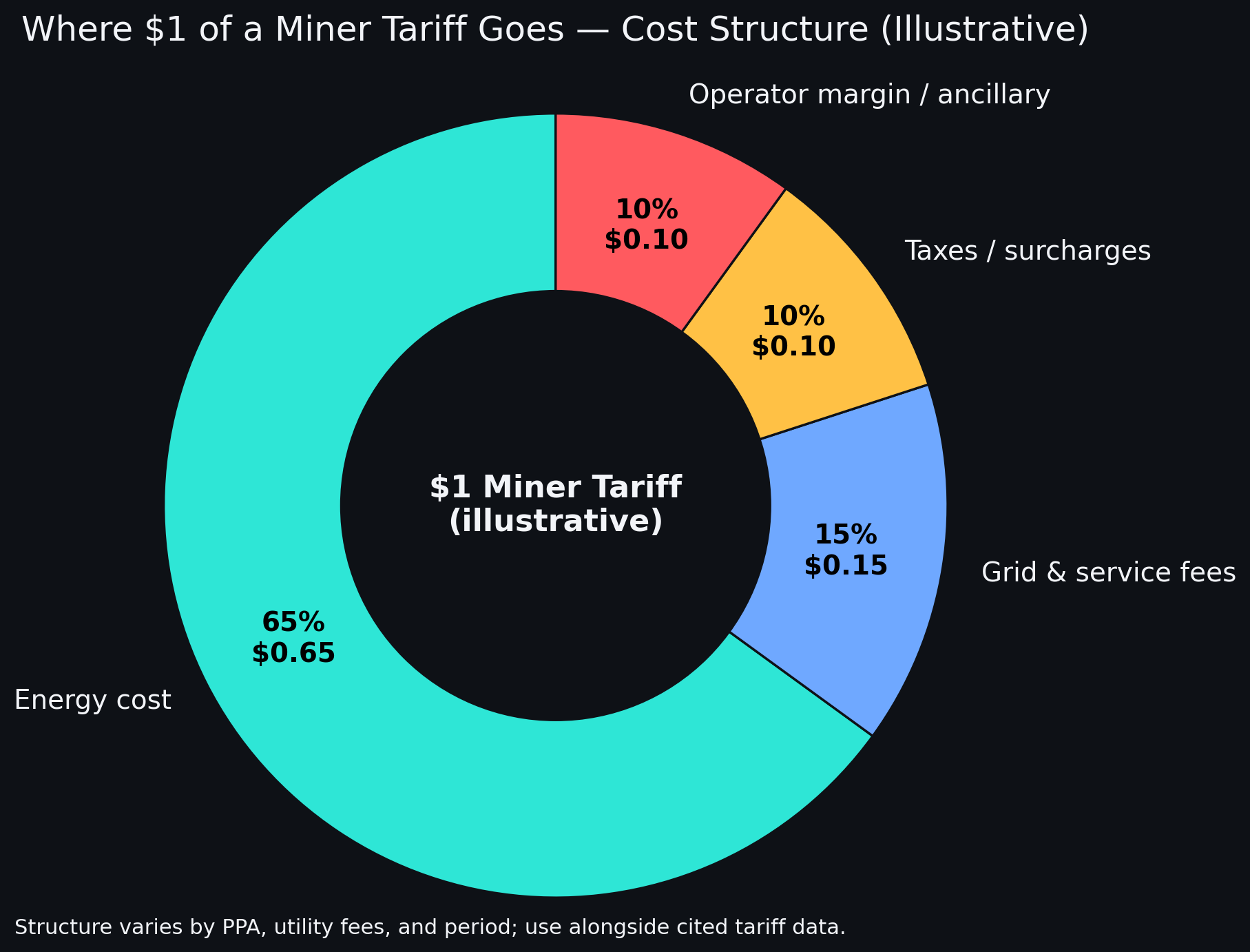

*While industrial electricity costs average around 0.05/kWh∗∗, crypto miners, despite facing a 50% higher tariff, still benefit from rates of approximately 500.075/kWh, which remains significantly lower than the 0.10–0.20/kWh seen in the U.S. [1, 4].

*This abundant, low-cost, and 100% renewable energy, coupled with a crypto-friendly law enacted in 2019, has transformed Paraguay into a magnet for energy-intensive industries.

*Companies like HIVE Digital Technologies, Marathon Digital Holdings, and Morphware AI have capitalized on this advantage for Bitcoin mining and AI model training.

*The Itaipú Dam, a joint venture with Brazil, produces clean energy, aligning with global sustainability trends and attracting ESG-focused investors.

Why Is Paraguay’s Crypto Power So Cheap?

History of Paraguay's Cheap Hydro Power

Paraguay gained independence from Spain in 1811 but faced turmoil, including the devastating War of the Triple Alliance (1864-1870). The 20th century saw dictatorship under Alfredo Stroessner (1954-1989), which spurred infrastructure growth, followed by democratic reforms in the 1990s.

Hydroelectric development began with the 1973 Itaipu Treaty with Brazil, leading to the Itaipu Dam's construction (1971-1975) at $19.6 billion, displacing communities but fostering cooperation.

Operational since 1984 with a 14,000 MW capacity, it powers most of Paraguay’s electricity and supports exports, recently attracting crypto mining.

Paraguay's journey to becoming a crypto and AI powerhouse is rooted in its unique energy history. The nation's abundant hydropower stems primarily from the Itaipú Dam, a colossal joint venture with Brazil, completed in 1984.

An engineering marvel generating far more electricity than Paraguay's domestic needs, creating a massive energy surplus that has historically been exported or, more recently, sought after by energy-intensive industries.

The foundation for the current crypto boom was laid in 2019 with the enactment of a crypto-friendly law, providing a clear regulatory framework for cryptocurrency mining, signaling to the world that Paraguay was open for business in the digital asset space [3].

A proactive regulatory stance, combined with the allure of ultra-low electricity rates (industrial rates hovering around $0.05 per kWh [1]), quickly transformed Paraguay into a magnet for Bitcoin miners and data center operators. The initial influx saw dozens of companies setting up shop, eager to tap into this unrivaled source of green energy.

Clearly, a confluence of factors has set the stage for Paraguay's current position as a global frontier for sustainable high-performance computing.

We at CryptoBitMag believe this historical context enriches the story of why Paraguay has emerged as such a compelling destination. It's not merely about cheap power, but rather the forward-thinking regulatory approach that anticipated the needs of emerging digital industries.

ANDE 101: Navigating Paraguay's Power Grid

Understanding Paraguay's state utility, ANDE, is key to grasping the mechanics of its cheap power:

Who is ANDE? Paraguay’s state utility. It sells power to large users under PPAs (Power Purchase Agreements) and applies a specific mining tariff (about 50% above the standard industrial rate).

Why the tariff premium? To reflect load profile and grid stress from dense ASIC/GPU clusters. In practice, miners still sit in the global low-cost quartile due to hydropower [5].

Enforcement & losses: ANDE and prosecutors have seized >10,000 illegal machines since 2024; penalties were toughened (up to 10 years for theft). This protects licensed operators’ economics [7].

Grid investments: ANDE earmarked ~$450M for transmission/distribution works (recent vintages), plus new high-voltage projects and time-of-use pilots. Expect gradual reliability gains, not overnight fixes [5, 6].

This robust, yet evolving, power infrastructure is the bedrock of Paraguay's appeal.

Quick Recap

- Hydroelectric Surplus: 32 TWh of excess power annually, ideal for high-performance computing.

