Tokenized Real Estate in 2025: 10 Critical Insights Every Investor Needs to Master

The 2025 Reality of Tokenized Real Estate

Imagine shattering the barriers of traditional property investment: Tokenized real estate has emerged from experimental pilots to a powerhouse market, primed for explosive growth.

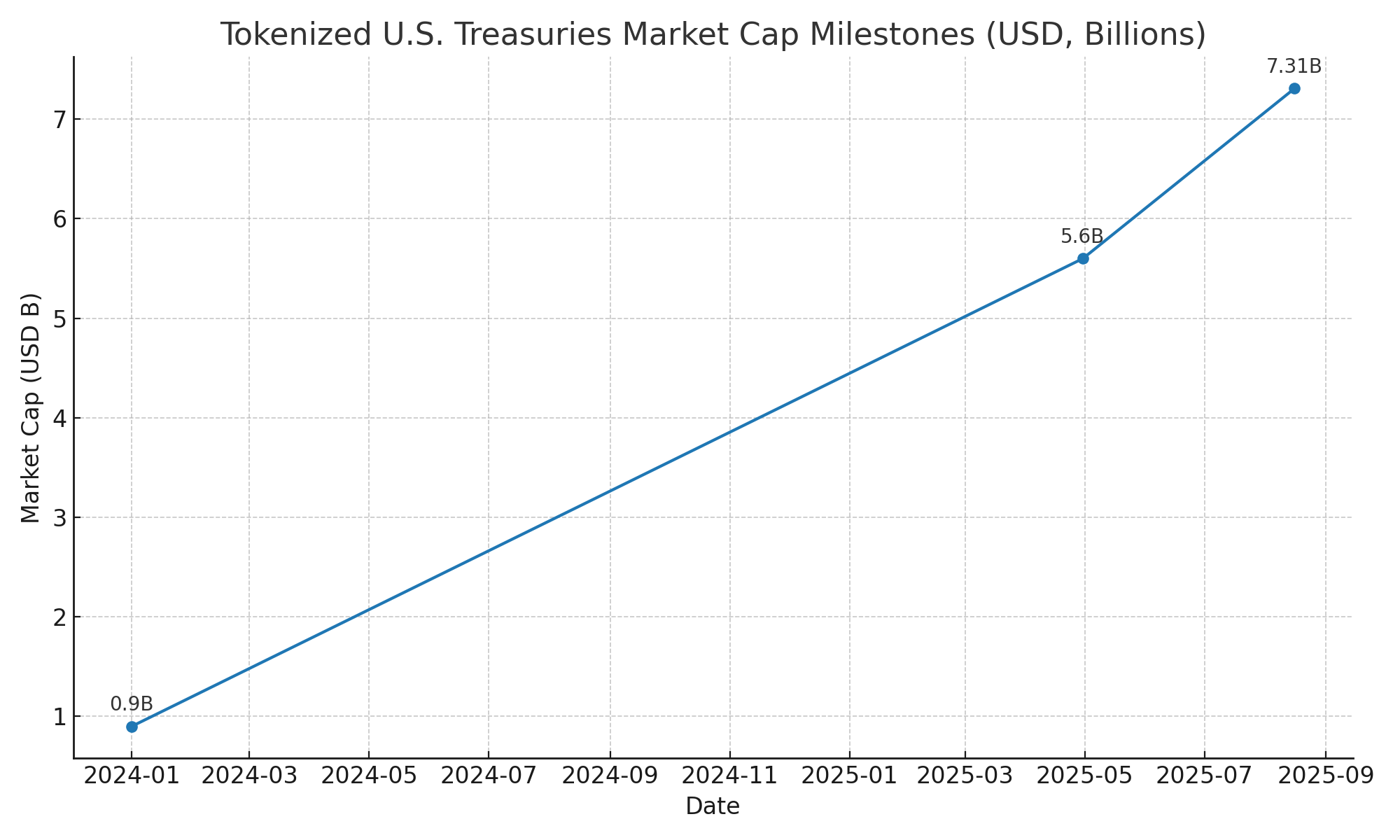

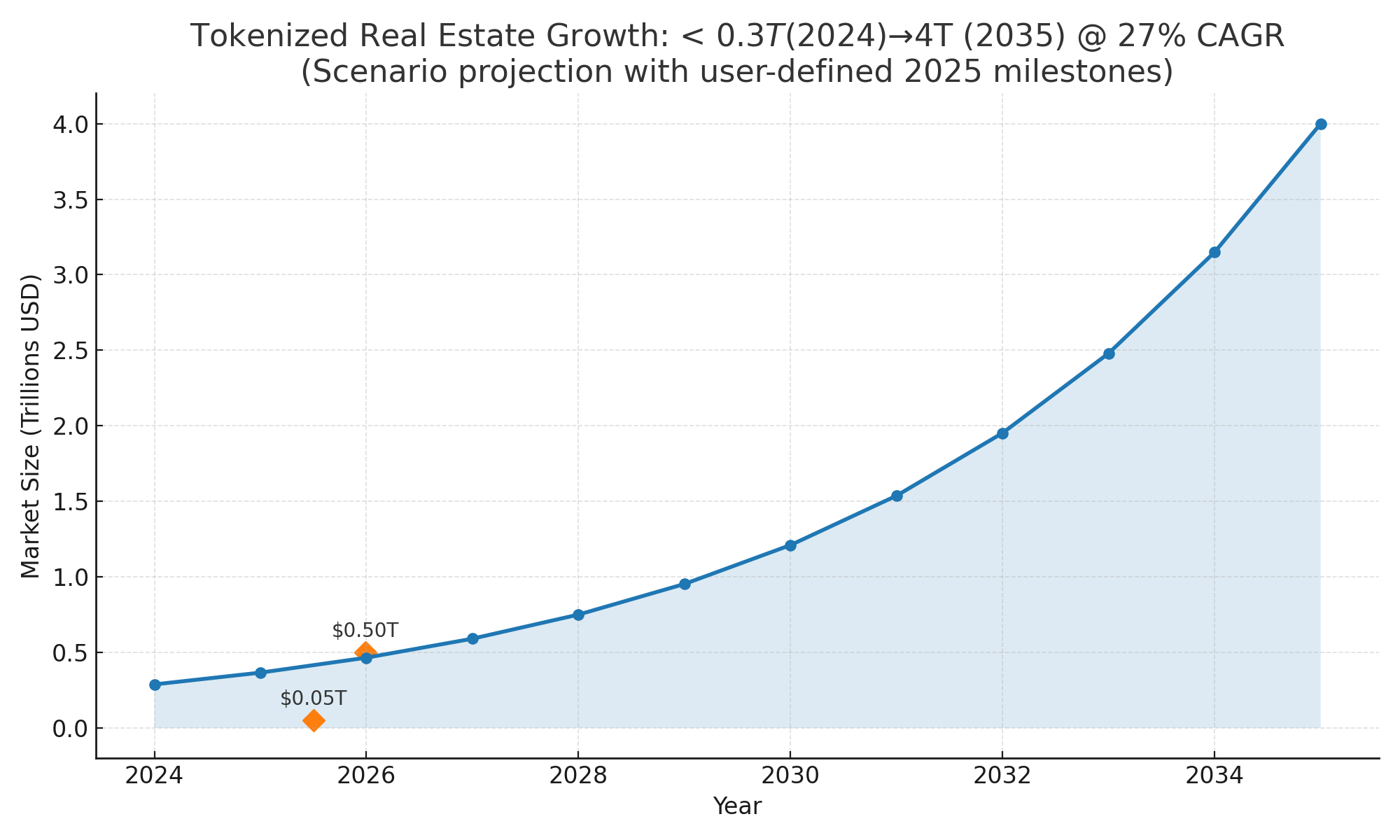

Deloitte's Center for Financial Services forecasts $4 trillion in tokenized real estate by 2035—a staggering leap from under $0.3 trillion in 2024, fueled by a 27% CAGR. [1]

