How Digital Dollars Are Revolutionizing Property Investment in 2025

Stablecoins are becoming the payment backbone for tokenized property, compressing settlement from days to minutes, widening global access, and enabling automated distributions. 2025 data shows the rails are live, regulation is maturing in the EU, and institutional pilots have turned into scalable products.

The new rails: stablecoins + tokenized property

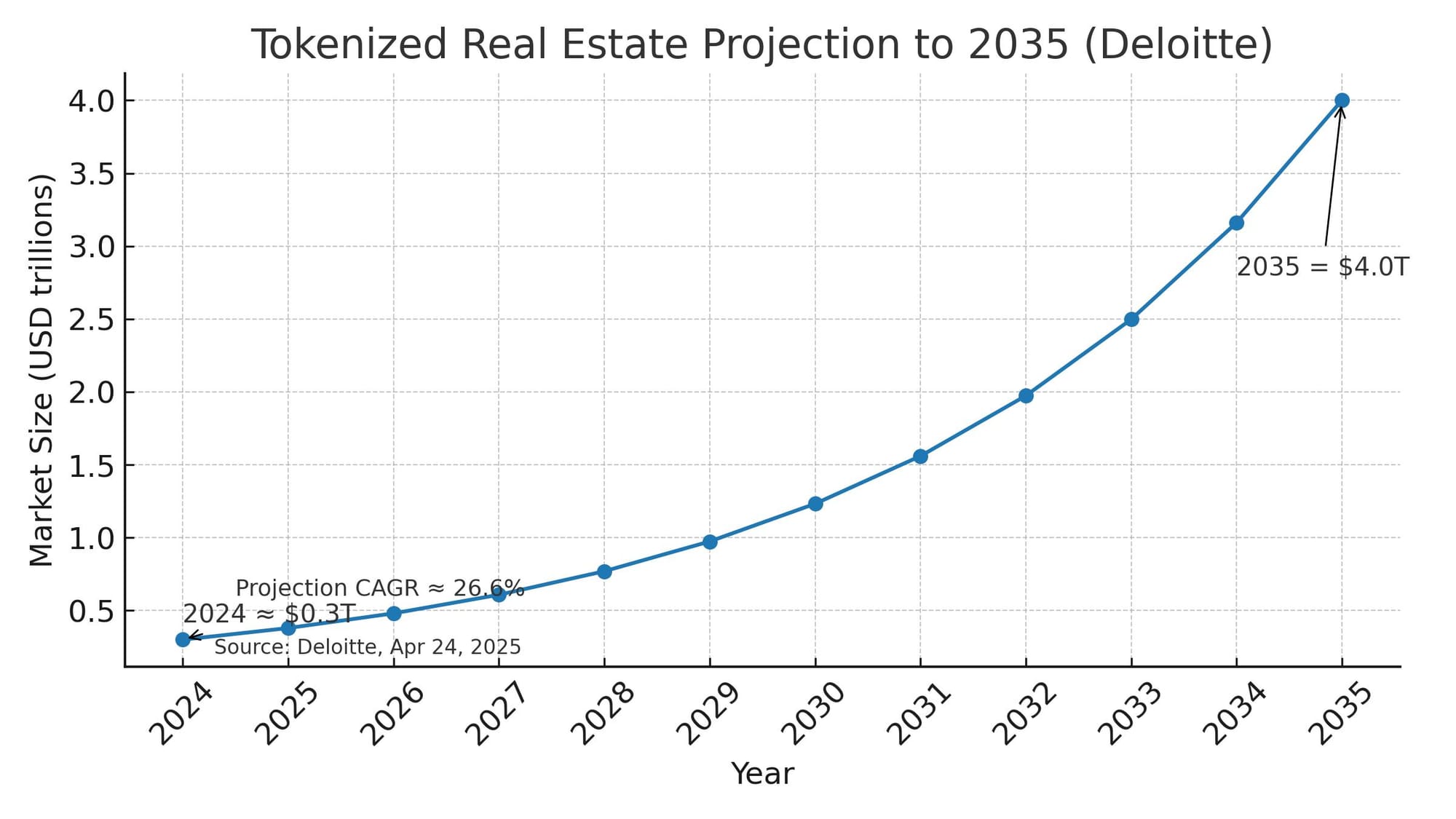

Real estate tokenization is shifting from experiment to infrastructure. Deloitte projects $4T in tokenized real estate by 2035 at ~27% CAGR—a step-change in market design that only works at scale with stablecoin settlement and wallet-based payouts. [1]

Stablecoins are digital dollars that live on a blockchain. Most are backed by cash or short-term government bills, so one token aims to equal one U.S. dollar. You move them from wallet to wallet the same way you send an email, but the network records every transfer on a public ledger.