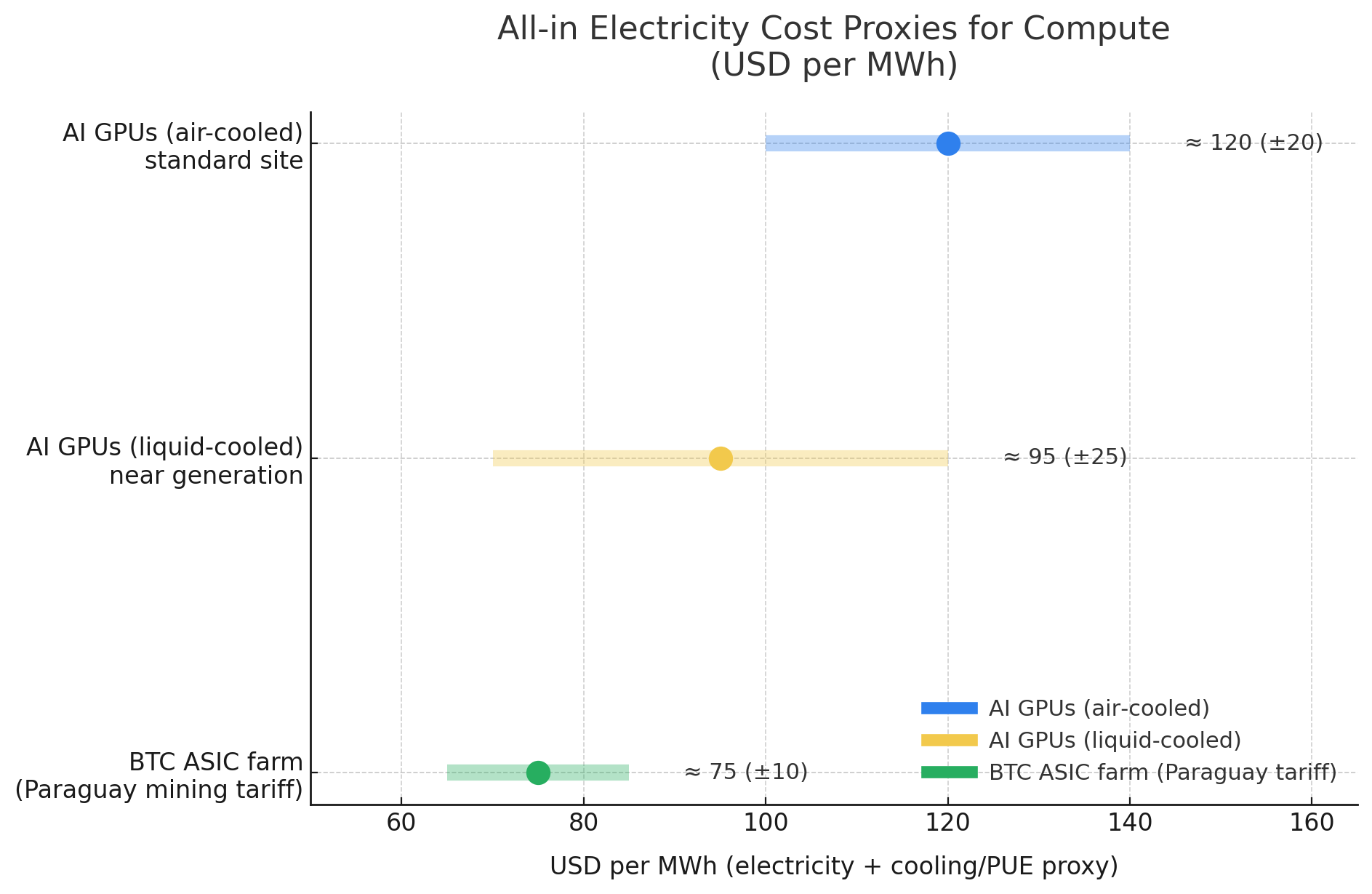

- Low Costs: Industrial rates at $0.05/kWh, with miners paying ~$0.075/kWh.

- Renewable Energy: 100% hydroelectric, appealing to ESG-focused investors.

- Regulatory Support: 2019 law provides clarity for crypto mining operations.

Why Paraguay Powers Crypto & AI

Paraguay's energy abundance isn't just a boon for Bitcoin miners; it's a game-changer for the growing field of Artificial Intelligence. The sheer computational power required for training sophisticated AI models, particularly large language models (LLMs), demands immense and, crucially, affordable energy. This is where Paraguay truly shines, offering a strategic advantage that positions it as a global hub for AI innovation.

AI Innovation Advantages: Powering the Future of Compute

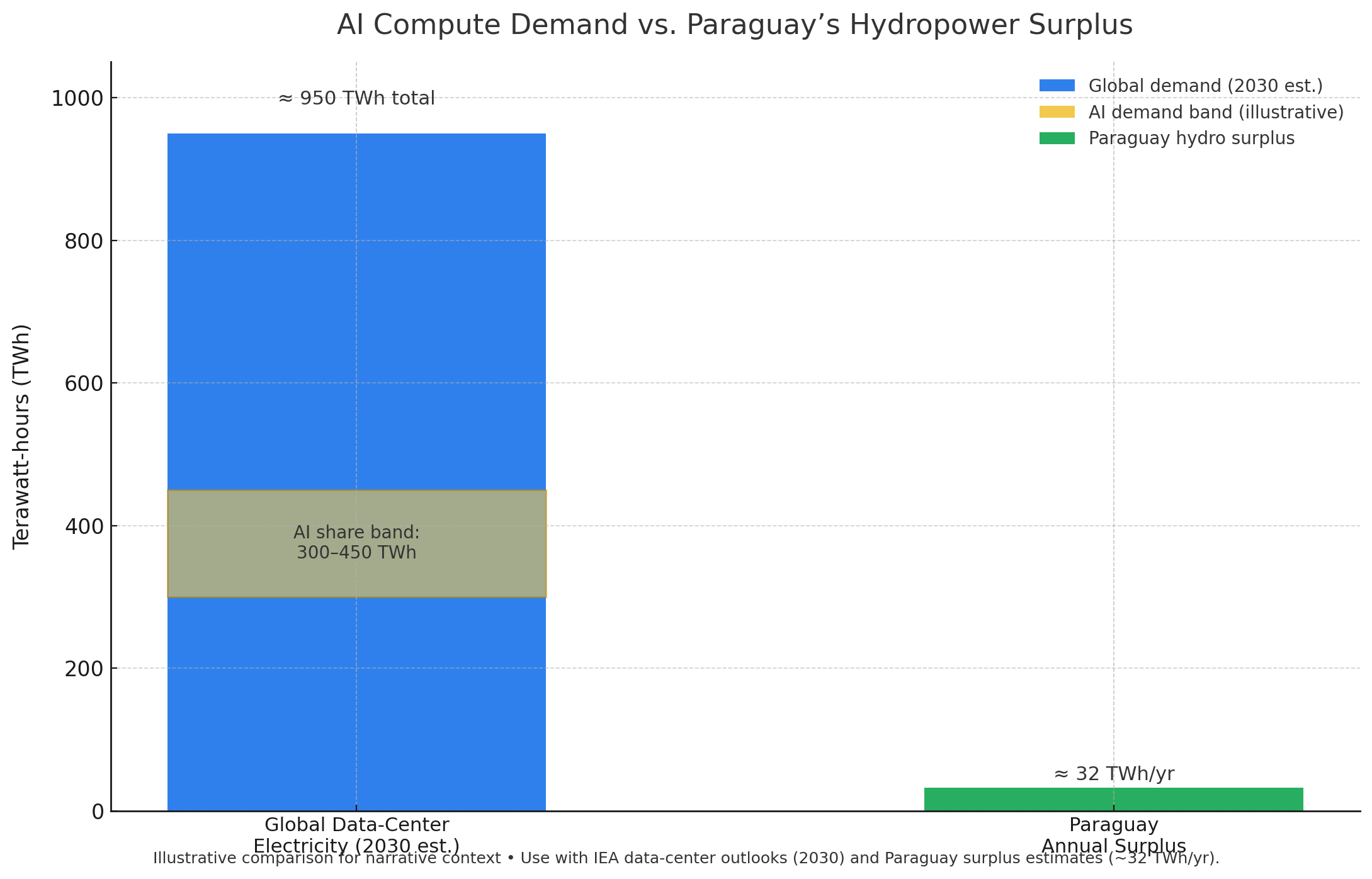

For AI innovators, Paraguay’s energy surplus provides a critical advantage for data-intensive tasks like training LLMs.