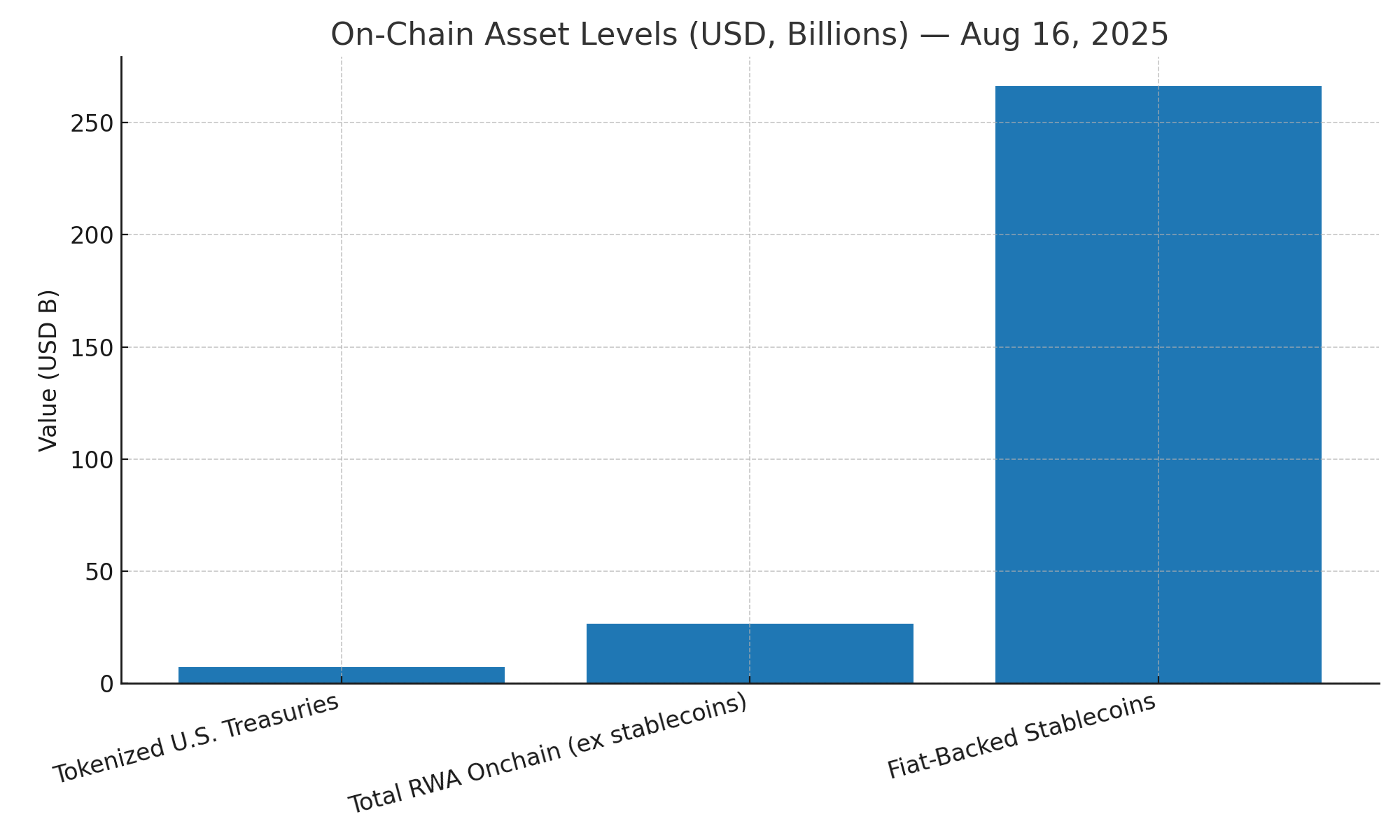

Midway through 2025, the RWA sector has already rocketed past $50 billion on-chain, eyeing $500 billion by year-end (excluding stablecoins), thanks to blockchain platforms streamlining income and compliance. [2]

