Introduction

Abstract: Litecoin has had a significant but lesser-known impact on the world of cryptocurrency. Here we provide a brief history of Litecoin and examine its continued relevance in the evolving world of crypto.

In the thrilling cryptocurrency sphere, with Bitcoin being constantly in the headlines and Ethereum reigning supreme in decentralization, one tends to forget about the lesser-known actors in this field.

And what if one of them, which is older than a decade, remains significant and relevant today?

Meet Litecoin, known as the "Silver to the Gold" of Bitcoin. Litecoin began in 2011 by Charlie Lee, a former Google programmer.

Litecoin wasn't here to revolutionize everything.

Rather, it sought to better it—making the process of the transaction quicker, decreasing fees, and making the process of mining clearer.

This assisted in its positioning in a rapidly evolving market.

Bitcoin invented the cash of the digital world and the technology itself. Litecoin enhanced that, simplified it, and provided a venue for testing new things such as SegWit and atomic swaps.

Litecoin does not receive an abundance of attention, but does serve an essential part in the infrastructure.

This article is about Litecoin’s story—not only as Bitcoin’s brother, but as an unsung leader transforming the crypto universe in ways that most individuals didn’t realize.

Explore the broader history of cryptocurrencies to understand Litecoin’s origins.

Genesis of Litecoin

- Background on Charlie Lee – ex-Google engineer.

- Launch in 2011 via GitHub, forked from Bitcoin.

- Early goals: faster transaction times, cheaper fees, a more accessible mining algorithm.

“A lighter, faster Bitcoin”—Litecoin was born out of necessity and designed with vision.

Litecoin was created by Charlie Lee, a former Google engineer, with the open-source client released on GitHub on October 7, 2011, and the network officially launched on October 13, 2011.

With deep expertise in software engineering and blockchain fundamentals, Lee saw Bitcoin’s immense potential—but also its limitations, particularly in transaction speed and mining accessibility.

Lee created Litecoin through modifying the Bitcoin Core client and altering significant aspects in an attempt to produce an improved form of digital currency.

He didn't want to compete with Bitcoin but assist it—causing Litecoin to earn the enduring nickname: “The Silver to Bitcoin's Gold.”

When Bitcoin started, the process of processing transactions would take a considerable amount of time (around 10 minutes for every block), and the mining became difficult since most people began using ASIC mining equipment.

He spoke of the problems with the 2.5-minute block time that fast-tracks confirmations and the Scrypt hash algorithm.

This algorithm consumes more memory than SHA-256 to avoid large corporations from dominating the mining process.

Litecoin was created for everyday people to use cryptocurrency in an easy, fair, and consistent manner.

It began gaining popularity on sites such as Bitcointalk.org only a couple of weeks after its release and soon became adopted by early miners and developers.

Litecoin played a significant role in the history of cryptocurrencies because it emphasized good engineering over hype.

Litecoin enthusiasts feel that it does not receive the recognition that it deserves, but it possesses several characteristics that make it as good as BTC (Bitcoin) and ETH (Ethereum).

Sources:

Key Technological Differences

- Comparison to Bitcoin:

- Block time (2.5 mins vs. 10 mins)

- Scrypt algorithm (vs. SHA-256)

- Supply cap (84 million vs. 21 million)

Learn about blockchain consensus algorithms, including Litecoin’s Scrypt.

- Why these changes mattered in 2011–2015.

Why Litecoin isn't an imitation, but rather an intelligent enhancement.

Litecoin differs from Bitcoin but shares a connection with it, as it carries important technical specifications that establish its own character and purpose.

The alterations were not accidental; Charlie Lee made them intentionally to address Bitcoin's issues with scaling and being user-friendly—particularly during the early years of the 2010s when blockchain networks were new.

Economic Design

Block Duration – 2.5 minutes or 10 minutes

Litecoin processes blocks every 2.5 minutes—four times faster than Bitcoin’s 10-minute interval—making it significantly more efficient for real-time transactions.

Litecoin is quick, so that makes it ideal for everyday purchases and small purchases. Sluggish transactions can be annoying or discourage users from using it.

Speed of cryptocurrency transactions isn't only a pleasant addition—it matters a great deal.