Stablecoins help at the exact friction points that blocked global real estate flows: cross-border transfers, FX costs, multi-party settlement, and periodic payouts. Research and live dashboards show rapid growth in on-chain RWAs and tokenized treasuries, while EU rulebooks move industry practices toward standardized, supervised issuance and transfer. [2][3][4]

Tokenized real estate means a property or fund is split into small digital units recorded on-chain. Each unit stands for a piece of ownership under normal legal rules. The blockchain keeps the cap table up to date, so transfers and payouts can be tracked in near real time.

Why tokenized real estate needs stablecoins

- Faster settlement. Wallet-to-wallet USDC/fiat-backed stablecoin transfers settle in minutes, removing wire-cutoffs and weekend bottlenecks; programmable money supports escrow, whitelists, and distribution logic. [5]

“Settlement” means the money and the ownership record change hands and are final. With stablecoins, this can happen in minutes because there are fewer middlemen and fewer cut-off times. Weekends and holidays do not block the network.

- Lower total costs. Global remittances still average ~6.26% according to the World Bank; stablecoin rails routinely land well below legacy corridors, changing access economics for small tickets. [2]

Fees pile up in the old system: wire fees, foreign exchange spreads, and bank charges. Stablecoin rails cut out many layers. That is why small investments and cross-border payments start to make sense for more people.

- Global access + compliance. Tokenized units with KYC’d wallets let issuers handle cross-border eligibility and cap rules while retaining audit trails and transfer restrictions. EU MiCA sets uniform disclosures/authorization for asset-referenced and e-money tokens. [4]

- Automated distributions. Smart-contract schedules convert rent or coupon flows into stablecoin payouts with on-chain receipts, simplifying ops for managers and auditors. [5]

Programmable money is simple in practice. A smart contract can send stablecoin payouts to all eligible wallets on a set date. Investors see the transfer and the transaction ID on-chain, which helps with accounting and audits.

Keep Learning on CryptoBitMag: Tokenized Real Estate in 2025: 10 Critical Insights