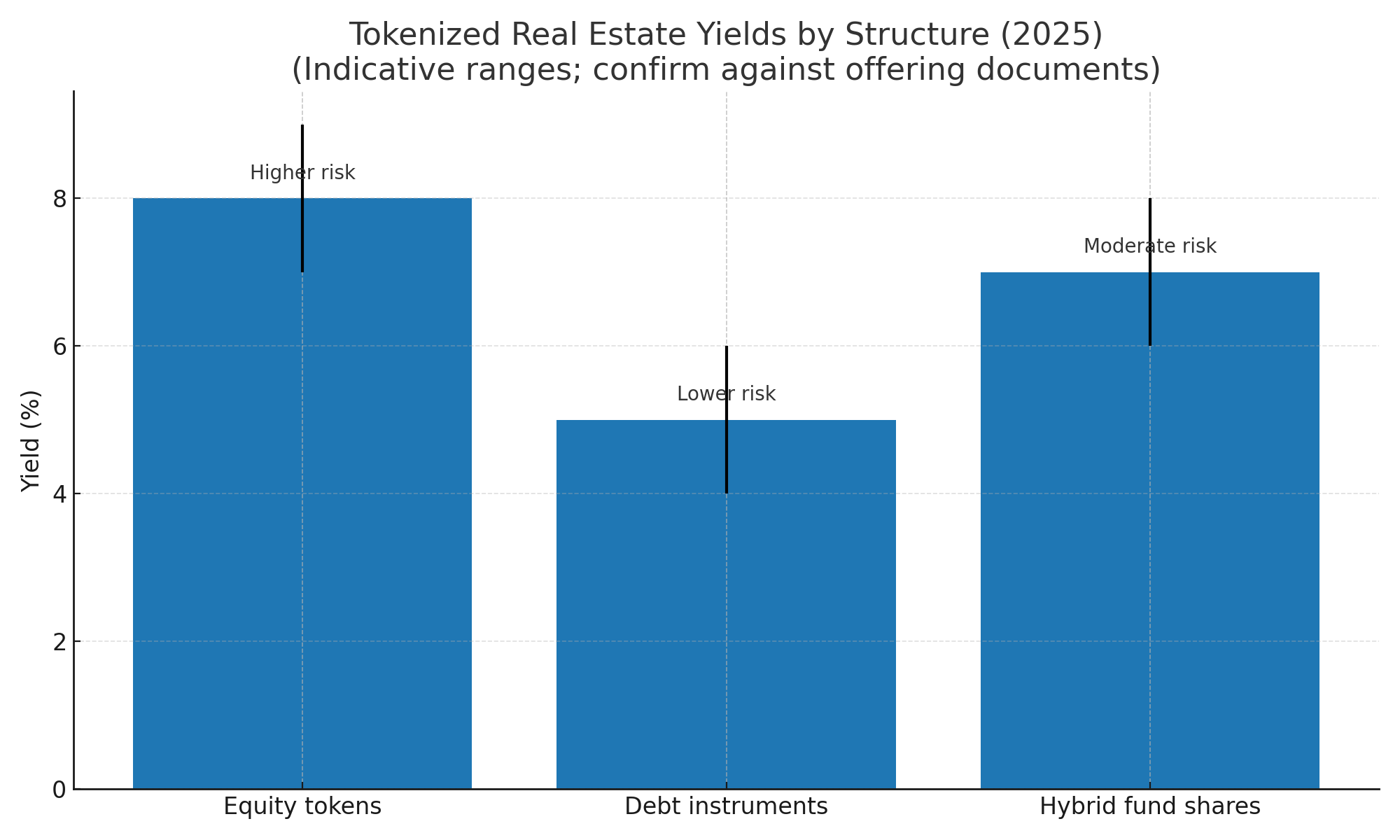

Real estate dominates here, claiming over 40% of the market and democratizing access to global properties through fractional ownership—delivering enhanced liquidity and steady 6-8% yields in robust setups. [3]

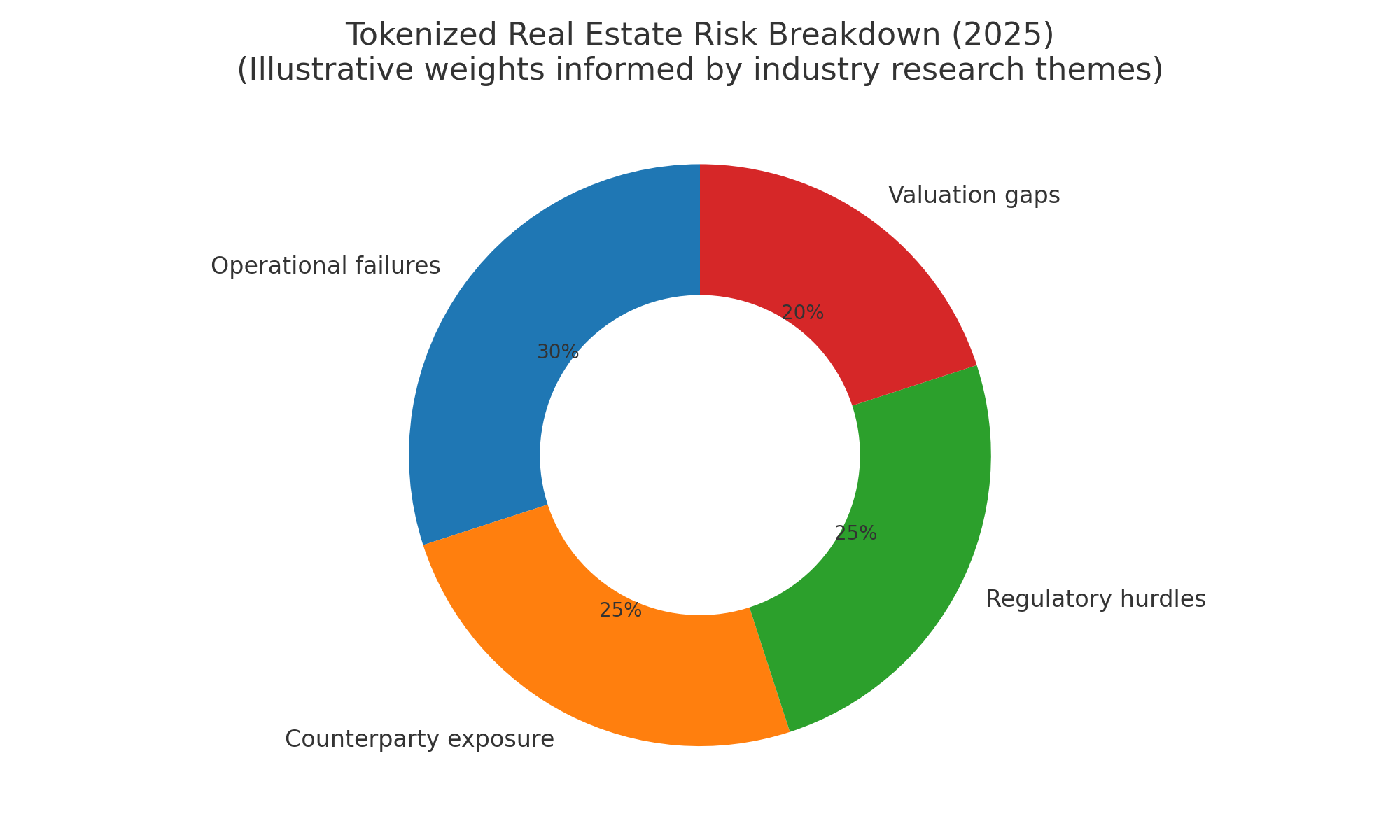

But beware the shadows: Regulatory traps and operational landmines lurk, calling for razor-sharp due diligence. We've hit that pivotal shift—the "pragmatists" phase in the adoption curve—where tokenization surges from early visionaries to institutional heavyweights. [2]

Investors are buzzing: How do I navigate this without getting burned?

Arm yourself with our no-fluff top-10 insights for investors focused on tokenized real estate, complete with practical fixes. Ready to turn property tokens into smart allocations? Let's dive in.

What "Tokenized Real Estate" Really Means: The Complete 2025 Landscape

Picture owning a slice of a bustling commercial tower or fertile farmland, all digitized on blockchain and secured by ironclad legal frameworks that make rights unbreakable.

By 2025, adoption of tokenized real estate has accelerated dramatically, with tokenized private funds projected to penetrate 8.5% of the global real estate market by 2035, enabling investors to trade fractions as small as $100. [1]

This isn't just hype; it's transforming illiquid assets into programmable ones, where dividends flow automatically and ownership verifies instantly.

The tokenization revolution is no longer theoretical.

Consider BlocHome's groundbreaking achievement in reducing property investment costs by 90% through fractional ownership, making luxury real estate accessible to retail investors who previously faced million-dollar minimum barriers. [4]

In Canada, T-RIZE Group signed a $300 million deal to tokenize Project Champfleury, a 960-unit residential development, demonstrating how large-scale projects are embracing blockchain technology. [1]

Meanwhile, Figure Technologies has reached over $13 billion in home equity line of credit (HELOC) originations and announced its first publicly rated, blockchain-based HELOC asset-backed securities (ABS) securitization, proving that traditional financial institutions are integrating tokenization into core operations. [1]

Tokenized real estate platforms in 2025 are delivering tangible value beyond mere technological novelty.

Emerging 2025 Trends: AI-Driven Valuations and Hybrid Structures

The tokenized real estate landscape in 2025 is characterized by several revolutionary trends:

AI-driven valuations are tightening NAV-market gaps by 15%, providing more accurate and frequent property assessments that reduce the traditional quarterly lag in real estate pricing – meaning the disconnect between token market prices and underlying asset values is being addressed with technological advancement. [5]

Hybrid equity-debt structures have emerged as a compelling innovation, blending 7-9% yields with downside protection. By offering investors the appreciation potential of equity tokens while providing the stability of debt instruments, hybrid equity-debt structures grew 50% in 2025. [3]

For instance, new funds are being issued "on-chain" based on real estate trust deeds, with covenants allowing properties to be held in neutral, third-party trusts until debt obligations are satisfied.

