Bitcoin: A Digital Revolution

In 2008, amidst a global financial crisis that eroded trust in traditional banks and governments, a pseudonymous individual or group known as Satoshi Nakamoto introduced a groundbreaking concept: a decentralized digital currency. This revolutionary idea was detailed in the whitepaper, "Bitcoin: A Peer-to-Peer Electronic Cash System," which proposed an entirely new way to perceive money, value, and trust, free from the need for intermediaries.

Introducing a Groundbreaking Concept

From Niche Idea to Global Phenomenon

What began as a niche concept has since exploded into a global asset. By 2024, Bitcoin's market capitalization surpassed an astounding $1.4 trillion, earning it the moniker "digital gold" due to its inherent scarcity and robust security features.

Understanding Crypto Market Dynamics

What Is Bitcoin? A New Financial System

Bitcoin is a decentralized digital currency allowing secure, direct transactions between individuals, without banks or governments. Born during the 2008 financial crisis, it aimed to fix flaws in centralized financial systems, offering a trustless system secured by code, not institutions.

Imagine sending money anywhere, securely, with low fees and no centralized control or censorship. That's the vision behind Bitcoin—a currency challenging traditional ideas of wealth and power.

Bitcoin's Roots: Ideas from the Past

Bitcoin didn't appear out of nowhere. It built on decades of work by the Cypherpunk movement, cryptographers and privacy advocates whose innovations inspired Bitcoin’s decentralized design.

Key contributors included:

- David Chaum: Creator of DigiCash and blind signatures for private digital payments.

- Adam Back: Developed Hashcash, a proof-of-work system used in Bitcoin mining.

- Wei Dai: Proposed b-money, a theoretical decentralized currency.

- Nick Szabo: Designed Bit Gold, a direct precursor to Bitcoin using proof-of-work and scarcity.

- Hal Finney: Built Reusable Proof of Work (RPoW) and received the first-ever Bitcoin transaction.

Fun Fact: Cypherpunk mailing lists in the 1990s were crucial for developing Bitcoin's core principles, especially the idea of privacy as a fundamental right.

The 2008 Whitepaper: The Blueprint

On October 31, 2008, Satoshi Nakamoto published the famous whitepaper, proposing a trustless financial system with:

- Peer-to-Peer Network: Direct transactions, no middlemen.

- Blockchain: A public, tamper-proof ledger for all transactions.

- Proof-of-Work: Miners solve puzzles to confirm blocks and earn rewards, securing the network.

This blueprint laid the foundation for a new kind of money: decentralized, transparent, and censorship-resistant.

🔗 Read the original whitepaper here

2009: Bitcoin's First Steps

- January 3, 2009: The Genesis Block (Bitcoin's first block) was mined. It contained a hidden message: "Chancellor on brink of second bailout for banks."

- January 9, 2009: Satoshi released Bitcoin v0.1, the first software.

- January 12, 2009: Satoshi sent 10 BTC to Hal Finney in the first Bitcoin transaction.

🔗 Explore the Genesis Block

2010–2011: Early Milestones

- Bitcoin Pizza Day: On May 22, 2010, Laszlo Hanyecz paid 10,000 BTC for two pizzas—Bitcoin’s first real-world purchase!

- Early Exchanges: Sites like BitcoinMarket.com and Mt. Gox launched, enabling BTC/USD trading.

- Mining Evolves: From CPUs to powerful GPUs, then specialized ASICs by 2012–2013.

- Price Growth: Bitcoin went from almost nothing to over $30 by 2011.

2011–2014: Booms, Busts, and Growing Pains

- Silk Road: This dark web market used Bitcoin for illicit transactions, drawing negative media and regulatory attention.

- Bitcoin Magazine: Founded in 2012 by Vitalik Buterin and others, it became a key source for crypto news.

- Mt. Gox Hack (2014): Over 850,000 BTC were lost in the biggest exchange collapse in history, leading to major industry reforms.

Despite these challenges, Bitcoin proved resilient and continued to grow.