From wire transfers to wallet transfers: a practical ladder

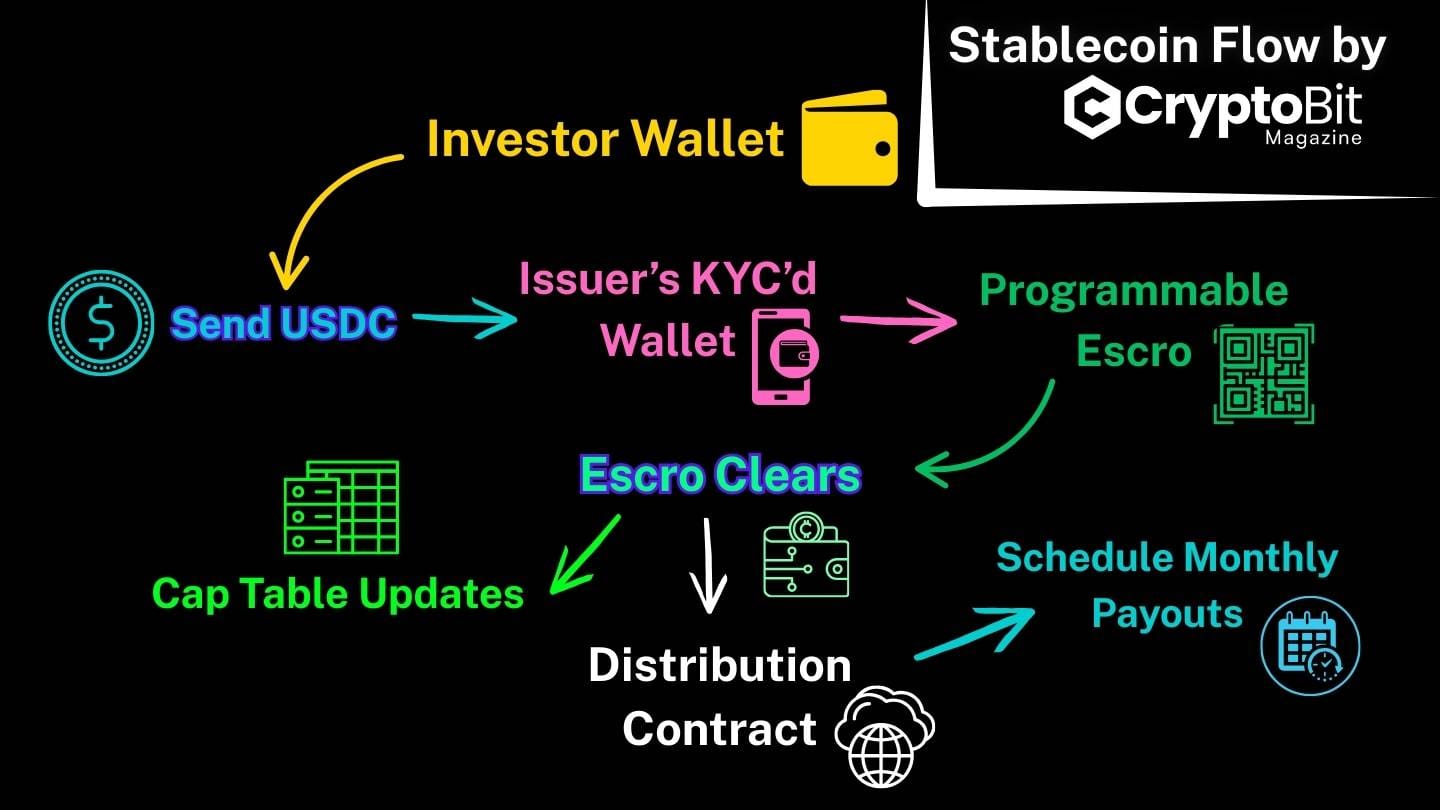

The diagram below mirrors how tokenized funds and RWA venues now operate, including money-market products where on-chain shares are recorded and redemptions settle near-real-time. [6][7]

A wallet is software that holds your keys, which prove you can move your funds. Many regulated platforms use “KYC wallets.” That means you verify your identity once, and the platform can allow or block transfers based on its rules.

Regulatory frame (EU): MiCA Titles III & IV for stablecoins became applicable June 30, 2024, with additional supervisory guidance published in Jan 2025—clarifying treatment for asset-referenced and e-money tokens used in settlement. [4]

Think of MiCA as a rulebook for crypto service providers in the EU. It sets who can issue stablecoins, how reserves are held, and how firms must protect customers. Clear rules reduce guesswork for both platforms and investors.