The Three Pillars of Tokenized Real Estate Value Creation

- Equity-Style SPVs: Capturing Growth and Income

Tokens represent LLC or limited partnership units owning the deed directly, capturing both rental income and property appreciation–ideal for growth-focused investors seeking exposure to real estate market upside.

In 2025, equity-style tokenization has become particularly popular for commercial properties in high-growth markets, where investors can benefit from both steady rental yields and capital appreciation.

- Debt-Style Notes: Prioritizing Stability and Predictable Returns

These instruments yield fixed returns, often 5-7% in 2025 markets, from mortgages or revenue shares, prioritizing stability over equity volatility. [3]

Debt tokenization has proven especially attractive to institutional investors seeking predictable cash flows. LiquidFi's innovation in reducing mortgage-backed securities reporting time from 55 days to 30 minutes on the Stellar blockchain exemplifies how technology is streamlining traditional debt instruments. [1]

- Fund Shares: Diversified Exposure with Enhanced Compliance

Mimicking REITs, tokens track diversified portfolios with custodial safeguards, now enhanced by MiCA-compliant wrappers in the EU for cross-border ease. [6]

Diversified fund structures offer investors exposure to multiple properties and markets while maintaining regulatory compliance across jurisdictions.

The Ecosystem: Who Does What

The tokenized real estate ecosystem has matured significantly, with clearly defined roles and responsibilities:

Issuers structure deals, secure regulatory exemptions like Reg D or MiCA authorizations, and handle comprehensive disclosures. In 2025, leading issuers are leveraging advanced legal frameworks to ensure token holders have enforceable rights to underlying assets.

Transfer Agents maintain capitalization tables, enforce KYC requirements, and manage investor whitelists. With more sophistication, agents now provide real-time compliance monitoring and automated investor onboarding.

Property Managers oversee day-to-day operations, from tenant leases to maintenance, feeding operational data into on-chain cash flow systems. Modern property management platforms integrate directly with blockchain infrastructure, enabling transparent, real-time reporting to token holders.

Custodians like BNY Mellon in recent tokenized fund launches safeguard assets and reconcile net asset values, reducing counterparty exposure. [7] Involving traditional financial institutions as custodians has significantly gained investor confidence in tokenized real estate products.

Trading Infrastructure: Where Tokens Come to Life

Public blockchains like Ethereum continue to dominate for accessibility, but permissioned ledgers have gained significant traction.

Stellar's ambitious target of $3 billion in RWAs by end-2025 demonstrates how specialized blockchain platforms are adding compliance layers for institutional trades. [8]

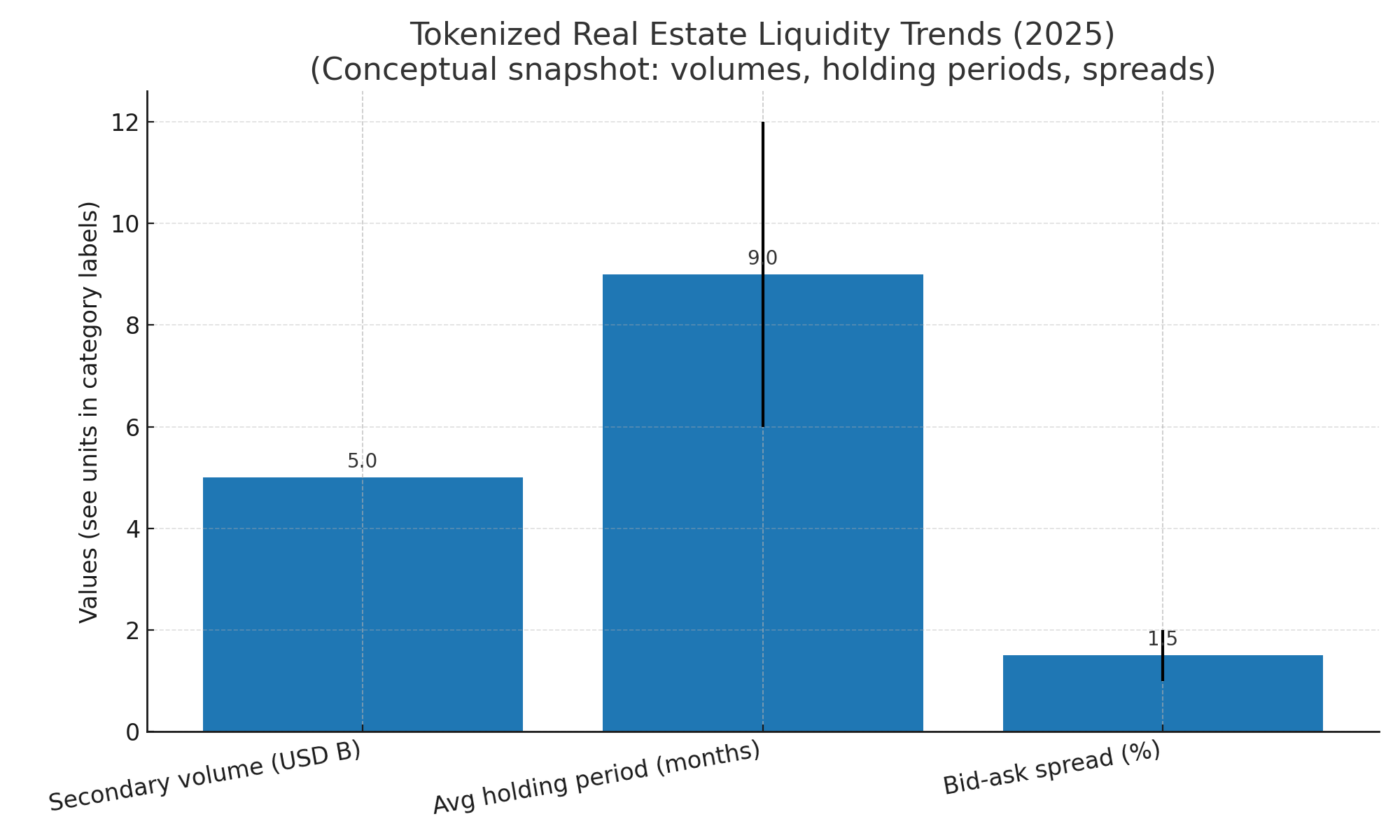

Secondary markets now feature Alternative Trading System (ATS) integrations, though liquidity remains semi-fluid with average hold periods of 6-12 months. [2]

The development of tokenized marketplaces and exchanges providing real-time visibility into asset performance has been a game-changer.

Platforms like World Property Exchange, Redswan, ABC Tokens, RETokens, Uniswap Exchange, Securitize, and Tokenise have launched or are preparing sophisticated trading infrastructure that rivals traditional real estate investment platforms. [1]

Unlocking the $3 Trillion Opportunity by 2030

ScienceSoft's research team predicts that by 2030, the global market for tokenized real estate will reach $3 trillion and represent 15% of real estate assets under management. [9]

This projection is supported by several converging factors: institutional adoption, regulatory clarity, technological maturation, and growing investor demand for fractional real estate exposure.