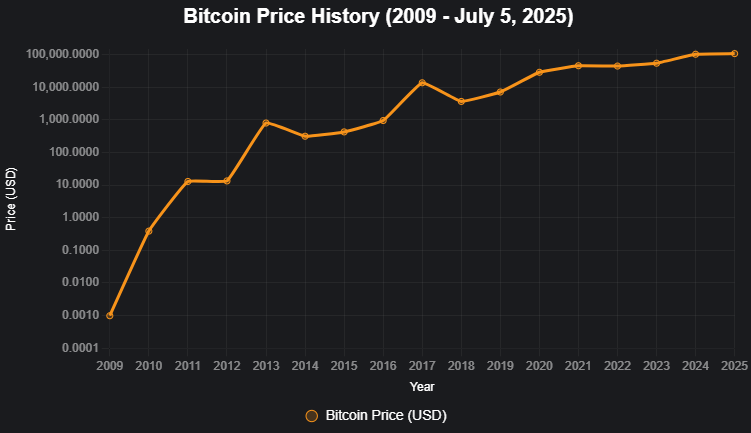

Bitcoin’s Price History: A Rollercoaster Ride

Year | Price Peak | Notable Event |

2010 | ~$0.50 | First real-world transaction (Pizza Day) |

2011 | $31 | Early exchange adoption |

2013 | $1,150 | First major bull run |

2017 | $19,783 | ICO boom & mainstream interest |

2021 | $69,000 | Institutional adoption, COVID stimulus |

2024 | ~$73,750 | Spot ETF approvals, halving event |

Bitcoin Halvings: Engineered Scarcity

Every 210,000 blocks (about every 4 years), the reward for miners is cut in half. These "halvings" reduce new BTC supply and often precede major price surges.

🔗 Learn more about Bitcoin Halvings

2010s–2020s: Bitcoin Goes Mainstream

- Bitcoin Cash (2017): A hard fork due to debates over transaction speed and block size.

- Spot ETFs Approved (2024): SEC approval opened doors for traditional investment.

- El Salvador (2021): Became the first country to adopt Bitcoin as legal tender.

- Regulatory Developments: Frameworks like the EU’s MiCA and SEC oversight aim to stabilize the market.

Institutional Adoption: Companies like MicroStrategy and Tesla added Bitcoin to their treasuries.

🔗 Track holdings on Bitcoin Treasuries

Spot ETFs Approved

Why “Digital Gold”?

Bitcoin earned this name because it shares key traits with gold:

- Scarcity: Only 21 million BTC will ever exist.

- Security: Protected by a vast, decentralized network.

- Portability: Instantly transferable worldwide.

- Predictable Supply: Halving events ensure controlled scarcity.

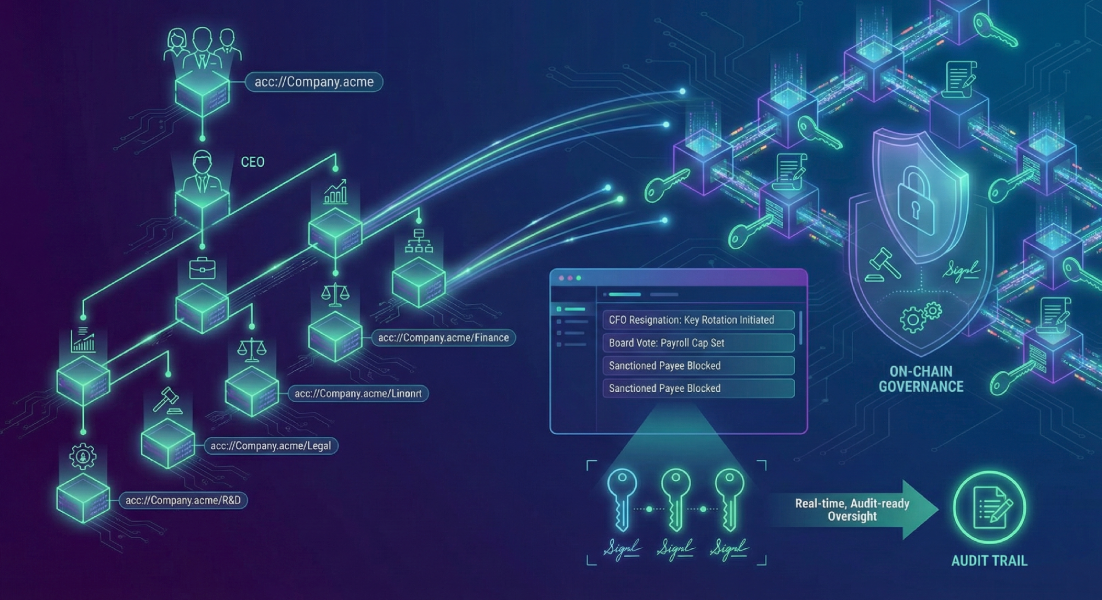

How Bitcoin Works

Key Components:

- Blockchain: A distributed, immutable digital ledger recording all transactions.