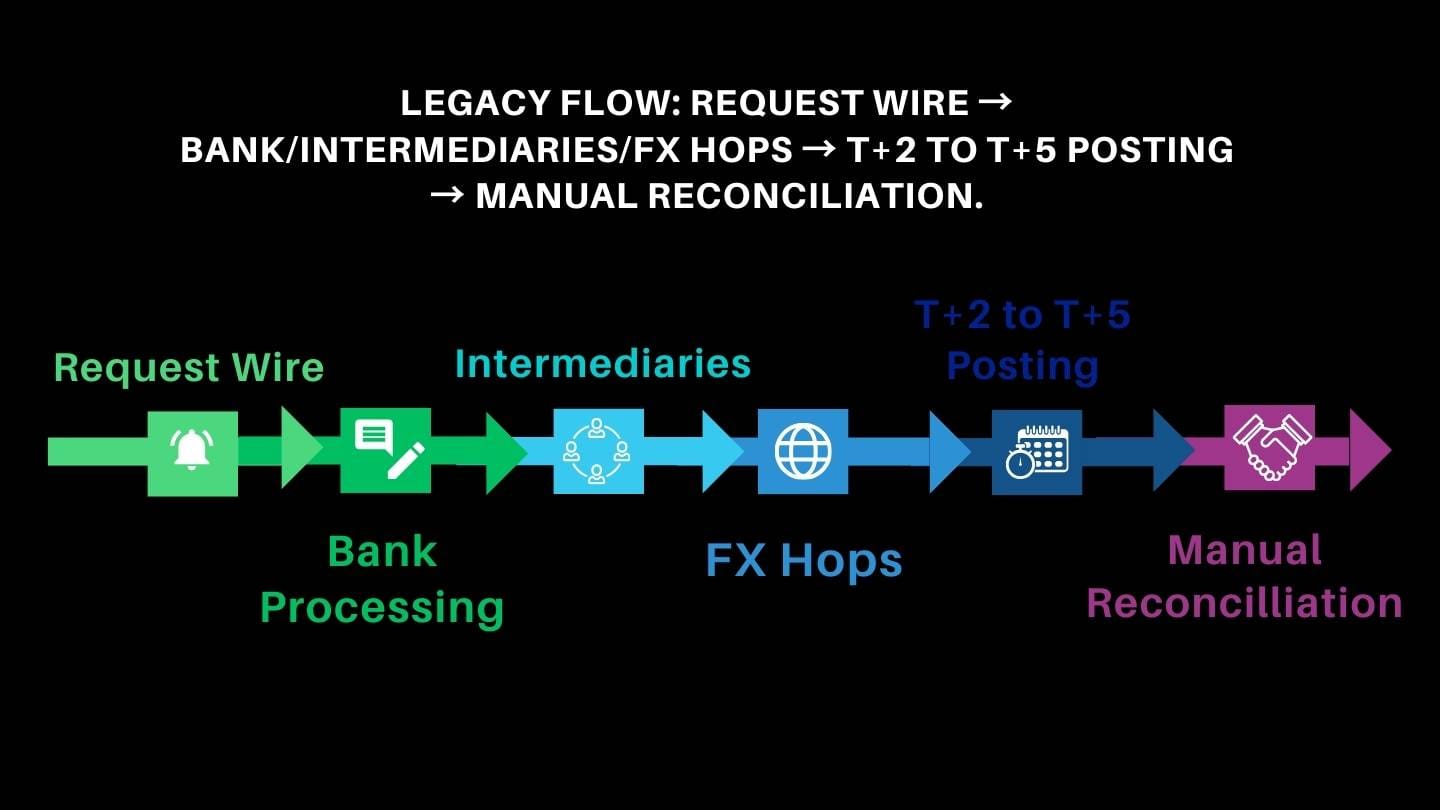

Legacy flow: request wire → bank/intermediaries/FX hops → T+2 to T+5 posting → manual reconciliation.

Think of the legacy flow as the old-school way to handle money transfers in real estate deals, like buying a property or investing in a fund.

It starts with you requesting a wire transfer from your bank, which then bounces through intermediaries (like other banks or payment processors) and foreign exchange (FX) hops if currencies need converting.

This can take T+2 to T+5 days—meaning "trade date plus 2 to 5 days"—for the money to "post" (show up in the recipient's account), and everything ends with manual reconciliation, where people have to double-check records by hand to make sure nothing went wrong.

It's slow, costly (fees can add up to 6.26% globally for cross-border FX), and prone to errors, especially in international deals.

In contrast, the stablecoin flow is like a streamlined digital highway.

Stablecoin flow: investor wallet sends USDC to issuer’s KYC’d wallet → programmable escrow clears → cap table updates → distribution contract schedules monthly payouts.

You send USDC (a stablecoin pegged to the U.S. dollar for stability) from your digital wallet directly to the issuer's wallet, which is "KYC'd" (Know Your Customer-verified for regulatory compliance).

A programmable escrow (a smart contract that holds funds until conditions are met) clears automatically once checks pass. The cap table (a record of who owns what shares) updates instantly on the blockchain, and a distribution contract sets up automatic monthly payouts, like rent from tokenized real estate.