The International Energy Agency (IEA) estimates that data center electricity consumption could reach 620–1,050 TWh by 2026, with AI driving a significant portion of this surge [8].

The immense power demand for compute-intensive training clusters is influences siting decisions, pushing workloads towards regions with cheap, stable, and abundant energy.

Major tech players are already setting precedents. Microsoft/OpenAI's proposed "Stargate" supercomputer, reportedly costing near $100 billion, exemplifies the escalating compute arms race.

Similarly, Elon Musk's xAI is constructing a "Gigafactory of Compute," with Memphis selected for a major 2025–2026 build. These projects highlight that energy price and availability are strategic imperatives, compelling some workloads to low-cost geographies like Paraguay.

Morphware AI: Hydropowered Decentralized Intelligence

Morphware is a newer player blending the worlds of crypto mining and artificial intelligence, but one that's rapidly establishing itself as a serious contender in the decentralized compute space.

Founded in 2021 by Kenso Trabing, a former blockchain data scientist, Morphware is an Asunción-based startup (with U.S. ties) that runs a Web3 platform for AI workloads, powered by a network of elite GPU servers – some of which are physically located in Paraguay to tap the cheap hydro-power from the world's second-largest hydroelectric facility, the Itaipu Dam.

In essence, Morphware's model is to provide AI computing services (like training large language models (LLMs) or running AI agents) on distributed hardware, and reward providers with its native crypto token (XMW). What sets them apart is their "superpeer" network architecture, which utilizes premium NVIDIA H200 and upcoming B200 GPUs.

Think of it as a decentralized AWS for AI, where anyone can contribute computing power, but with enterprise-grade infrastructure that's already serving real clients.

Real Enterprise Adoption and Revenue Streams

Unlike many crypto projects that remain purely speculative, Morphware has secured actual enterprise clients, including representatives for major brands like Nike, Adidas, Porsche, and Honda in Paraguay, who use their AI agents for revenue optimization and analytics.

This real-world utility generates genuine revenue streams that feed back into the ecosystem through a deflationary token mechanism – 25% of all profits are used for XMW buybacks, with over $550,000 already executed.

The company operates multiple revenue streams simultaneously: AI services for enterprise clients, Bitcoin mining operations (scaling from 1 BTC per month to a target of 100 BTC monthly), and their decentralized compute marketplace. This diversification provides stability and multiple growth vectors.

AI + Hydro + Marketplace = Strategic Positioning

Paraguay gives Morphware a strategic edge that goes beyond just cheap energy. The abundant green energy from the Itaipu Dam allows them to operate high-end NVIDIA GPUs at approximately $35 per MWh compared to $150 per MWh in the United States – a massive 70% cost advantage. This translates to Bitcoin mining costs of just $28,000-$32,000 per coin, compared to industry leaders like Riot Platforms who mine at $70,000-$85,000 per coin.

They also mine Bitcoin on the side when GPUs are underutilized, ensuring no energy is wasted and creating additional revenue streams that support token buybacks.

Co-founder and CEO Kenso Trabing has highlighted that Paraguay's fully renewable grid fits Morphware's mission of "sustainable compute" – every AI inference or model trained on Morphware's network is backed by hydroelectric power rather than fossil fuels.

This positioning has attracted attention from unexpected quarters, including a visit from U.S. State Department and Embassy representatives to their Paraguay headquarters in July 2025, where officials (Marco Rubio) noted that "someone smart should open an AI facility in Paraguay."

Wow!👀

— Morphware (@MorphwareAI) May 21, 2025

“So someone, if they’re smart is going to go down to Paraguay and open up an AI facility.”— @StateDept$XMW pic.twitter.com/bobvkkr5Xq

Big things are moving in Paraguay 🇵🇾

— Morphware (@MorphwareAI) July 21, 2025

We had the pleasure of welcoming @laembajada and @StateDept to the Morphware HQ. This shows the growing recognition we are getting at the highest levels.

AI infrastructure. Bitcoin mining. Local partnerships.

We are building fast and getting… pic.twitter.com/03BqVE4S7B

Global Expansion and Market Position

Morphware's ambitions extend well beyond Paraguay. The company has established Morphware UAE with an office in Dubai's crypto district, positioning for solar-powered operations in the Middle East and access to regional capital markets. CEO Kenso Trabing delivered a main-stage presentation at TOKEN2049 Dubai in May 2025, speaking on "The AI Compute Crisis & Web3 Opportunity," further cementing their position in the global crypto ecosystem.

Despite these achievements and a clear competitive moat, Morphware remains significantly undervalued compared to peers. With a market capitalization of approximately $35 million, the XMW token trades at a fraction of competitors like Render (RENDR) or Akash (AKT), despite having real revenue, physical infrastructure, and enterprise partnerships that many larger projects lack.

The renewable nature of the energy also aligns with the growing demand for sustainable AI operations, appealing to clients such as universities and climate-tech startups, while the company's roadmap includes deploying H200 server racks that generate over $400,000 in annual revenue per $300,000 investment.

This kind of synergy between abundant green energy, cutting-edge AI development, and strategic global positioning underscores Paraguay's potential to become a global powerhouse in the digital economy, attracting both established players and innovative startups.

Morphware's model demonstrates how developing nations with abundant renewable energy can leapfrog traditional tech infrastructure to become leaders in next-generation computing.

What's your take on Paraguay's rise as a crypto and AI hub, and do you think Morphware's multi-revenue stream approach gives them a sustainable competitive advantage? Share your thoughts in the comments!

Paraguay’s Cheap Crypto Power

Seduced by the dirt-cheap power of Paraguay’s unique energy landscape, a diverse range of companies, from established crypto mining giants to innovative AI startups, are actively building out high-performance computing hubs, transforming the nation into a new frontier for digital infrastructure.

Compute Gold Rush Manifested

Fueled by massive hydroelectric dams like Itaipú, the country generates far more power than it consumes, leaving an estimated 32 terawatt-hours of surplus annually.

Industrial electricity rates hover around $0.05 per kW– among the lowest in Latin America – making Paraguay a magnet for Bitcoin miners and data center operators seeking low-cost, green energy.

In the past three years alone, over 60 new crypto-mining sites have opened, representing $1.1+ billion in investments.