New users and those unfamiliar with how blockchain confirmations take place are usually frustrated when delays occur.

Litecoin operates with greater speed, facilitating the entry of new users and gaining their confidence in the system.

Litecoin is faster and cheaper for purchasing items from stores, tipping content creators, or transferring funds to abroad. Litecoin is one of the simplest forms of money to use these days.

Supply Cap – 84 million vs 21 million

Bitcoin is limited to 21 million coins, but Litecoin can have up to 84 million coins, which is four times larger.

This increased supply was intended to mirror the gold-to-silver ratio. It provided a more accessible and abundant alternative without making it too rare.

Method of Mining

SHA-256 and Scrypt Litecoin employs the Scrypt algorithm for proof-of-work, rather than the SHA-256 employed by Bitcoin.

Scrypt consumes more memory and was designed with the intention of being less hospitable to ASIC hardware.

Scrypt mining is competitive today, but it enabled GPU miners and smaller participants to participate during the early years.

Sources:

- Litecoin vs Bitcoin – Gemini Learning Hub

- Investopedia – Litecoin Explained

- Binance Academy – What Is Litecoin?

Early Adoption and Community Growth

- How Litecoin built a loyal early community.

- Listings on major exchanges.

- Use in early online commerce and experiments.

Litecoin succeeded because it possessed an intelligent community that prized speed, integrity, and assistance over flashy promotion or endorsement by celebrities.

Litecoin code was made available from the start on the GitHub website so that developers and initial users could view it.

Charlie Lee actively participated in online forums such as Bitcointalk.org. He responded to questions, commented on suggestions for improvement, and communicated with the community. This earned him credibility and trust.

Litecoin was among the very first alternative currencies to list on major cryptocurrency exchange sites such as BTC-e, Mt. Gox, and subsequently on Coinbase.

Lee became the Director of Engineering for Coinbase. Being on these sites made it far easier for common users to purchase, sell, or exchange LTC.

Litecoin started being employed for online purchases. Individuals utilizing Litecoin experimented with payment solutions and instant payments prior to major retailers utilizing Bitcoin.

Sites such as Litecoin Local emerged, and initial payment processors such as CoinPayments and GoCoin started accepting LTC.

Sources:

- Bitcointalk Archive – Charlie Lee on Litecoin

- Litecoin Foundation – Merchant Adoption

- CoinPayments – Supported Coins

Major Milestones

- 2013: First price boom during crypto bull run

- 2017: SegWit adoption before Bitcoin; Atomic Swaps pioneered

- 2022: MimbleWimble privacy upgrade added

From breakout bull runs to blockchain breakthroughs, Litecoin’s legacy is built on quiet innovation. Let’s walk through its pivotal moments:

2013: First Price Boom

In 2013, as more individuals took an interest in cryptocurrency, Litecoin jumped from under $1 to over $40.

Bitcoin reached $1,000, and Litecoin's growth demonstrated that it was a significant cryptocurrency.

Charlie Lee turned into a prominent speaker, speaking on CNBC and Bloomberg.

2017: SegWit and Atomic Swaps

The Litecoin implementation of Segregated Witness (SegWit) in the year 2017 resolved transaction malleability and made second-layer solutions such as the Lightning Network possible.

In September 2017, Litecoin developers successfully executed some of the first atomic swaps, enabling peer-to-peer exchanges between Litecoin and Decred, Bitcoin, and Vertcoin.

2022: MimbleWimble Privacy Update

On May 19, 2022, Litecoin activated MimbleWimble Extension Blocks (MWEB) via the Litecoin Core 0.21.2 upgrade. As of 2025, over 150,000 LTC have been locked into MWEB, indicating strong adoption of its optional privacy features.

Legacy of Peaceful Change

Through various changes in the market, system updates, and significant milestones, Litecoin has continuously acted rather than spoken.

Litecoin demonstrates that it is significant by initiating SegWit, enabling Atomic Swaps, and introducing private transactions with MWEB.

This demonstrates that it is not merely a "Bitcoin testnet." It's a sandbox, a tool, and a leader. It assists a committed community of actual users with each release.

Sources:

Controversies and Setbacks

- In 2017, Litecoin founder Charlie Lee sold his entire LTC holdings, sparking backlash.