The benefits of fractional ownership in tokenized real estate extend beyond mere accessibility.

Investors can now construct highly diversified real estate portfolios with minimal capital requirements, access global markets previously restricted by geography or regulation, and enjoy enhanced liquidity compared to traditional real estate investments.

New opportunities always come with corresponding challenges that savvy investors must navigate carefully.

We continue this deep dive to provide unparalleled value, informing investors how to navigate the emerging tokenized paradigm with grace and precision.

By the end of this next section, you will have a foundational map to act as your guide for distinguishing the most important aspects of entering RWA tokenization markets.

Subscribe & Share if you think CryptoBitMag provides top tier insights for investors.

The Top 10 Things Investors Must Know: Master These to Thrive in the Tokenized Boom

Arm yourself with these essential insights to avoid costly missteps and unlock hidden opportunities in 2025's tokenized real estate revolution.

1. Eligibility & Investor Status: Navigating the New Access Paradigm

What if accreditation no longer locked you out of prime real estate?

The 2025 landscape has flipped the script: U.S. deals still demand verified status under Reg D—$1 million net worth or $200,000 income—but MiCA in the EU blasts open retail doors with €30,000 caps and beefed-up disclosures. [6]

Take this real investor win: A U.S. retail player sidestepped domestic limits by jumping to MiCA-safe EU platforms, snagging 8% returns on top-tier tokens without those grueling U.S. lockups.

Cross-border plays like this are surging, empowering savvy types to diversify worldwide. Don't overlook global KYC hurdles—they're sleeker now but still demand rigor under FATF rules.

Platforms like RealT supercharged non-accredited options by 35% in 2025, using Reg CF to raise up to $5 million from everyday investors. [10]

Key Insights to Consider

~Remember, these doors come with caps and extra paperwork.

~Weigh the risks carefully—tokenization's inclusive wave brings thrills, but skipping due diligence on watered-down gates could spell trouble.

~Lower thresholds mean more players, but the game demands sharper vigilance to dodge hidden dangers.

2. Jurisdiction & Licensing: The Regulatory Maze That Determines Success

Properties are inherently local, but tokens cross borders seamlessly—a dynamic that creates both opportunities and compliance challenges.

Successful tokenized real estate investments demand issuers licensed in both asset and investor jurisdictions.

MiCA's 2025 implementation updates mandate ESMA-registered providers for EU deals, effectively ending the "global by default" assumptions that characterized earlier tokenization efforts. [6]

The regulatory landscape varies dramatically by jurisdiction across a regulatory spectrum.

For example, Singapore's Monetary Authority has established clear guidelines for real estate tokenization, while jurisdictions like Switzerland and Luxembourg have created favorable frameworks for digital asset issuance.

Conversely, some jurisdictions maintain restrictive approaches that effectively prohibit tokenized real estate offerings.

Red Flag Warning: Vague claims about regulatory compliance without named regulators or specific exemptions should trigger immediate skepticism. Legitimate tokenized real estate offerings provide detailed regulatory disclosures, including specific exemptions, applicable regulations, and jurisdictional limitations.

Emerging Opportunity: The development of regulatory passporting systems, particularly within the EU under MiCA, is creating new opportunities for cross-border tokenized real estate investment. Investors who understand these frameworks can access broader markets while maintaining regulatory protection.

3. Asset Structure: Equity, Debt, or Fund Share—The Foundation of Returns

Ever wondered what truly shapes your tokenized real estate returns? It boils down to the core structure—equity, debt, or fund shares—each carving unique paths for risk, reward, and liquidity.

The underlying asset structure fundamentally determines investment returns, risk profiles, and liquidity characteristics. Aligning investments with financial objectives and risk tolerance is "the juice," "the glue," and the essence of what every investor must do for their portfolio to succeed.

Equity Tokens: The Growth Play

Equity tokens yield variable returns of 7-9% from rental income and property appreciation, offering direct exposure to real estate market dynamics. [3] These structures have become increasingly sophisticated, with some offerings providing voting rights on major property decisions and direct participation in refinancing or sale proceeds.

Real-World Performance: A luxury residential development in Miami tokenized as equity shares delivered 12% total returns in 2024, combining 6% rental yields with 6% appreciation. However, investors also experienced volatility during market downturns, with token values fluctuating 15-20% based on local market conditions and interest rate changes.

Debt Instruments: The Stability Strategy

For those prioritizing calm waters, debt tokens offer predictable 4-6% returns with senior claims, shielding income seekers from equity's storms. [3] Evolution brings flair: Participating debt now mixes fixed payouts with bonus upside beyond thresholds, blending security with potential kickbacks.

Innovation Spotlight: Centrifuge's protocol revolutionizes this space by bundling real estate loans into tokenized pools, fueled by MakerDAO's liquidity boost. Investors tap diversified debt while enjoying blockchain's seamless flow, proving how tech elevates traditional stability. [1]

Fund Shares: Diversify to Dominate

Why settle for one when you can command many? Fund shares track NAV across broad portfolios, backed by pro management and easy exits. By 2025, hybrids skyrocketed 50%, fusing equity's thrill with debt's guardrails via clever waterfalls and guarantees. [3]

Key Insight: Top funds shine with reliable yields and superior liquidity over old-school real estate but watch those fees; they can dent net gains, so make scrutiny your secret weapon for smarter plays.

4. Title, Custody & the Real Chain of Ownership: Where Legal Meets Digital

Tokens aren't deeds—this fundamental distinction cannot be overstated.

Successful tokenized real estate investment requires tracing the complete ownership chain from physical title to special purpose vehicle (SPV) to token.

This legal architecture determines investor rights, recourse mechanisms, and asset protection.

The Custody Revolution: Custody via audited firms like BNY Mellon has become the gold standard, preventing the catastrophic failures that plagued early tokenization efforts. [7] The 2025 Bank for International Settlements (BIS) guidelines stress segregated accounts to prevent the $500 million+ losses experienced in previous crypto custody failures. [2] Investors gain peace of mind as traditional banking muscle merges with blockchain resilience.

Legal Structure Layers: Modern tokenized real estate offerings typically employ a three-tier structure: (1) Property ownership by an SPV, (2) Token representation of SPV equity or debt, and (3) Custodial protection of both digital and physical assets. Beyond clarity, this design unleashes blockchain perks like instant verification while anchoring everything in enforceable law.

Due Diligence Checklist: Investors must verify title insurance, SPV formation documents, custody agreements, and token smart contract audits. The complexity of these legal structures requires professional review, but the investment protection justifies the additional due diligence costs.

Emerging Best Practice: Top platforms pioneer live blockchain dashboards, empowering you to independently confirm titles, SPV setups, and custody—democratizing trust in ways that redefine investor confidence.

5. Cash Flows, Fees & Waterfalls: The Mathematics of Net Returns

How do automated payouts turn promise into profit?

Programmatic distributions stand out as tokenization's key advantage, yet grasping the full fee landscape proves essential for realistic return forecasts and smart platform choices.