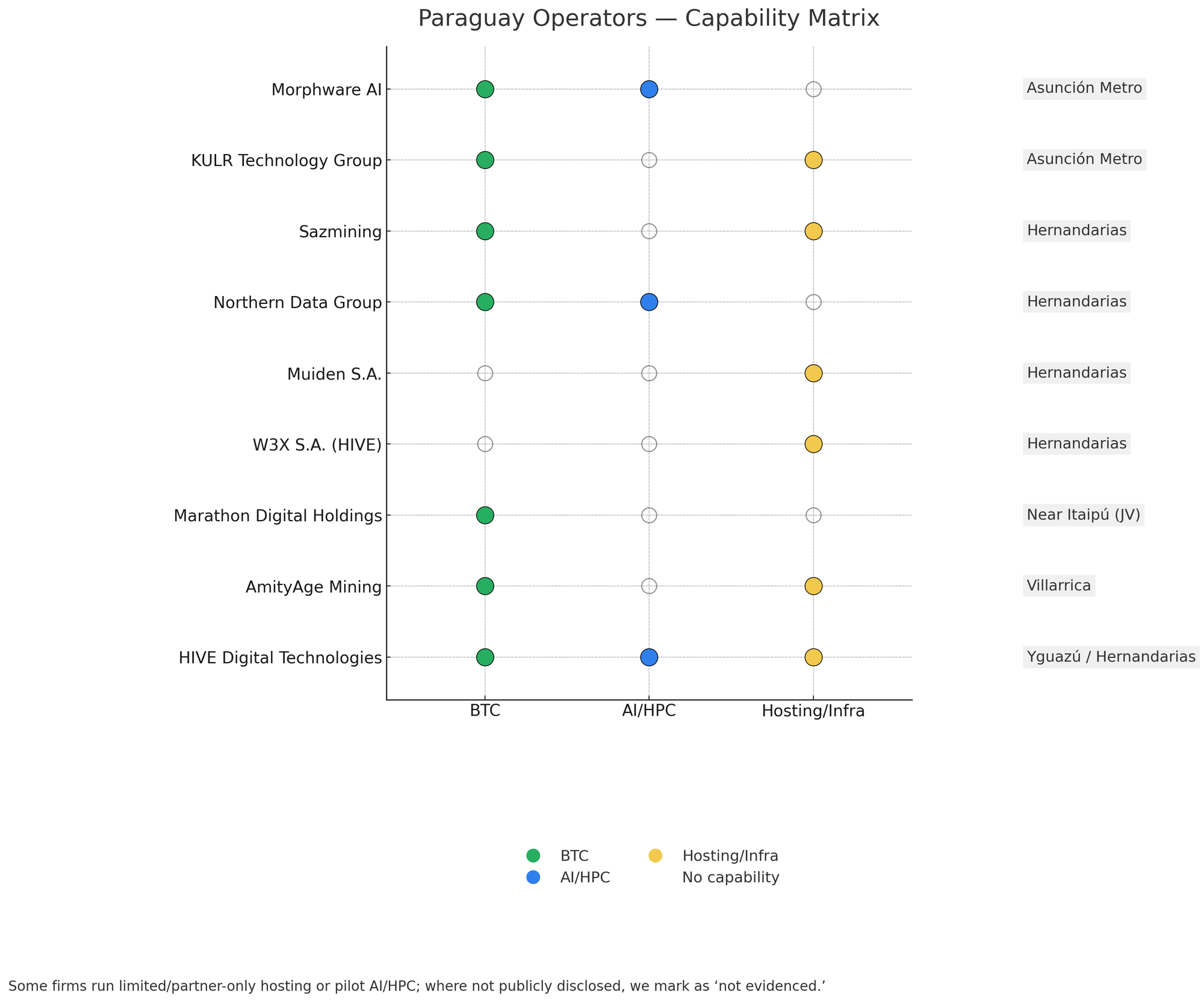

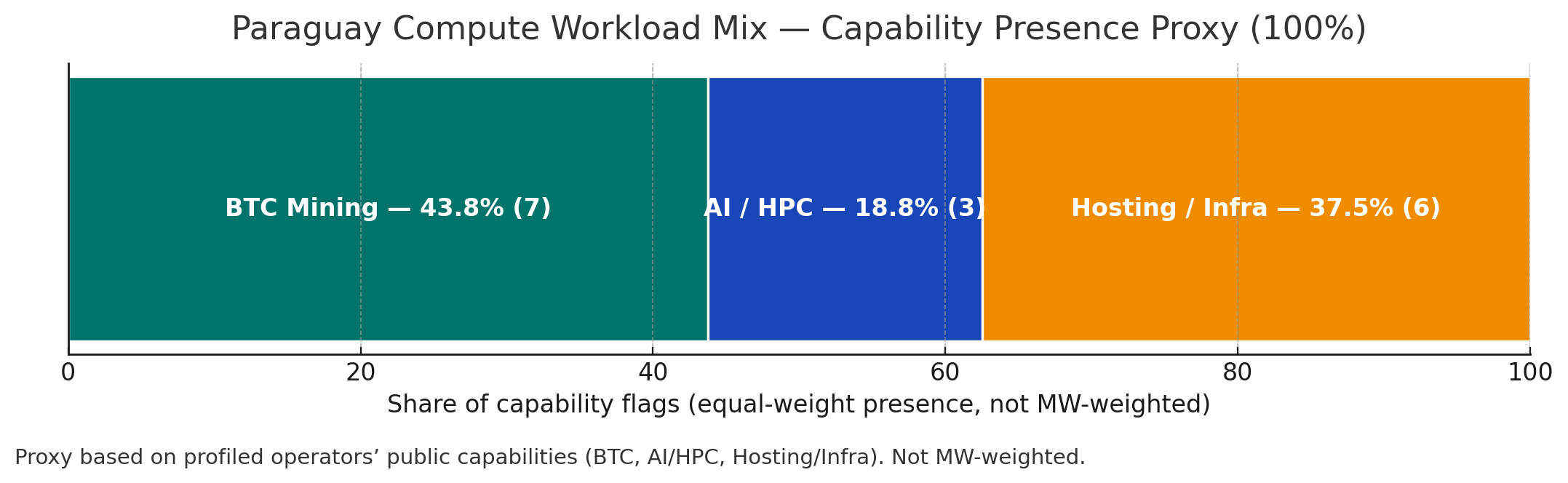

This influx includes both global corporations and local startups building out high-performance computing hubs. Before diving into some key players and their strategy, here’s a quick list of the major companies leveraging Paraguay’s power advantage:

- HIVE Digital Technologies – Founded 2017, CEO Aydin Kilic.

- Marathon Digital Holdings – Founded 2010, CEO Fred Thiel.

- Morphware AI – Founded 2021, CEO Kenso Trabing.

- KULR Technology Group – Founded 2015, CEO Michael Mo.

- Sazmining – Founded 2018, CEO William Szamosszegi.

- Northern Data Group – Founded 2017, CEO Aroosh Thillainathan.

- AmityAge Mining – Founded ~2022, CEO Dušan Matuška.

- Muiden S.A. – Founded ~2020, CEO Xinrou Zhu.

- W3X S.A. – (Subsidiary of HIVE Paraguay).

HIVE Digital Technologies: Green Bitcoin Mining & HPC Ambitions

HIVE Digital Technologies (NASDAQ: HIVE), a Toronto-based firm, has strategically positioned itself as a “green” digital infrastructure company.

In mid-2024, HIVE solidified its presence in Paraguay by signing agreements to develop a 100 MW hydro-powered data center, acquiring local firm W3X S.A. in the process.

This site, tapping energy from the Itaipú Dam via a Power Purchase Agreement (PPA), is set to significantly boost HIVE’s hashing capacity, adding 6.5 EH/s to reach a projected 12.1 EH/s total [10].