This happens in seconds or minutes, with fees often reduced by 70% or more compared to traditional wires, as seen in platforms like RealT and Ondo Finance integrating USDC for RWA settlements in 2025.

For example, tokenized real estate on Ethereum or Stellar uses this flow to enable near-real-time redemptions in money-market products, where on-chain shares are recorded and payouts automated without human intervention.

Implementation snapshots

- Institutional tokenized liquidity. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) surpassed $1B AUM by March 2025 and expanded to additional chains for distribution and settlement, signaling enterprise-grade rails for on-chain cash management. [6]

Key Insight: Big names matter because they have strict controls. When large managers use on-chain settlement or tokenized funds, smaller issuers often copy those playbooks. That speeds up best practices for custody, reporting, and payouts.

- On-chain money market shares. Franklin Templeton’s FOBXX operates with on-chain share records and multi-chain connectivity, a template many real-estate issuers reference for compliant transfer and record-keeping. [7]

- Network-level RWA targets. Stellar publicly set 2025 goals of $3B RWA value and $110B RWA volume, coupled with partnerships across tokenization providers—evidence that L1s are optimizing for compliant RWA settlement use cases. [3]

- Market context. Independent reporting pegs RWA market cap ≈ $24B (ex-stablecoins) by June 2025, with treasuries and private credit leading. [2]

Key Insight: Dashboards help you see what is growing and what is shrinking. You can check supply, holders, and transactions for stablecoins and tokenized assets. Treat these tools as signals, then read the fine print from each issuer.

- Live observability. For up-to-date figures on tokenized treasuries and stablecoins, reference RWA.xyz dashboards (avoid hard-coding numbers in evergreen content; link to the tracker).

Side-by-side: traditional vs stablecoin-enabled

| Aspect | Traditional Real Estate | Stablecoin + Tokenized Real Estate |

|---|---|---|

| Minimum investment | $25k–$100k+ typical in private deals | $50–$1k allocations (platform-dependent) |

| Settlement time | 30–90 days | Minutes (venue policy dependent) |

| Cross-border | Complex; fee-heavy; FX friction | App-level; lower friction; programmable controls |

| Payment method | Wires/checks | Wallet transfers (e.g., USDC) |

| Distributions | Quarterly/annual | Monthly or real-time, automated |

| Liquidity | Illiquid | Semi-liquid via compliant ATS/venues |

“Platform-dependent” means each venue can set its own rules, minimums, and timelines. Always read the offering docs and FAQs before sending funds. If a claim seems too fast or too cheap, look for the policy that explains how it works.