The Fee Reality Check: Management fees (1-2%), administrative costs (0.5%), and performance incentives (20% carry) can reduce net returns by 50% on 8% gross yields. [1] However, tokenization's operational efficiency can offset some traditional real estate investment costs, creating net benefits for investors.

Transparency Revolution: Emerging tools like on-chain oracles ensure complete fee transparency, with some platforms providing real-time dashboards showing fee calculations and distributions – a significant improvement over traditional real estate investment structure.

Waterfall Dynamics: Modern tokenized real estate offerings employ sophisticated waterfall structures that align manager and investor interests. These structures often include preferred returns for investors, catch-up provisions for managers, and shared upside above target returns.

6. Liquidity & Resale Restrictions: The Semi-Liquid Reality

Trading tokenized real estate brings more flexibility than traditional property deals, though market realities and rules shape what's possible in practice.

The Liquidity Landscape: Secondary market volumes reached $5 billion in 2025, but trading remains subject to whitelists, holding periods, and market-making limitations. [2] Average holding periods of 90 days to 6 months reflect the semi-liquid nature of these investments.

Market-Making Innovation: Platforms with dedicated market-makers like Ondo Finance have narrowed bid-ask spreads to 1-2%, revolutionizing exit opportunities compared to traditional 6-month private real estate sales processes.[11] Such advances mark steady progress toward better real estate mobility.

Trading Strategy Considerations: Successful tokenized real estate investors develop specific liquidity strategies, including position sizing based on expected holding periods, diversification across platforms with different liquidity characteristics, and timing considerations for market entry and exit.

Regulatory Impact: MiCA's implementation has created new liquidity opportunities within the EU, while U.S. regulations continue to impose transfer restrictions on many tokenized real estate offerings – factors that guide careful liquidity decisions.

7. Valuation: NAV vs Market Price—Bridging the Gap

Net Asset Value (NAV) calculations refresh quarterly via independent appraisals, while tokens trade at 5-10% premiums or discounts based on market sentiment and liquidity conditions. [3] This dynamic creates both opportunities and risks for active investors.

Valuation Innovation: AI-driven property valuations are becoming standard practice, with some platforms providing monthly or even weekly NAV updates. These frequent valuations help reduce the traditional lag between property market movements and investment vehicle pricing.

Arbitrage Opportunities: Sophisticated investors are identifying arbitrage opportunities between token market prices and underlying NAV, particularly during periods of market stress or limited liquidity. However, these opportunities require careful analysis of holding period restrictions and transaction costs.

Professional Valuation Standards: Leading tokenized real estate platforms employ MAI-certified appraisers and follow USPAP standards for property valuations. This professional approach enhances investor confidence and provides defensible valuation methodologies.

8. Counterparty & Operational Risk: The Multi-Layer Challenge

Tokenized real estate's multi-layer technology stack amplifies certain risks while mitigating others. Understanding these risk dynamics is crucial for portfolio construction and platform selection.

The Risk Stack: Issuer default risk, smart contract vulnerabilities, oracle failures, and custody risks create a complex risk profile that requires sophisticated analysis. The BIS warns that operational risks could spike significantly as the market approaches $30 trillion in tokenized assets by 2030. [2]

Mitigation Strategies: Prefer SOC-audited firms with established track records, diversify across vetted custodians, and maintain position limits based on platform risk assessments. Leading investors are developing comprehensive due diligence frameworks that address both traditional real estate risks and blockchain-specific considerations.

Insurance Evolution: The development of specialized insurance products for tokenized real estate is addressing some operational risks. These products cover smart contract failures, custody risks, and certain operational disruptions, providing additional investor protection.

9. Taxes, Reporting & K-1/1099 Logistics: Navigating the Complexity

Tax treatment varies significantly based on investment structure, with important implications for reporting requirements and net after-tax returns.

Structure-Dependent Taxation: SPV structures often generate K-1 forms with pass-through income treatment, while fund structures may provide simplified 1099 reporting. EU MiCA implementation has added withholding tax clarity, but local property taxes and occupancy requirements persist. [6]

Reporting Innovation: Electronic delivery of tax documents rose 40% in 2025, improving efficiency and reducing administrative burdens. [6] Leading platforms provide comprehensive tax reporting packages that include all necessary documentation for investor tax preparation.

Cross-Border Considerations: International investors face additional complexity related to treaty benefits, withholding taxes, and foreign investment reporting requirements. Professional tax advice is essential for non-domestic investors in tokenized real estate.

10. Due Diligence Signals & Red Flags: The Investor's Defense System

Comprehensive due diligence becomes even more critical in tokenized real estate, where traditional gatekeeping mechanisms may be reduced or eliminated.

Essential Documentation: Demand offering documents, service provider rosters, escrow proofs, detailed rent rolls (target DSCR >1.5), and independent audits. Leading platforms should provide comprehensive data rooms with all relevant documentation easily accessible to potential investors.

Red Flag Identification: Anonymous teams, synthetic performance claims, undisclosed fee structures, and vague regulatory compliance statements should trigger immediate skepticism. The 2025 market has seen several high-profile failures related to inadequate disclosure and misrepresentation.

Professional Networks: Successful tokenized real estate investors develop networks of professionals including attorneys specializing in digital assets, accountants familiar with tokenization tax treatment, and technical experts who can evaluate smart contract implementations.

Ongoing Monitoring: Due diligence doesn't end at investment. Successful investors establish ongoing monitoring procedures to track property performance, platform developments, and regulatory changes that might affect their investments.

Best Solutions & How to Apply Them: Your Strategic Roadmap to Success

Transform knowledge into winning strategies with these 2025-tuned tactics designed to empower your approach to the $4 trillion tokenized real estate opportunity by 2035.

Map the Legal Wrapper First: Foundation Strategy for Success

Step-by-Step Implementation:

- Define Your Investment Objectives: Begin by clearly articulating your risk tolerance, return expectations, and liquidity requirements. Equity structures suit growth-oriented investors seeking 7-9% total returns with appreciation upside, while debt instruments appeal to income-focused investors prioritizing 4-6% stable yields. [3]

- Jurisdiction Analysis: Research the regulatory framework in your target markets. EU investors benefit from MiCA-backed redemption rights and enhanced disclosure requirements, while U.S. investors must navigate Regulation D restrictions and state-specific requirements. [6]

- Structure Selection Process: Evaluate each opportunity's legal wrapper against your investment thesis. For short-term positions (6-18 months), prioritize fund shares with built-in liquidity mechanisms. For long-term wealth building (3-7 years), consider equity SPVs in high-growth markets.

Advanced Strategy: Hybrid Structure Optimization

Emerging hybrid equity-debt structures offer compelling risk-adjusted returns by combining equity upside with debt-like downside protection. These structures typically provide 6-8% base returns with participation in appreciation above predetermined thresholds. Savvy investors are allocating 20-30% of their tokenized real estate exposure to these hybrid instruments.

Pro Tip: Align wrapper selection with tax optimization strategies. Pass-through structures (SPVs) may provide depreciation benefits for high-income investors, while fund structures offer simplified reporting for retirement account investments.

Verify Compliance Rails Before Capital Deployment

Comprehensive Compliance Verification Process:

- Regulatory Exemption Analysis: Probe specific exemptions such as Regulation A+, Regulation D, or Regulation CF. Verify that platforms maintain current exemption status and understand investor limitations under each framework.