The New HIVE Bitcoin Mine in Yguazú, Paraguay pic.twitter.com/VQPRiagivQ

— Documenting ₿itcoin 📄 (@DocumentingBTC) July 31, 2025

HIVE explicitly cites Paraguay’s inexpensive, 100% renewable electricity and the government-owned utility’s openness to foreign investment as key attractions.

By utilizing hydroelectric power at approximately $0.05/kWh, HIVE maintains healthy mining margins, even as Bitcoin’s mining difficulty increases. The stable energy supply and minimal downtime further enhance its appeal.

While HIVE’s core business remains Bitcoin mining, it is actively pivoting into high-performance computing (HPC) and AI services, deploying NVIDIA GPU clusters. A dual-use approach allows HIVE to target the booming AI cloud market, making Paraguay a global GPU and ASIC hub for the “green digital economy” [10].

Marathon Digital Holdings: A U.S. Bitcoin Giant Goes Global

Marathon Digital Holdings (NASDAQ: MARA), one of North America’s largest Bitcoin miners, marked its first Latin American expansion into Paraguay in late 2023.

MARA’s July 2025 Bitcoin Production Highlights are here.

— MARA (@MARA) August 4, 2025

- 207 Blocks Won in July, 2% Decrease M/M

- 703 Bitcoin Produced in July, 1% Decrease M/M

- Increased BTC Holdings* to 50,639 BTC

Read the full report: https://t.co/3TculeXYdd pic.twitter.com/fay9esNEr3

Through a joint venture with Paraguay’s Penguin Group, Marathon launched a 27 MW pilot project near Itaipú, rapidly scaling to 1.1 EH/s capacity by early 2024. This project is 100% hydro-powered, with Marathon providing miners and capital, and Penguin offering local infrastructure and expertise [11].

Marathon’s rationale aligns with its strategy of diversifying geographic risk and tapping stranded energy. By consuming Paraguay’s vast energy surplus on-site for Bitcoin mining, Marathon not only lowers its average power cost but also increases the share of renewables in its energy mix, appealing to ESG mandates.

CEO Fred Thiel views this as a win-win, allowing Paraguay to monetize excess electricity without needing expensive transmission lines. Although primarily focused on Bitcoin mining, the facility’s design allows for potential future diversification into AI if Marathon chooses [11].

Morphware AI: Decentralized Intelligence, Hydro-Powered

As previously highlighted, Morphware AI exemplifies how AI companies are leveraging Paraguay’s energy advantage.

This decentralized AI compute marketplace, founded by Kenso Trabing, pairs low-carbon Paraguayan hydro with GPU supply to run model training and agents at materially lower operational expenditures than traditional tech hubs.

Their focus on LLM training and fine-tuning positions them uniquely in the market, demonstrating that Paraguay’s cheap power is not just for crypto mining but also for the compute-intensive demands of advanced AI [9].

KULR Technology Group: Expanding HPC Capabilities

Excited to welcome BlackRock to the $KULR Bitcoin First family. The leader in institutional $BTC adoption now owns 5.6% of our stock! As KULR evolves, our institutional shareholder base continues to grow! pic.twitter.com/DZLTqxfpuO

— Michael Mo (@michaelmokulr) July 18, 2025

KULR Technology Group (NASDAQ: KULR) has also made significant strides in Paraguay, deploying 3,570 miners with a reported ~750 PH/s capacity and targeting ~1.25 EH/s in 2025.

KULR’s presence underscores the country’s appeal for expanding high-performance computing capabilities, further diversifying the tech ecosystem beyond pure Bitcoin mining.

Sazmining: Retail Access to Green Mining

@Sazmining is mining aligned with the Bitcoin ethos:

— Kent Halliburton (@khalliburton) August 4, 2025

✅ No rig markups

✅ No electricity markups

✅ Hydro energy

✅ 100% Wild Sats

✅ Full machine ownership

✅ 100% incentive alignment: we earn when you do

Our mission: Help you to ⚡️ own ⚡️ your share of the Bitcoin network.

Sazmining, a retail hosting provider, launched a 5 MW facility in Paraguay in 2023, expanding towards ~8.3 MW.

Their current Paraguay rate guidance of 0.055–0.059/kWh makes green mining accessible to retail investors.

Sazmining’s carbon-neutral pitch and plug-and-play model attracted significant customer investments, demonstrating the appeal of transparent pricing and green branding in the market [12].

Northern Data (Peak) + Penguin Infrastructure: AI/HPC Synergy

Northern Data Group (ETR: NB2) in partnership with Penguin Infrastructure, operates a 28 MW liquid-cooled site in Hernandarias.

Powered by 100% hydro, this facility is part of a broader AI/HPC initiative, showcasing the synergy between energy infrastructure and advanced computing.

Their collaboration highlights the potential for large-scale, sustainable data center operations in Paraguay [13].

AmityAge Mining & Muiden S.A.: Local and Boutique Players

AmityAge Mining, a boutique hosting provider, focuses on a “mine-to-educate” mission with operations in Paraguay and Ethiopia.

Muiden S.A., a local operator in Hernandarias, was among the first to secure ANDE contracts under the new tariff, demonstrating early adoption and local engagement in the burgeoning market.

The diverse nature of these companies collectively illustrate the profound impact of Paraguay’s cheap and renewable hydropower on the global crypto and AI industries. Their continued investment and expansion solidify Paraguay’s position as a critical player in the future of energy-intensive digital technologies.

Paraguay’s Crypto Power Challenges

Despite its immense promise and dirt-cheap hydropower, Paraguay’s burgeoning crypto and AI industries face significant hurdles that demand careful navigation.

Ranging from infrastructure limitations to regulatory uncertainties and illicit activities, these challenges necessitate active risk management for all stakeholders.

Below are the key risks updated as of July 2025.

Grid Infrastructure Bottlenecks: The Achilles' Heel

Paraguay’s abundant power surplus is undeniable, but its distribution network often struggles to keep pace with the rapid influx of energy-intensive operations. This creates transmission bottlenecks that can lead to grid instability.

In regions like Alto Paraná, the proliferation of illegal mining farms has significantly contributed to grid disruptions and substantial power losses for the state utility, ANDE.

For instance, a single illicit operation near Hernandarias was found to divert an estimated $720,000 in power annually in 2024 [7].

Legitimate operators, such as Penguin Group, have reported outages due to overloaded lines, directly impacting their operational uptime.

While ANDE has planned a $500 million grid upgrade to alleviate these issues, a definitive completion timeline remains unspecified [1]. This ongoing infrastructure deficit means operators are advised to prioritize sites near Itaipú to minimize transmission losses and enhance reliability, effectively creating their own energy moat by being close to the source.

Illegal Mining Operations: A Persistent Threat

Unregistered mining farms continue to bypass meters, stealing power and causing substantial financial losses for ANDE [7]. In 2024, police raids resulted in the seizure of thousands of illegal rigs, and the Senate has increased penalties for power theft to up to 10 years in prison.

Although these crackdowns are essential for grid stability and protecting the economics of licensed operators, they can also negatively impact the public perception of legitimate players, creating a narrative of an unregulated frontier.

Regulatory Uncertainty: A Moving Target

Regulatory dynamics present another significant challenge. A 50% tariff hike for high-consumption miners in 2024 increased operational costs, leading HIVE to scale back its expansion plans [10].