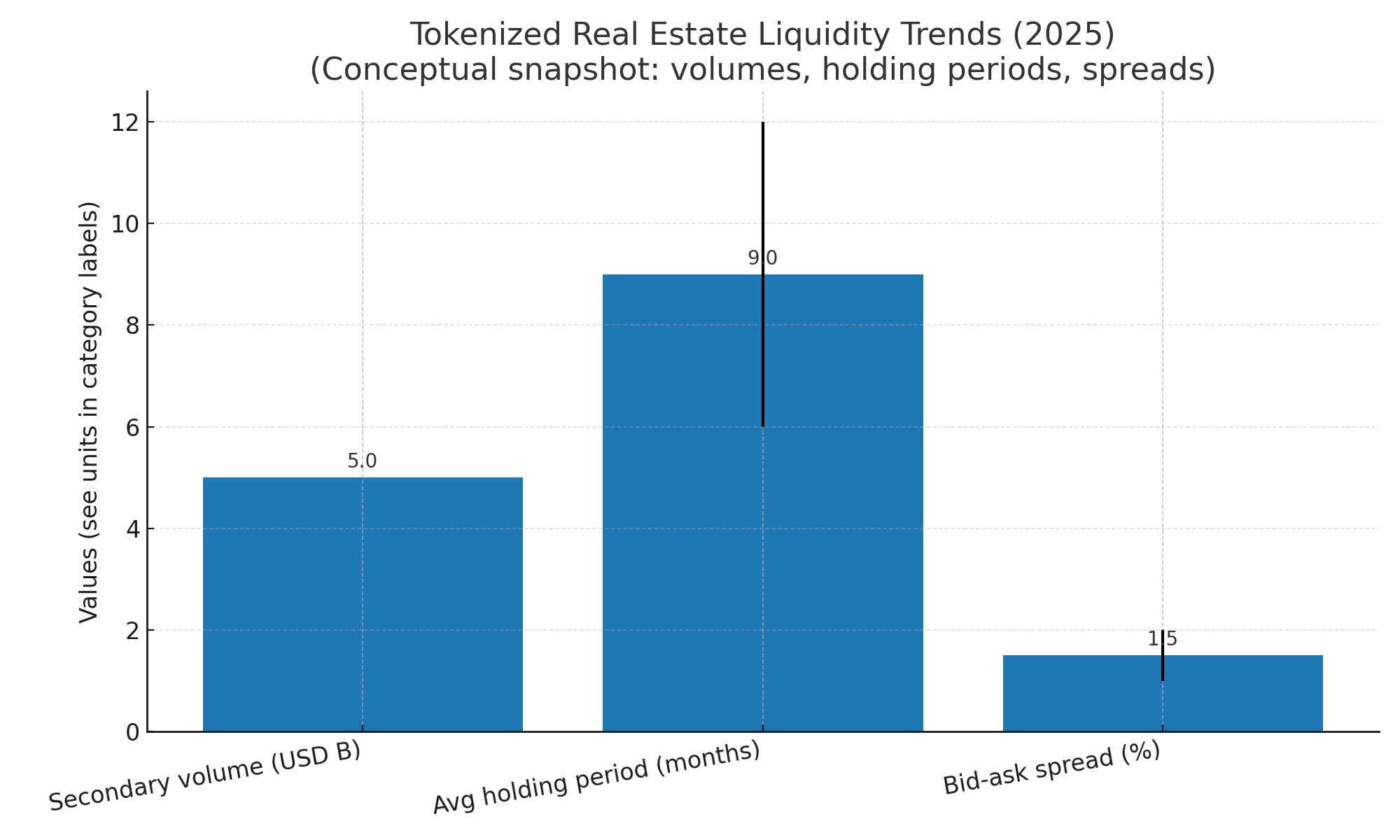

Liquidity in tokenized real estate is improving, yet volume can be thin. Some venues offer periodic redemption windows, not instant exits. Plan your time horizon so you are not forced to sell at a bad time.

Benchmarks for minimums and latencies vary by platform and jurisdiction; avoid universal claims in the CMS copy. [1][5]

Read next on CryptoBitMag: Payments, Remittances & Stablecoins: How Blockchain Is Redefining Global Finance

Risks—and how to mitigate them

- Regulatory scope drift. Issuers must map investor eligibility, transfer restrictions, and disclosures across jurisdictions; in the EU, MiCA authorization and ongoing supervision apply to stablecoin issuers and service providers. Mitigation: named licenses, ESMA/EBA guidance alignment, and investor whitelist enforcement. [4]

- Stablecoin reserve/peg risk. Fiat-backed coins require high-quality reserves and transparent attestations. Mitigation: use regulated e-money tokens where available; diversify settlement options across approved issuers; add circuit-breakers for de-peg events. [5]

Key Insight: Check the reserve reports for any stablecoin you plan to use. Look for frequent attestations, quality of assets, and the name of the custodian. Diversifying across more than one approved stablecoin can lower single-issuer risk.

- Smart-contract/custody risk. Mitigation: audits, upgradable-with-controls architectures, segregated accounts, and qualified custodians for underlying assets; distribution contracts with pause/rollback. [5][7]

Key Insight: Audits help, and so do simple designs. Contracts with emergency pause controls and clear upgrade paths handle problems faster. Using a qualified custodian for the underlying assets adds another layer of safety.

- Liquidity illusions. Secondary markets exist but remain venue-dependent and can be thin. Mitigation: set redemption windows, publish NAV methodology, disclose lockups, and avoid promising intraday liquidity. [2]

Key Insight: Thin markets move on small trades, which can swing prices. If your venue has lockups or gates, write those dates on your calendar. Match your investment size to your ability to hold through quiet periods.