- Critics often refer to Litecoin as “just a Bitcoin testnet,” questioning its originality.

- Litecoin has struggled to maintain relevance amid newer, more hyped blockchain platforms.

No Legacy Without Scrutiny

Despite its technical contributions and longevity, Litecoin hasn’t escaped criticism. From internal decisions to external perceptions, the coin has faced several controversies that continue to shape public opinion.

Charlie Lee Sells All His Litecoin (2017)

Charlie Lee reported selling and donating all his LTC in December 2017, when the market was booming. He clarified that he did not wish to have interest issues due to his status as a public figure and activities on the project:

“Whenever I tweet about Litecoin, I’m accused of doing it for personal benefit. So in a sense, it is conflict of interest for me to hold LTC and tweet about it.”

— Charlie Lee, Reddit AMA

He continued to remain with the project as an advisor and promoter, but several took issue with the timing—particularly because LTC had its highest price levels ever.

This prompted backlash that questioned his commitment for the long term and shook confidence in the leadership of the project, albeit temporarily.

"Just a Testnet for Bitcoin" Allegation

Litecoin has the nickname the "testnet for Bitcoin with real value," which implies that Litecoin tested out features such as Segregated Witness and Atomic Swaps ahead of Bitcoin.

The comparison holds some truth—Litecoin typically tests changes first—but the point has also rightly been made by critics that Litecoin itself does not possess a distinct identity.

Despite this, proponents argue that Litecoin having a genuine testing ground with actual usage is a positive, not a negative. “Litecoin is Bitcoin but produces blocks quicker and with an alternative method of securing data.” — Critics on Twitter

It's an area in which we can experiment with major enhancements—Bitcoin would not expand so rapidly without Litecoin.