- Transfer Agent Verification: Confirm that qualified transfer agents maintain capitalization tables and enforce investor eligibility requirements. Leading platforms work with established transfer agents like American Stock Transfer & Trust Company or Continental Stock Transfer & Trust Company.

- AML Policy Assessment: Review Anti-Money Laundering policies and Know Your Customer procedures. Robust platforms implement continuous monitoring and maintain compliance with FATF guidelines across all operating jurisdictions.

- Settlement Infrastructure: Modern platforms achieve T+1 settlement on integrated systems, significantly improving upon traditional real estate transaction timelines. Confirm settlement procedures and understand any lockup periods or transfer restrictions. [7]

- Emerging Compliance Innovation & Automated Regulatory Monitoring: Leading platforms now employ automated compliance monitoring systems that track regulatory changes in real-time and adjust platform operations accordingly, boosting investor confidence at remaining compliant as regulations evolve.

Due Diligence Checklist:

- Verify platform registration with relevant securities regulators

- Confirm transfer agent qualifications and track record

- Review AML/KYC procedures and technology infrastructure

- Understand investor eligibility requirements and verification processes

- Assess ongoing compliance monitoring and reporting capabilities

Make Liquidity a Design Choice: Strategic Liquidity Management

Advanced Liquidity Strategy Framework:

- Platform Selection Based on Liquidity Infrastructure: Choose venues with established order books and dedicated market-makers. Stellar's expansion promises 10x growth in RWA liquidity, while Ethereum-based platforms offer broader market access. [8]

- Position Sizing for Liquidity Constraints: Size positions assuming 10% bid-ask spreads during normal market conditions, with potential widening during stress periods. Maintain 60-70% of tokenized real estate allocation in higher-liquidity instruments.

- Diversification Across Liquidity Profiles: Combine high-liquidity fund shares (monthly redemptions) with medium-liquidity equity tokens (quarterly trading windows) and strategic long-term positions in development projects.

Innovative Liquidity Solutions:

DeFi Integration for Enhanced Exits: Progressive investors are exploring DeFi protocols that accept tokenized real estate as collateral, enabling liquidity without asset sales. Platforms like MakerDAO have begun accepting certain real estate tokens as collateral for DAI generation, creating new liquidity pathways. [1]

Automated Exit Strategies: Smart contract-based exit mechanisms are emerging that trigger automatic sales when predetermined conditions are met (price targets, time horizons, or market volatility thresholds). These tools help investors maintain discipline and optimize exit timing.

Cross-Platform Arbitrage: Sophisticated investors identify price discrepancies across different trading venues and execute arbitrage strategies to enhance returns while providing market liquidity.

Risk Management: Favor platforms with short lock-up periods (90 days or less) and transparent fee structures for early redemptions. Understand that enhanced liquidity often comes with slightly lower yields compared to longer-term commitments.

Demand Data You Can Audit: The Transparency Imperative

Comprehensive Data Verification Framework:

- Property-Level Transparency: Insist on dashboards providing rent rolls, occupancy rates, capital expenditure tracking, and tenant quality metrics. Target properties with Debt Service Coverage Ratios (DSCR) above 1.5 for stable cash flow generation.

- Financial Performance Monitoring: Demand monthly financial statements, quarterly property appraisals, and annual audited financials. Leading platforms provide real-time dashboards with key performance indicators updated continuously.

- Third-Party Validation: Require independent property valuations from MAI-certified appraisers, environmental assessments, and property condition reports. Verify that all third-party providers maintain appropriate professional insurance and credentials.

Blockchain-Enhanced Transparency: On-chain proofs complement traditional documentation by providing immutable records of cash flows, distributions, and ownership changes.

Smart contracts can automatically execute distributions based on predetermined criteria, reducing operational risk and enhancing transparency.

Advanced Analytics Integration: Leading platforms now integrate satellite imagery, local economic data, and predictive analytics to provide comprehensive property and market analysis.

Data Quality Indicators:

- Real-time rent collection and occupancy data

- Automated financial reporting with audit trails

- Third-party property valuations with methodology disclosure

- Environmental and regulatory compliance monitoring

- Market comparables and performance benchmarking

Build an Exit Plan Up Front: Strategic Exit Planning

Comprehensive Exit Strategy Development:

- Define Multiple Exit Pathways: Establish primary and secondary exit strategies before investment. Primary exits might include platform redemption mechanisms or secondary market sales, while backup strategies could involve holding to maturity or participating in property sales.

- Set Performance Targets and Triggers: Establish specific yield targets (e.g., 7% minimum annual return) and discount thresholds that trigger exit consideration. Document these criteria to maintain investment discipline during emotional market periods.

- Pilot Testing Approach: Start with small positions (1-2% of portfolio) to test platform functionality, liquidity mechanisms, and exit procedures before scaling to meaningful allocations.

Advanced Exit Strategies:

Structured Exit Timing: Coordinate exits with tax planning, particularly for pass-through structures that generate K-1 income. Consider year-end timing for tax-loss harvesting or gain recognition optimization.

Portfolio Rebalancing Integration: Integrate tokenized real estate exits with broader portfolio rebalancing activities. Use real estate token sales to fund other investment opportunities or maintain target asset allocation percentages.

Market Cycle Optimization: Develop exit strategies that consider real estate market cycles, interest rate environments, and tokenization market maturity. Early-stage investors may benefit from platform appreciation as markets mature.

Emergency Liquidity Planning: Maintain emergency liquidity plans for unexpected capital needs. Understand which positions offer fastest liquidity and at what cost, enabling informed decisions during financial stress.

Leverage Technology for Competitive Advantage

AI-Enhanced Investment Analysis: Utilize platforms that employ artificial intelligence for property valuation, market analysis, and risk assessment. AI-driven systems can process vast amounts of data to identify investment opportunities and risks that traditional analysis might miss.

Automated Portfolio Management: Implement automated rebalancing systems that maintain target allocations across different tokenized real estate strategies. These systems can execute trades based on predetermined criteria, removing emotional decision-making from portfolio management.

Integration with Traditional Finance: Explore platforms that integrate with traditional banking and investment systems, enabling seamless portfolio management across tokenized and traditional assets. This integration simplifies reporting, tax preparation, and overall wealth management.

Blockchain Analytics Tools: Employ blockchain analytics tools to monitor token movements, identify large holder behavior, and assess market sentiment.

Risk Management and Diversification Strategies

Geographic Diversification: Spread investments across multiple geographic markets to reduce concentration risk. Consider currency hedging for international exposures and understand local market dynamics that might affect property values.

Platform Diversification: Avoid concentration in single platforms or issuers. Diversify across multiple tokenization platforms to reduce operational and counterparty risks.

Vintage Diversification: Invest across different vintage years to reduce timing risk and benefit from market cycle diversification. This strategy helps smooth returns over time and reduces the impact of market timing decisions.

Correlation Analysis: Monitor correlations between tokenized real estate investments and traditional portfolio holdings. Adjust allocations based on changing correlation patterns to maintain diversification benefits.