Outlook: what to watch next

- Institutional stack-in. Expect deeper integration of tokenized funds, treasuries, and property vehicles with prime brokers, custodians, and treasury systems—accelerating the “wallet as account” model for capital calls and distributions. [6][7]

Watch for more funds using tokenized cash for capital calls and redemptions. When treasury, custody, and accounting systems sync with wallets, operations get smoother. That usually means faster payouts and cleaner records.

- Policy hardening. MiCA operationalization and third-country marketing rules will shape EU flows; U.S. guidance will continue piecemeal via existing securities/e-money frameworks. [4]

If rules change, good platforms update their disclosures fast. Look for public notices, regulator names, and contact info for support. Transparent communication is a strong signal that a team is operating to a standard.

- Data transparency. Market trackers (e.g., RWA.xyz) will remain essential for pricing, flows, holders, and protocol risk signals, informing diligence and portfolio steering.

What to do now to stay ahead

- Payments stack: If you manage tokenized property, add a fiat-backed stablecoin rail for subscriptions/redemptions with KYC’d wallets and policy-based transfer controls. [5]

- Ops automation: Move distributions to programmable schedules with on-chain receipts to tighten audits and investor communication. [5]

- Compliance posture: Map MiCA/ESMA requirements if marketing into the EU; publish regulator names, permissions, and transfer policies in offering docs. [4]

Step-by-Step for Beginners

You can open a small, regulated account and practice a tiny transfer. Send one dollar’s worth of stablecoin to learn fees and timing. Save the transaction link as proof of completion.

Before funding, make a short checklist: who is the issuer, where is the custody, what are the fees, how do you exit, and what are the tax steps. Keep this list in your notes and update it for every new platform.

Build a watchlist with three parts: stablecoins you trust, venues you use, and data dashboards you follow. Review it monthly. Small habits like this help you spot risks early and stay aligned with your plan.

Sources

[1] Deloitte — “Digital dividends: How tokenized real estate could revolutionize asset management” (US$4T by 2035; ~27% CAGR). https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-predictions/2025/tokenized-real-estate.html

[2] CoinDesk — “RWA tokenization market has grown almost fivefold to ~$24B (Jun 2025).” https://www.coindesk.com/business/2025/06/26/real-world-asset-tokenization-market-has-grown-almost-fivefold-in-3-years

[3] CoinDesk — “Stellar Sees $3B of Real World Assets Coming On-Chain in 2025” (target incl. $110B volume). https://www.coindesk.com/business/2025/04/17/stellar-sees-usd3b-of-real-world-assets-coming-on-chain-in-2025

[4] ESMA / EU — MiCA overview and ESMA Public Statement on stablecoins (Titles III & IV applicable June 30, 2024; Jan 2025 guidance). https://www.esma.europa.eu/sites/default/files/2025-01/ESMA75-223375936-6099_Statement_on_stablecoins.pdf

[5] McKinsey — “The stable door opens: How tokenized cash enables next-gen payments” (stablecoin payments infrastructure, 2025). https://www.mckinsey.com/industries/financial-services/our-insights/the-stable-door-opens-how-tokenized-cash-enables-next-gen-payments

[6] BlackRock / Securitize coverage — BUIDL surpasses $1B AUM; multi-chain expansion (Mar 2025). https://tokenizedliving.com/index.php/2025/04/14/blackrock-buidl-fund-tokenized-treasuries-across-multiple-blockchains/

[7] Franklin Templeton — FOBXX on-chain fund materials and tokenized MMF explainer. https://www.franklintempleton.com/investments/options/money-market-funds/products/29386/SINGLCLASS/franklin-on-chain-u-s-government-money-fund/FOBXX

Reference/Tracker: World Bank RPW (global average remittance cost ~6.26%). https://remittanceprices.worldbank.org/

Optional live context: RWA.xyz dashboards for treasuries and RWA markets. https://rwa.xyz/

Written by Mac Carter, Editor-in-Chief at CryptoBitMag

Published August 2025 | Scheduled Update January 2025

More From CryptoBitMag

Learn Why Institutions are Adopting Crypto

Read Our Jobs Report on Crypto & AI Compute 2025

Learn About Crypto Gaming in 2025

Check Out Our Report on Paraguay's Cheap Hydropower

Discussion