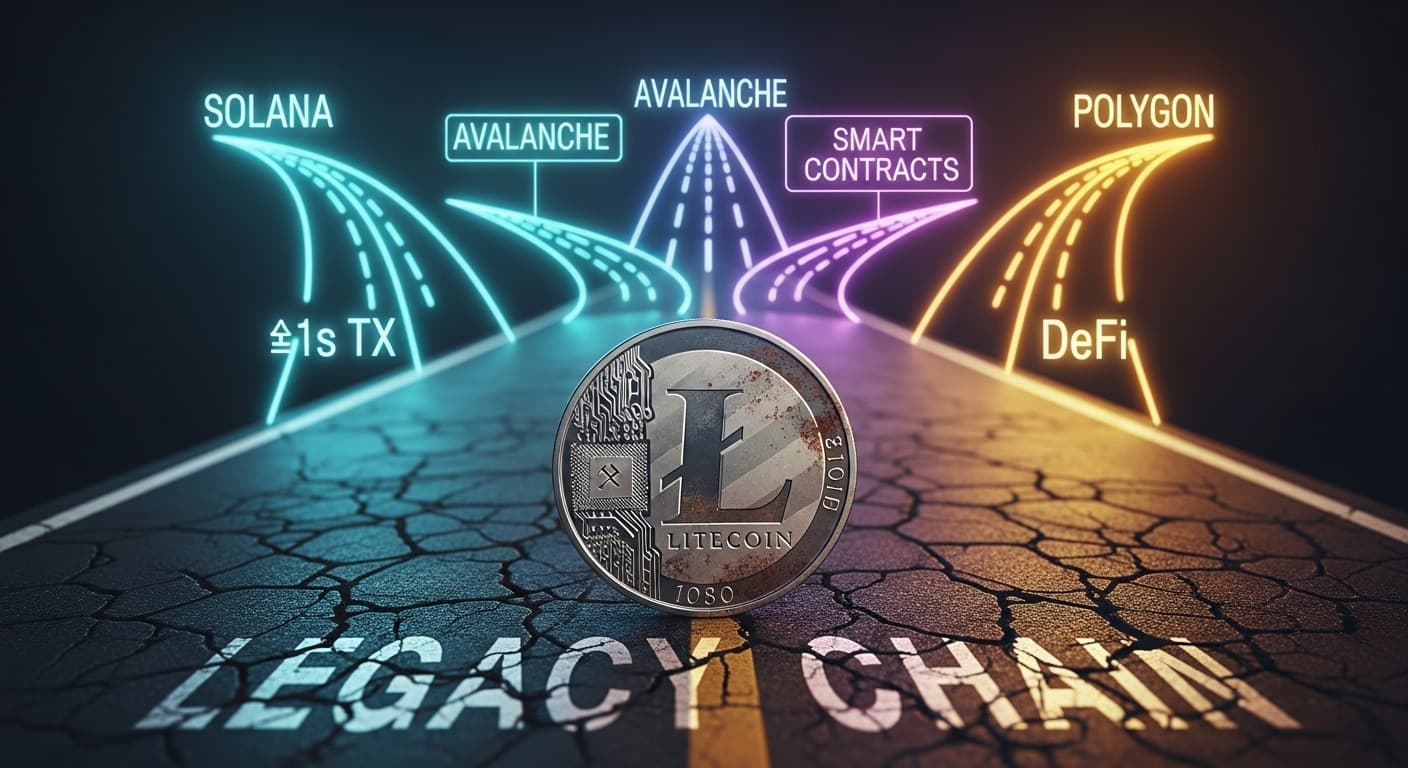

Comparisons to Newer, Flashier Chains

Litecoin has also faced growing pressure from newer blockchains like Solana, Avalanche, and Polygon, which offer:

- Faster transaction speeds (sometimes <1 second)

- Built-in smart contract capabilities

- Greater developer mindshare and funding

These modern chains appeal to DeFi, NFT, and dApp developers—while Litecoin remains focused on being a fast, lightweight payments rail.

This perceived lack of innovation or ecosystem has led some to label Litecoin a “legacy chain,” struggling to stay relevant in the age of smart contracts and Layer-2 protocols.

However, its defenders argue that Litecoin doesn’t need to compete with DeFi platforms—it remains a core asset for payments and transfer efficiency.

Sources:

- Investopedia – What Is Litecoin? 🔗 https://www.investopedia.com/terms/l/litecoin.asp

- CoinDesk – “Charlie Lee Sells All His Litecoin” 🔗 https://www.coindesk.com/markets/2017/12/20/litecoin-founder-charlie-lee-sells-all-his-litecoin/

Current Use Case and Role in the Ecosystem

- Low fees, high uptime, continued use for payments.

- Used by merchants and payment processors (BitPay, etc.).

- Role in bridging and testnet comparisons for Bitcoin updates.

Litecoin: Facilitating everyday cryptocurrency use.

With a market that tends to see a lot of rumors and speculations, Litecoin (LTC) has remained consistent and reliable—one of the most reliable currencies to purchase and make payments with.

Litecoin features low transaction fees, fast confirmation times (2.5 minutes per block), and 99.99% uptime. Due to this, it is favored by users as a light and fast alternative to Bitcoin.

Among the main advantages of Litecoin is its continual connection with major payment processors.

Payment processors such as BitPay, CoinPayments, and NOWPayments all accept LTC. This enables merchants globally to accept Litecoin as payment for goods and services.

BitPay's data for 2023 indicates that Litecoin ranked among the top five most popular cryptocurrencies on the network. Litecoin made more daily use than several larger cryptocurrencies such as Solana and Cardano.

Litecoin is prized for global payments as it charges low fees and confirmation times that come quickly.

While ordinary banks may make payments difficult in areas where money values fluctuate greatly, LTC offers a quicker and safer alternative.

Litecoin can serve for payments purposes and acts as an ideal testing ground for Bitcoin updates.

Segregated Witness (SegWit) and Taproot were both considered or experimented with in part with the use of Litecoin.

Developers tend to view LTC as some sort of playfield. They can experiment with new features in an actual environment with less money-at-stakes and faster turnaround than Bitcoin's slow process.

Litecoin may not be that exciting at present, but it does remain significant.

After the frenzy dies down, in the midst of a busy online environment, it quietly emphasizes the value of speed, reliability, and usefulness—attributes that will remain significant.

Sources:

- BitPay Merchant Payment Statistics 🔗 https://bitpay.com/stats

- CoinPayments – Litecoin Integration 🔗 https://www.coinpayments.net/supported-coins

- Litecoin Uptime Status – BitInfoCharts 🔗 https://bitinfocharts.com/comparison/litecoin-confirmationtime.html

- Litecoin Foundation – Developer Insights 🔗 https://litecoin.net/technology

Market Position and Future Outlook

- LTC’s rank by market cap in 2025.