- Mining: Miners use ASICs to solve puzzles, confirm transactions, and secure the network.

- Wallets: Secure tools (hardware or software) to store and manage your private keys.

Upgrades & Scalability

- SegWit (2017): Increased transaction capacity and lowered fees.

- Taproot (2021): Improved privacy and enabled more complex smart contracts.

- Lightning Network: A Layer 2 solution for instant, low-fee transactions.

🔗 Explore Bitcoin’s network activity on Mempool.space

Bitcoin Scalability

Bitcoin in Times of Crisis

Bitcoin offers a financial lifeline in turbulent economies:

- Argentina (2024): Citizens use BTC to combat ~280-290% inflation.

- Nigeria: Used to bypass strict currency controls.

- Ukraine (2022): Accepted BTC donations during wartime.

- Venezuela & Lebanon: A hedge against devalued fiat currency and banking collapses.

Everyday Bitcoin Use

Bitcoin is becoming more practical for daily life:

- Apps: Cash App, Strike, Coinbase let you buy, sell, and spend BTC easily.

- Lightning Payments: Fast, near-free transactions via QR codes for daily purchases.

- Retailers: More businesses are accepting BTC for various goods and services.

ATMs: Over 40,000+ Bitcoin ATMs globally as of mid-2024.

🔗 Find a Bitcoin ATM near you

Cultural Impact

Bitcoin is more than just code—it’s a global movement:

- Conferences: Events like Bitcoin 2025 Las Vegas draw thousands of enthusiasts.

- Communities: Vibrant online groups on r/Bitcoin and X (Twitter) foster growth.

- Influencers: Voices like Jack Mallers and Michael Saylor shape public perception and adoption.

Investing in Bitcoin

Popular options for investing in Bitcoin include:

- ETFs: Now available through traditional brokerage accounts.

- IRAs: Crypto retirement options with tax advantages.

- DCA: Dollar-cost averaging (investing a fixed amount regularly) helps reduce risk.

🔗 Try a DCA Calculator

Crypto Trading Strategies

Bitcoin Security Tips

Protect your assets with these essential tips:

- Hardware Wallets: Devices like Ledger and Trezor store your keys offline for maximum security.

- Self-Custody: "Not your keys, not your crypto." Control your own funds.

- Seed Phrase: Safely store your 12- or 24-word backup phrase offline.

- Scam Prevention: Be wary of phishing, fake ATMs, and unrealistic investment schemes.

- Quantum Resistance: Bitcoin's encryption is currently secure, and the community is working on future protections.

Tax Implications

Understanding Bitcoin’s tax treatment is crucial:

- El Salvador: No capital gains tax on BTC, as it's legal tender.

- Global: Tax rules vary widely. Always consult a local tax advisor.

U.S.: Bitcoin is generally treated as property by the IRS; capital gains taxes apply when you sell or spend it.

2025–2030 Outlook

Analysts have varying forecasts for Bitcoin's future:

- 2025: Many predict prices reaching $100,000–$200,000 as adoption grows.

- 2030: Some bullish predictions see $500,000–$1.5 million if Bitcoin becomes a major global store of value.

Possible Futures:

- Digital Gold: Secure, scarce asset (most likely scenario).

- Daily Currency: Enabled by Lightning, especially in high-inflation economies.

- Global Reserve: A long-shot, but theoretically possible if fiat currencies face widespread instability.

🔗 Track trends with the Rainbow Price Chart

FAQ

What is Bitcoin?

A decentralized digital currency for peer-to-peer payments.

Who created it?

Satoshi Nakamoto, whose identity remains unknown.

How does mining work?

Miners validate transactions and earn BTC by solving complex puzzles.

What’s the halving?

An event every ~4 years that cuts new BTC rewards in half, reducing supply.

Where’s a Bitcoin ATM?

Find one here on Coin ATM Radar

How to store Bitcoin securely?

Use a hardware wallet or a trusted custodial service.

Crypto Terminology

Conclusion

From a mysterious whitepaper in 2008 to a trillion-dollar asset, Bitcoin has sparked a financial revolution. Its decentralized, open-source design empowers individuals to reclaim control of their money.

As technology and adoption continue to expand, Bitcoin's impact will likely deepen.

Discussion