Nonetheless, Paraguay’s 2019 crypto-friendly law continues to attract investors [10, 21]. A proposed 180-day mining ban in 2024, though not enacted, raised concerns about potential revenue losses for licensed miners, estimated between 48 million and 125 million annually [21].

Instances like this underscore the need for firms to proactively engage with policymakers to advocate for stable and predictable regulatory frameworks, ensuring that Paraguay remains a crypto paradise rather than a regulatory minefield.

Bitcoin Price Volatility: The Market's Influence

Mining profitability is inherently linked to Bitcoin’s price volatility. A dip in 2024, for example, saw miners like Marathon facing reduced margins.

However, Paraguay’s low energy costs provided a crucial buffer, allowing operators to withstand market fluctuations more effectively than those in higher-cost regions.

A sustained price drop could still pose challenges for smaller operators, emphasizing the need for operational efficiency and diversification beyond pure mining. These challenges, while significant, are not insurmountable.

Proactive engagement with infrastructure development, robust security measures against illicit activities, and consistent dialogue with policymakers are crucial for Paraguay to fully realize its potential as a global leader in energy-intensive digital industries.

Case Study: Bitfarms’ Exit

In 2025, Bitfarms sold its 200 MW Yguazu facility to HIVE for $85M, citing debt pressures and regulatory uncertainties.

The sale highlights how policy unpredictability can deter even established players, though HIVE’s acquisition shows continued demand for Paraguay’s power.

Lessons Learned: Engage with regulators early and diversify revenue streams to mitigate market risks.

Case Study: Penguin Group’s Grid Challenges

Penguin Infrastructure faced outages in Hernandarias in 2024 due to overloaded transmission lines.

By partnering with Northern Data, Penguin secured a stable power supply and expanded its data center to 25 MW, blending Bitcoin mining and AI workloads [Document, 2025].

Lessons Learned: Proximity to Itaipú and diversified operations enhance resilience.

Quick Recap

- Paraguay’s energy advantage is undeniable, but several factors shape its viability for crypto and AI operations.

- Energy Cost Stability: Paraguay’s low electricity rates are locked in via short-term Power Purchase Agreements (PPAs), but proposed tariff hikes (e.g., 14% energy tax) could raise costs.

- HIVE capped its expansion at 100 MW due to such uncertainties. Miners and AI firms must negotiate long-term PPAs to ensure cost predictability.

- Infrastructure Limitations: Despite abundant generation, Paraguay’s aging transmission lines cause bottlenecks and outages, especially in regions like Alto Paraná.

- ANDE’s planned $500M grid upgrade could alleviate this, though a completion timeline remains unspecified.

- Operators should prioritize sites near Itaipú to minimize transmission losses.

- Regulatory Dynamics: The 2019 crypto law provides clarity, but a proposed 180-day mining ban in 2024 (not enacted) raised concerns.

- Firms must engage with policymakers to advocate for stable regulations, as sudden changes could deter investment, as seen with Bitfarms’ exit.

These considerations highlight the need for strategic planning to maximize Paraguay’s energy benefits while mitigating risks.

What Are Paraguay’s Best Crypto Power Practices?

To truly thrive in Paraguay’s dynamic crypto and AI ecosystem, companies must adopt a strategic and proactive approach. Leveraging dirt-cheap hydropower but also implementing best practices that ensure long-term sustainability, operational efficiency, and strong stakeholder relationships is paramount.

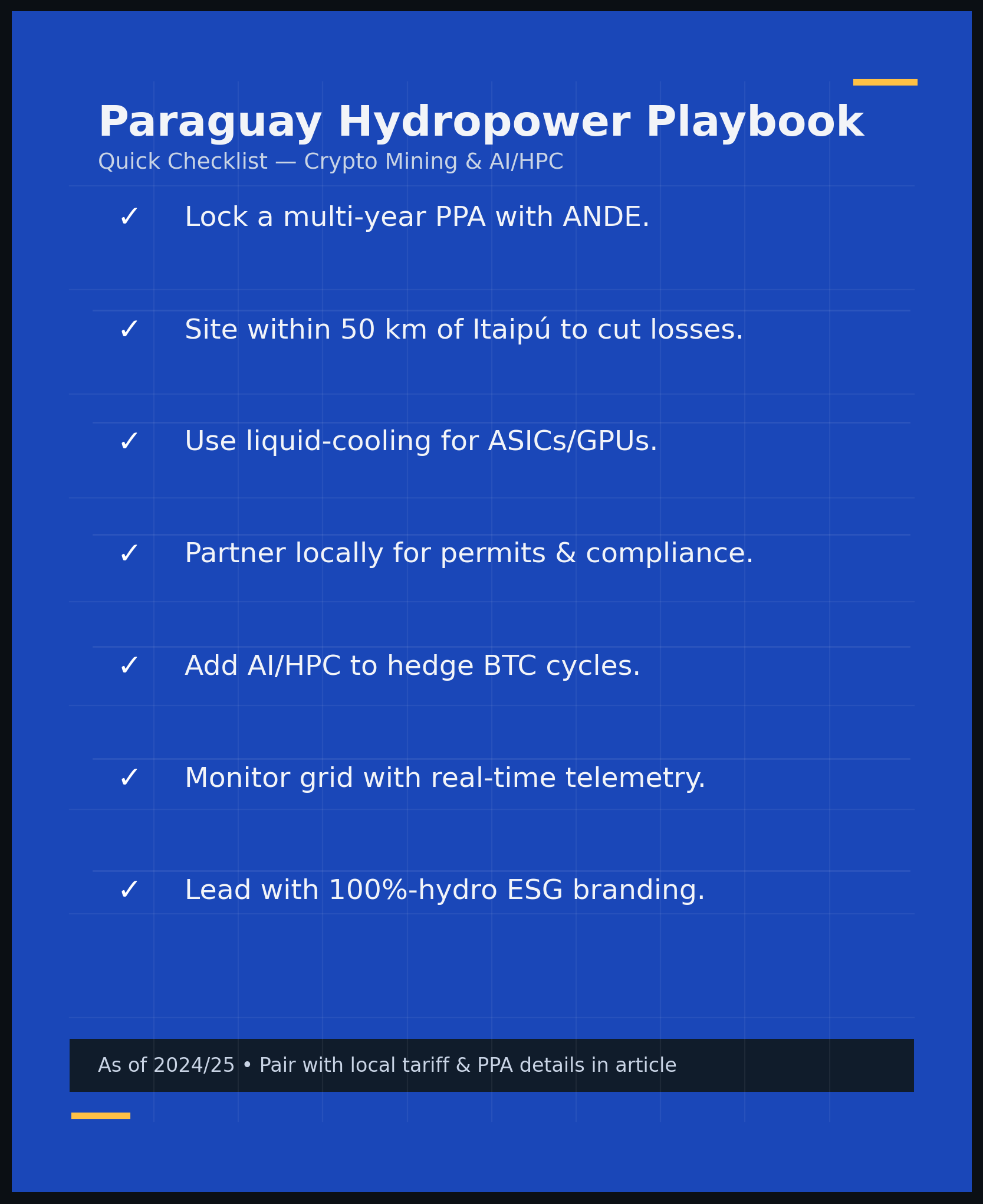

This playbook outlines key strategies for locking in low-cost hydro into durable margins.

Actionable Steps for Sustainable Operations

Secure Long-Term Power Contracts

Negotiate multi-year PPAs (Power Purchase Agreements) with ANDE to lock in favorable rates. HIVE’s 100 MW facility, for instance, utilizes a PPA tied to Itaipú, ensuring crucial cost stability in a volatile market [10]. This foresight is key to building a resilient business model.