- Predictions: utility coin vs. store of value vs. legacy chain.

- Challenges from newer chains and stablecoins.

Discover Ethereum’s market trends and how they compare to Litecoin’s outlook.

Litecoin in 2025: Useful tool or outdated asset?

Litecoin (LTC) occupies position #21 of the top 50 cryptocurrencies by market capitalization in mid-2025, as indicated by CoinGecko and CoinMarketCap.

Despite new chains, new shiny DeFi tokens, and AI-oriented blockchains, Litecoin remains stable with a market capitalization of approximately $7 billion, demonstrating an ability to endure the years.

But where will Litecoin go from here?

It is viewed by some as an old coin—a relic from the early days of cryptocurrency that is no longer valuable. Others think it is a valuable asset, ideal for fast and inexpensive payments among individuals.

Litecoin is utilized by numerous retailers, has a solid network, and is useful for such things as shopping and global payments. It remains significant in a manner that newer currencies tend to lack for sensational attention.

However, there are also challenges in the future. Stablecoins like USDC and USDT dominate the payments sector due to their stable prices.

Meanwhile, emerging blockchains like Avalanche, Solana, and Layer-2 chains on Ethereum are attracting more developers and processing more transactions.

Litecoin 2025 - LitVM Launch

In 2025, Litecoin experienced substantial growth, evolving well beyond its early beginnings. To maintain its relevance in the evolving Web3 landscape, Litecoin introduced key updates. The most anticipated announcement at the Litecoin Summit (May 29–30 in Las Vegas, Nevada) was the debut of LitVM (Litecoin Virtual Machine)—a major upgrade that enables smart contracts and supports cross-chain development, marking a pivotal step forward for the network.

LitVM supports a smart contract layer for Web3 development. It enables the creation of decentralized apps (dApps) on Litecoin or integration with other blockchains through bridges.

That's a good move: Litecoin will continue to prioritize secure payments but LitVM opens the door for DeFi, NFTs, and automation of the blockchain.

This can provide Litecoin an opportunity to contribute to the next generation of decentralized finance and identity.

The summit provided various forms of technology, such as basic dApps such as atomic swap tools and decentralized escrow services.

They would potentially become part of wallets and merchant software that support Litecoin.

The work on LitVM illustrates what Litecoin strives to do in 2025: remain secure and quick with involvement in new Web3 concepts.

This combination of the new and the old solidifies its position in the market and informs developers and businesses that Litecoin is not an obsolete coin—it's expanding and evolving.

Sources:

Litecoin's Future Predictions

Litecoin's future likely entails remaining an easy and trustworthy means to conduct payments, particularly in international markets not well served by traditional banks.

Its limit of being 84 million LTC and its decentralized nature made it possible for it to serve as a form of holding value, but not so widely as Bitcoin.

Litecoin is readily available on solid products and platforms such as Grayscale's LTC trust, BitPay, and PayPal cryptocurrency wallets. Due to this, it remains a significant cryptocurrency for institutions for an extended duration.

Litecoin may not be the quickest for an evolving industry but will typically last many years. As a key element of blockchain technology, it will continue to be valuable for years to come.

Sources:

- CoinMarketCap – Litecoin Live Market Ranking 🔗 https://coinmarketcap.com/currencies/litecoin/

- CoinGecko – Litecoin Data Dashboard 🔗 https://www.coingecko.com/en/coins/litecoin

- BitPay – Top Crypto Payments by Volume 🔗 https://bitpay.com/stats

- PayPal Cryptocurrency Offerings 🔗 https://www.paypal.com/us/digital-wallet/manage-money/crypto

Conclusion

Amongst a quickly evolving world with brief trends, Litecoin had remained consistent and reliable.

It has proven itself by enhancing blockchain technology and enabling real-life payments, not merely speculating on prices.

Although larger currencies are more well known, Litecoin remains a quick, secure, and simple type of digital currency.

Last thought: Bitcoin revolutionized money. Litecoin made it accessible to all.

Discussion