Pro Tips: 2025's Tokenized Real Estate Market

1. Chase AI-Enhanced Disclosures for Revolutionary Underwriting

Leverage platforms employing artificial intelligence for property analysis and risk assessment. Propy's implementation of AI-driven property valuations achieved 40% efficiency gains in underwriting processes, enabling faster deal execution and more accurate pricing.[12] Smart investors prioritize platforms with automated due diligence systems that can process vast amounts of property data, market comparables, and regulatory information in real-time.

2. Focus on Income Over Appreciation in Volatile Markets

In 2025's uncertain interest rate environment, prioritize debt wrappers and income-focused structures over pure appreciation plays. Target properties with strong rental yields and established tenant bases rather than speculative development projects. This strategy provides downside protection while maintaining upside participation through hybrid structures.

3. Exploit Regulatory Arbitrage Opportunities

Navigate cross-border opportunities by understanding regulatory differences. EU investors can access broader tokenized real estate markets through MiCA compliance, while U.S. investors might find opportunities in Regulation A+ offerings that provide enhanced liquidity compared to traditional Regulation D private placements.

4. Master the Art of Fee Optimization

Negotiate fee structures when possible, particularly for larger investments. Some platforms offer reduced management fees for commitments above certain thresholds. Calculate total cost of ownership including management fees, performance incentives, and transaction costs to make accurate return comparisons.

5. Implement Dynamic Allocation Strategies

Adjust tokenized real estate allocations based on market cycles and interest rate environments. Increase allocations to floating-rate debt instruments during rising rate periods, while emphasizing equity structures during economic expansion phases.

6. Leverage Technology Integration for Competitive Advantage

Utilize platforms that integrate with traditional portfolio management systems, enabling seamless reporting and analysis. Advanced investors employ blockchain analytics tools to monitor token holder behavior and identify market trends before they become apparent in pricing.

7. Build Strategic Platform Relationships

Develop relationships with platform management teams to gain early access to new offerings and enhanced terms. Leading platforms often provide preferential access to high-quality deals for established investors with strong track records.

8. Monitor Regulatory Developments Proactively

Stay informed about regulatory changes that might affect tokenized real estate investments. Subscribe to regulatory updates from key jurisdictions and consider how changes might create new opportunities or risks for existing positions.

Key Takeaways: Your Roadmap to Tokenized Real Estate Success

- Market Opportunity: Tokenized real estate represents a $4 trillion opportunity by 2035, with current market growth exceeding 27% annually, but success requires sophisticated understanding of legal structures and regulatory compliance.

- Liquidity Evolution: The market has evolved to semi-liquid status with $5 billion in secondary trading volume, but investors must plan for holding periods and bid-ask spreads while benefiting from enhanced liquidity compared to traditional real estate.

- Risk Management: Multi-layer operational risks require comprehensive due diligence, platform diversification, and ongoing monitoring, but proper risk management enables access to attractive risk-adjusted returns.

- Strategic Exit Planning: Success demands exit strategy development from day one, including multiple liquidity pathways and performance triggers to ensure profit realization and capital preservation.

- Data-Driven Decisions: Demand verifiable, auditable data from all investments, leveraging blockchain transparency and traditional due diligence to make informed investment decisions.

Frequently Asked Questions

Q1. Can non-accredited investors access tokenized real estate in 2025? Yes, through multiple pathways. EU investors benefit from MiCA retail exemptions with €30,000 caps and enhanced disclosures. U.S. investors can access Regulation CF offerings (up to $5 million raises) and certain Regulation A+ deals. Non-accredited options grew 25% in 2025, though investment limits and additional restrictions typically apply. [6]

Q2. Do tokenized real estate investments provide direct property ownership? No, tokens typically represent economic rights through legal wrappers like SPVs rather than direct property deeds. Investors own shares in entities that own real estate, with rights defined by offering documents and legal structures. Always trace the complete ownership chain from property title to token to understand your actual rights and recourse mechanisms. [7]

Q3. How liquid are tokenized real estate investments compared to traditional real estate? Semi-liquid with significant improvements over traditional real estate. Secondary market volumes reached $5 billion in 2025, with average holding periods of 6-12 months. Expect bid-ask spreads of 1-2% on platforms with market-makers, though liquidity varies significantly by platform and asset type. Trading volumes increased 210% year-over-year, indicating growing market maturity. [2]

Q4. What fees should investors expect and which impact returns most significantly? Management fees (1-2%), administrative costs (0.5%), and performance incentives (20% carry) can reduce net returns by 2-3% annually. Performance fees typically have the largest impact on total returns, followed by management fees. Scrutinize fee structures early and calculate total cost of ownership including transaction costs and potential early redemption fees. [1]

Q5. How are tokenized real estate investments taxed? Tax treatment depends on investment structure. SPV investments typically generate K-1 forms with pass-through taxation, while fund structures may provide simplified 1099 reporting. EU MiCA implementation has clarified withholding tax treatment for cross-border investments. Consult tax professionals familiar with digital assets, as treatment varies by jurisdiction and investor status. [6]

Sources and Citations

[1] Deloitte Center for Financial Services. "Tokenized Real Estate: Digital Dividends and Asset Management Revolution." Deloitte Insights, April 24, 2025. Digital dividends: How tokenized real estate could revolutionize asset management

[2] Barraza, Jason, and Alexandra Levis. "What 2025 Holds for Tokenized Real World Assets." CoinDesk, January 8, 2025. What 2025 Holds for Tokenized Real World Assets

[3] McKinsey & Company. "From Ripples to Waves: The Transformational Power of Tokenizing Assets." McKinsey Insights, 2024 with 2025 projections. From ripples to waves: The transformational power of tokenizing assets

[4] ScienceSoft. "Real Estate Tokenization in 2025: Facts and Trends." ScienceSoft Research, May 8, 2025. Real Estate Tokenization in 2025: Facts and Trends

[5] Primior Capital. "5 Reasons Real Estate Tokenization Could Dominate The Market By 2025." Primior Insights, January 10, 2025. 5 Reasons Real Estate Tokenization Could Dominate The Market By 2025 | Primior Group

[6] European Securities and Markets Authority (ESMA). "Markets in Crypto-Assets Regulation (MiCA) Implementation Hub: 2025 Updates." ESMA Digital Finance, 2025. Markets in Crypto-Assets Regulation (MiCA)

[7] BNY Mellon and Goldman Sachs. "Tokenized Money Market Funds Solution Launch." BNY Corporate News, 2025. BNY and Goldman Sachs Launch Tokenized Money Market Funds Solution

[8] AInvest. "Stellar Targets $3 Billion RWA Tokenization in 2025." AInvest News, 2025. Stellar Targets $3 Billion RWA Tokenization by 2025

[9] Forbes Digital Assets. "Real-World Asset Tokenization Hits $24 Billion As Wall Street Bets Big." Forbes, June 20, 2025. Real-World Asset Tokenization Hits $24 Billion As Wall Street Bets Big

[10] RealT Platform. "Regulation CF Real Estate Tokenization: 2025 Market Analysis." RealT Research, 2025.

[11] Ondo Finance. "Market Making and Liquidity Solutions for Tokenized Real Estate." Ondo Platform Documentation, 2025.

[12] Propy. "AI-Driven Property Valuations: 40% Efficiency Gains in Real Estate Tokenization." Propy Technology Report, 2025.

Author: Mac Carter

Last Updated: August 2025 | Scheduled Update: January 2026