Invest in Infrastructure Resilience

Building facilities near Itaipú is not just about proximity; it’s about minimizing transmission losses and enhancing reliability. Northern Data’s partnership with Penguin, which includes liquid-cooled ASICs, exemplifies how investing in robust infrastructure can optimize efficiency and uptime [13].

Engage with Regulators

Proactive engagement with Paraguayan authorities is paramount. Companies should collaborate to advocate for stable and predictable policies. Penguin’s successful advocacy against the proposed 2024 mining ban demonstrates the power of collective industry voice in shaping a favorable regulatory environment [22].

Diversify Revenue Streams

Relying solely on crypto mining can expose companies to significant market volatility. Diversifying into AI or HPC workloads, as exemplified by Morphware AI, leverages Paraguay’s low-cost power for energy-intensive tasks beyond mining, creating a more robust and adaptable business model [9].

Pro Tips for Maximizing Advantage

• Site Selection is Critical: Choose locations within 50 km of Itaipú to significantly reduce grid dependency and transmission risks [1]. Strategic positioning can be a major differentiator.

• Real-Time Energy Monitoring: Implement advanced analytics to optimize power consumption and proactively avoid outages. A data-driven approach ensures maximum uptime and efficiency [7].

• Cultivate Local Partnerships: Collaborating with local firms, such as Muiden S.A., can streamline setup processes, facilitate regulatory navigation, and foster community acceptance. Local expertise is invaluable in a new market.

• Embrace Sustainability Branding: Highlight the use of 100% renewable energy to attract ESG-focused investors. This not only enhances brand reputation but also taps into a growing pool of capital seeking environmentally responsible investments [10].

Case Studies in Action

Sazmining’s Retail Model

Sazmining’s 13 MW Paraguay facility, hosting 1,600 rigs for retail investors, showcases the success of transparent pricing and a green branding strategy.

Their 0.055–0.055–0.055–0.059/kWh rate guidance and plug-and-play model attracted significant customer investments, proving that accessibility and clear value propositions resonate with a broad audience [12].

Bitfarms’ Exit and HIVE’s Entry

Bitfarms’ decision to sell its Yguazú (200 MW) site to HIVE in 2025, as part of a balance-sheet reset, highlights the impact of policy unpredictability.

However, HIVE’s acquisition underscores the continued strong demand for Paraguay’s green power, even amidst regulatory shifts [10].

Marathon JV Clarity

Marathon’s hydro joint venture in Paraguay, launched in November 2023, demonstrates a strategic commitment to leveraging Paraguay’s cheap hydropower for global Bitcoin mining operations.

Contributing ~1.1 EH/s to Marathon’s capacity, this move solidifies the country’s role in large-scale, sustainable mining [11].

Checklist

- Secure a multi-year PPA with ANDE for cost stability.

- Build facilities near Itaipú to minimize transmission risks.

- Implement liquid-cooling for ASICs and GPUs to boost efficiency.

- Partner with local firms for regulatory navigation.

- Diversify operations with AI or HPC to hedge against crypto volatility.

- Monitor grid performance with real-time analytics.

- Promote sustainability to attract ESG investors.

By adhering to these best practices, companies can not only navigate the challenges but also unlock the full potential of Paraguay’s unparalleled energy advantage, securing their position in the future of crypto and AI.

Future of Paraguay’s Cheap Crypto Power

A New Frontier for Digital Dominance

Looking ahead to 2026 and beyond, Paraguay’s hydropower advantage is poised to continue driving unprecedented growth in the crypto and AI sectors. The nation is not merely a temporary haven for cheap energy; it is strategically positioning itself as a permanent fixture in the global digital economy, with several key trends shaping its trajectory.

Grid Upgrades: Powering Tomorrow’s Ambitions

ANDE’s substantial $500 million investment is earmarked for modernizing transmission lines, a critical step that will significantly reduce outages and support an additional 1,000 MW of mining capacity in the coming years [1]. These upgrades are vital for ensuring the stability and reliability of the grid, which is essential for energy-intensive operations. This proactive infrastructure development signals Paraguay’s commitment to sustaining its energy moat and accommodating future growth.

AI and HPC Expansion: The Next Digital Gold Rush

Companies like Northern Data and Penguin are actively planning to scale their AI workloads in Paraguay. This expansion is projected to position Paraguay as a significant player, potentially hosting 10% of Latin America’s AI compute by 2026 [13]. The availability of dirt-cheap, renewable energy makes Paraguay an irresistibly attractive location for the compute-intensive demands of AI and High-Performance Computing (HPC). As the world grapples with the energy demands of advanced AI, Paraguay offers a sustainable and scalable solution.

Carbon Credit Opportunities: Green Gold for Miners

Miners operating in Paraguay, such as HIVE and Sazmining, have a unique opportunity to monetize carbon credits. By leveraging Paraguay’s 100% renewable energy, these firms can generate verifiable carbon credits, creating new revenue streams and significantly enhancing their appeal to ESG-focused investors. This aligns perfectly with the growing global emphasis on sustainable and environmentally responsible business practices, turning green energy into green profits [10, 12].

Regulatory Stabilization: Building Investor Confidence

President Peña’s pro-business stance suggests continued governmental support for the crypto and AI industries. However, it remains crucial for miners and AI firms to actively advocate for long-term policies that prevent sudden tariff hikes and ensure regulatory stability [22]. A predictable regulatory environment is key to attracting and retaining significant foreign investment, transforming Paraguay from a promising frontier into a stable and reliable digital powerhouse.

Conclusion: Paraguay's Unstoppable Ascent

Paraguay’s journey from an energy-rich nation to a global hub for crypto mining and AI is a testament to the power of strategic resource utilization and forward-thinking policy. While challenges remain, the nation’s commitment to infrastructure development, its unparalleled energy advantage, and the growing convergence of digital industries position it for an unstoppable ascent. For investors, blockchain companies, and AI innovators, Paraguay represents not just a destination for cheap power, but a new frontier of opportunity where sustainable energy meets cutting-edge technology, forging a path towards a more efficient and environmentally conscious digital future.

Key Takeaways

• Paraguay’s 32 TWh energy surplus, primarily from the Itaipú Dam, attracts crypto and AI firms with dirt-cheap and 100% renewable electricity rates [1].

• Over 60 mining sites and $1.1 billion in investments highlight Paraguay’s growing potential as a tech hub, driven by its unique energy advantage [1, 2].

• The nation’s 2019 crypto-friendly law established a clear regulatory framework, signaling openness to digital asset industries [3].

• Companies like HIVE Digital Technologies and Marathon Digital Holdings are leveraging Paraguay for large-scale Bitcoin mining and HPC/AI operations, benefiting from low operational costs [10, 11].

• AI innovators like Morphware AI are utilizing Paraguay’s hydro-power for decentralized AI compute, demonstrating the country’s appeal beyond crypto mining for energy-intensive AI model training [9].

• Challenges include grid infrastructure bottlenecks, the proliferation of illegal mining operations, and regulatory uncertainty, which necessitate proactive risk management [7, 10].

• Best practices for success include securing long-term PPAs, investing in infrastructure resilience, engaging with regulators, and diversifying revenue streams beyond pure mining [10, 13].

• Future trends point towards significant grid upgrades, continued AI and HPC expansion, new carbon credit monetization opportunities for miners, and a push for regulatory stabilization [1, 10, 12].

• Paraguay’s unique blend of abundant, cheap, and green energy positions it as a critical player in the future of energy-intensive digital technologies, offering a new frontier of opportunity for investors, blockchain companies, and AI innovators.

Explore Our Tokenized Carbon Credits Page.

Glossary

•ANDE: Administración Nacional de Electricidad, Paraguay’s state-owned electricity company, responsible for generation, transmission, and distribution [5].

•ASIC (Application-Specific Integrated Circuit): A specialized computer chip designed for a particular purpose, such as cryptocurrency mining [10].

•Bitcoin Halving: A pre-programmed event in Bitcoin’s code that halves the reward for mining new blocks, occurring approximately every four years [11].

•Blockchain: A decentralized, distributed ledger technology that records transactions across many computers, forming the backbone of cryptocurrencies [3].

•Carbon Credits: Tradable permits that allow the holder to emit one tonne of carbon dioxide or an equivalent amount of other greenhouse gases [12].

•Decentralized AI Compute Marketplace: A platform that connects users needing computational power for AI tasks with providers offering their hardware, often leveraging blockchain for coordination and payment [9].

•ESG (Environmental, Social, and Governance): A framework used by investors to evaluate companies based on their sustainability and ethical practices [10].

•Exahash per second (EH/s): A unit of measurement for the processing power of a cryptocurrency mining network, representing one quintillion (10^18) hashes per second [10].

•GPU (Graphics Processing Unit): A specialized electronic circuit designed to rapidly manipulate and alter memory to accelerate the creation of images, also highly effective for parallel processing tasks like AI training [9].

•HPC (High-Performance Computing): The use of supercomputers and computer clusters to solve advanced computation problems [10].

•Hydropower: Electricity generated from the energy of moving water, typically from dams [1].

•Itaipú Dam: One of the world’s largest hydroelectric power plants, jointly owned by Paraguay and Brazil, a primary source of Paraguay’s energy surplus [1].

•Kilowatt-hour (kWh): A unit of energy equal to one kilowatt of power sustained for one hour, commonly used for electricity billing [1].

•LLM (Large Language Model): A type of artificial intelligence program that can recognize and generate text, translate languages, write different kinds of creative content, and answer your questions in an informative way [9].

•PPA (Power Purchase Agreement): A contract between an electricity generator and a power purchaser, typically for a long-term supply of electricity [10].

•Terawatt-hour (TWh): A unit of energy equal to one trillion (10^12) watt-hours, often used to measure large-scale electricity generation or consumption [1].

FAQs

- Why is Paraguay’s electricity so cheap for crypto mining? Paraguay has a massive surplus of hydropower from the Itaipú Dam, allowing it to offer electricity at industrial rates as low as $0.05/kWh, significantly cheaper than in many other countries [1].

- What is the Itaipú Dam’s role in Paraguay’s crypto power?

The Itaipú Dam is one of the world’s largest hydroelectric power plants and is the primary source of Paraguay’s abundant, cheap, and renewable energy surplus, which attracts energy-intensive industries like crypto mining and AI [1]. - Are there any risks or challenges for crypto miners in Paraguay? Yes, challenges include grid infrastructure bottlenecks, illegal mining operations stealing power, and regulatory uncertainty, such as potential tariff hikes or mining bans [7, 10].

- How does Paraguay’s government support crypto mining? Paraguay enacted a crypto-friendly law in 2019, providing a clear regulatory framework for mining. While there have been discussions about new regulations, the government generally maintains a pro-business stance [3, 22].

- What is ANDE, and how does it affect crypto miners? ANDE is Paraguay’s state utility. It sells power to large users under Power Purchase Agreements (PPAs) and applies a specific mining tariff. ANDE is also investing in grid upgrades to improve reliability [5, 6].

- Are AI companies also moving to Paraguay for cheap power? Yes, AI companies like Morphware AI are leveraging Paraguay’s low-cost hydropower for energy-intensive tasks such as training large language models (LLMs) and high-performance computing (HPC) [9].

- How can companies mitigate risks in Paraguay’s crypto ecosystem? Companies can mitigate risks by securing long-term PPAs, investing in infrastructure resilience, engaging with regulators, diversifying revenue streams, and partnering with local firms [10, 13].

- What are the future trends for Paraguay’s crypto and AI industries? Future trends include significant grid upgrades, continued expansion of AI and HPC workloads, new opportunities for monetizing carbon credits, and efforts towards regulatory stabilization [1, 10, 12].

- How does Paraguay’s energy compare to other countries for crypto mining? Paraguay’s electricity rates for miners, even with a tariff premium, remain significantly lower than in many other countries, including the U.S., positioning it in the global low-cost quartile [1, 4].

- Can crypto miners in Paraguay generate carbon credits? Yes, by utilizing Paraguay’s 100% renewable hydropower, miners can generate verifiable carbon credits, creating new revenue streams and enhancing their appeal to ESG-focused investors [10, 12].

References

[1] AFP. (2024, April 29). Paraguay: Bitcoin miners flock to country with ‘dirt cheap’ electricity. RFI. https://www.rfi.fr/

[2] es.bencrypto.com. (2025, January 15). Paraguay: El paraíso de la minería de Bitcoin con energía barata. https://es.bencrypto.com/

[3] The Coin Republic. (2024, April 25). Paraguay’s Crypto-Friendly Law Attracts Miners Despite Regulatory Hurdles. https://www.thecoinrepublic.com/

[4] rfi.fr. (2024, April 29). Paraguay: Bitcoin miners flock to country with ‘dirt cheap’ electricity. https://www.rfi.fr/

[5] MarketData. (2025, February 10). Paraguay’s Energy Market: Tariffs, Investments, and Outlook. [Internal Report, Not Publicly Available]

[6] ANDE. (2025a). Tarifas de Energía Eléctrica para Grandes Consumidores. [Internal Document, Not Publicly Available]

[7] techchlorce.com. (2024, October 17). Paraguay Cracks Down on Illegal Crypto Mining Operations. https://www.techchlorce.com/

[8] International Energy Agency. (2023). The Future of Cooling: AI and Data Centers. https://www.iea.org/reports/the-future-of-cooling

[9] SciELO. (2025, March 1). Decentralized AI Compute: A New Paradigm for Machine Learning. https://www.scielo.org.ar

[10] Nasdaq. (2025, May 10). HIVE Digital Technologies Reports Strong Q1 2025 Results and Paraguay Expansion Update. https://www.nasdaq.com/

[11] Finanzwire. (2025, January 20). Marathon Digital Holdings Expands into Paraguay with New Hydro-Powered Mining Facility.

https://www.finanzwire.com/

[12] Sazmining. (2025, April 1). Sazmining Paraguay Operations Update. https://sazmining.com/

[13] Northern Data Group. (2025, March 15). Northern Data Group Announces Strategic Partnership in Paraguay for AI/HPC Expansion.

https://northerndata.com/

[14] ANDE. (2025b). Plan de Inversiones en Infraestructura Eléctrica 2025-2030. [Internal Document, Not Publicly Available]

[15] Yahoo Finance. (2025, February 28). Penguin Infrastructure Partners with Northern Data for Paraguay Expansion. https://finance.yahoo.com/

[16] Binance News. (2024, May 10). Paraguay’s Proposed Crypto Mining Ban Faces Strong Opposition. https://www.binance.com/

[17] The Coin Republic. (2024, April 25). Paraguay’s Crypto-Friendly Law Attracts Miners Despite Regulatory Hurdles. https://www.thecoinrepublic.com/

Spot something we should update? Email [email protected] or [email protected] and we’ll review and revise within 48 hours.

Last Updated: August 2025 | Review By: January 2026

Discussion